| Harding Loevner Emerging Markets Advisor HLEMX |

|

|

|

| Release date as of 2024-03-31. Data on page is subject to change. |

|

|

| Style Box Details for Stock Holdings |

|

| Size |

|

| Average Mkt Cap $Mil |

38,940 |

|

|

|

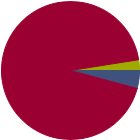

| Market Capitalization |

% of Portfolio |

| Giant |

61.48 |

| Large |

27.16 |

| Medium |

10.13 |

| Small |

1.23 |

| Micro |

0.00 |

| |

|

|

| Trailing Valuations |

Stock

Portfolio

|

| Price/Book |

2.3 |

| Price/Earnings |

14.2 |

| Price/Cash Flow |

9.4 |

|

|

|

|

|

| As of 2023-12-31 |

|

|

|

| % of Net Assets |

|

U.S. Stocks |

4.2 |

|

Non-U.S. Stocks |

93.4 |

|

Bonds |

0.0 |

|

Cash |

2.5 |

|

Other |

0.0 |

|

|

|

| Data through 2023-12-31 |

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

42.44 |

|

Basic Materials |

0.97 |

|

Consumer Cyclical |

16.18 |

|

Financial Services |

24.21 |

|

Real Estate |

1.08 |

|

|

|

|

Sensitive |

47.54 |

|

Communication Services |

6.52 |

|

Energy |

2.12 |

|

Industrials |

12.14 |

|

Technology |

26.76 |

|

|

|

|

Defensive |

10.03 |

|

Consumer Defensive |

6.36 |

|

Healthcare |

3.03 |

|

Utilities |

0.64 |

|

| Data through 2023-12-31 |

|

|

| Morningstar World Regions |

|

| % Fund |

| Americas |

19.0 |

|

| North America |

4.3 |

| Latin America |

14.7 |

|

| Greater Europe |

10.6 |

|

| United Kingdom |

0.4 |

| Europe Developed |

3.2 |

| Europe Emerging |

1.9 |

| Africa/Middle East |

5.1 |

|

| Greater Asia |

70.4 |

|

| Japan |

0.0 |

| Australasia |

0.0 |

| Asia Developed |

26.4 |

| Asia Emerging |

44.1 |

|

| Data through 2023-12-31 |

|

|

|

|

| Total Number of Stock Holdings |

76 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

34.35 |

|

|

| Turnover % |

(as of 2023-10-31) |

31.00 |

| 30 Day SEC Yield % |

--- |

|

|

Sector |

Country |

% of Net

Assets

|

|

|

|

|

|

|

Samsung Electronics Co Ltd DR |

|

South Korea |

5.56 |

|

Taiwan Semiconductor Manufacturing Co Ltd |

|

Taiwan |

5.49 |

|

HDFC Bank Ltd |

|

India |

4.95 |

|

Tencent Holdings Ltd |

|

China |

3.43 |

|

Tata Consultancy Services Ltd |

|

India |

3.34 |

|

|

Fomento Economico Mexicano SAB de CV ADR |

|

Mexico |

2.47 |

|

Maruti Suzuki India Ltd |

|

India |

2.46 |

|

Northern Institutional Treasury Premier |

--- |

United States |

2.30 |

|

Grupo Financiero Banorte SAB de CV Class O |

|

Mexico |

2.26 |

|

Eclat Textile Co Ltd |

|

Taiwan |

2.09 |

|

|

Wal - Mart de Mexico SAB de CV |

|

Mexico |

2.08 |

|

Tenaris SA ADR |

|

Italy |

2.07 |

|

Globant SA |

|

United States |

1.99 |

|

Delta Electronics Inc |

|

Taiwan |

1.87 |

|

Airtac International Group |

|

Taiwan |

1.83 |

|

|

Aspeed Technology Inc |

|

Taiwan |

1.75 |

|

PT Bank Rakyat Indonesia (Persero) Tbk Registered Shs Series -B- |

|

Indonesia |

1.63 |

|

Trip.com Group Ltd |

|

China |

1.61 |

|

Localiza Rent A Car SA |

|

Brazil |

1.61 |

|

Itau Unibanco Holding SA ADR |

|

Brazil |

1.58 |

|

|

AIA Group Ltd |

|

Hong Kong |

1.55 |

|

XP Inc Class A |

|

Brazil |

1.52 |

|

Shenzhou International Group Holdings Ltd |

|

China |

1.51 |

|

Zhejiang Sanhua Intelligent Controls Co Ltd Class A |

|

China |

1.43 |

|

EPAM Systems Inc |

|

United States |

1.38 |

|

|

|

|

|

© Copyright 2024 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|