| TCW MetWest Total Return Bd Plan MWTSX |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 520

Intermediate Core-Plus Bond Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 32,293.78 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks to maximize long-term total return.

|

|

| The fund pursues its objective by investing, under normal circumstances, at least 80% of its net assets in investment grade fixed income securities or unrated securities determined by the Adviser to be of comparable quality. Up to 20% of the fund's net assets may be invested in securities rated below investment grade or unrated securities determined by the Adviser to be of comparable quality. The fund also invests at least 80% of its net assets, plus any borrowings for investment purposes in fixed income securities it regards as bonds. |

|

|

| Morningstar Category: Intermediate Core-Plus Bond |

|

| Intermediate-term core-plus bond portfolios invest primarily in investment-grade U.S. fixed-income issues including government, corporate, and securitized debt, but generally have greater flexibility than core offerings to hold non-core sectors such as corporate high yield, bank loan, emerging-markets debt, and non-U.S. currency exposures. Their durations (a measure of interest-rate sensitivity) typically range between 75% and 125% of the three-year average of the effective duration of the Morningstar Core Bond Index.

|

|

|

| Growth of $10,000 |

|

(from 2015-01-01

to 2025-09-30)

|

|

|

|

|

|

Investment: |

TCW MetWest Total Return Bd Plan |

|

Benchmark 1: |

Bloomberg US Agg Bond TR USD |

|

Benchmark 2: |

Bloomberg US Universal TR USD |

|

Category: |

Intermediate Core-Plus Bond |

|

|

This graph presents historical performance for the investment as well as an index and/or peer group. If the investment, index and/or peer group have performed similarly, the line representing the fund will overlay the index and/or peer group. Therefore, the line(s) representing the index and/or peer group history may be hidden.

|

|

|

| Total Annualized Returns % |

|

|

YTD |

1 Year |

3 Year |

5 Year |

10 Year |

Since Inception |

| Investment |

6.70 |

2.89 |

5.23 |

-0.45 |

2.01 |

2.79 |

| Bloomberg US Agg Bond TR USD |

6.13 |

2.88 |

4.93 |

-0.45 |

1.84 |

4.29 |

| Bloomberg US Universal TR USD |

6.31 |

3.40 |

5.60 |

0.08 |

2.26 |

--- |

| Category |

6.32 |

3.40 |

5.65 |

0.35 |

2.32 |

4.39 |

|

|

|

| Morningstar Rating |

--- |

--- |

|

|

|

--- |

|

|

# of compared

Intermediate Core-Plus Bond

funds covered

(3 yrs : out of

520

funds)

(5 yrs : out of

468

funds)

(10 yrs : out of

344

funds)

|

|

|

|

| Ratings reflect risk-adjusted performance and are derived from a weighted average of the performance figures associated with its three, five and ten-year (if applicable) time periods. |

|

|

|

|

|

| Investment results shown represent historical performance and do not guarantee future results. Investment returns and principal values fluctuate with changes in interest rates and other market conditions so the value, when redeemed may be worth more or less than original costs. Current performance may be lower or higher than the performance data shown. |

|

|

|

Total Annual Operating Expense

|

0.37%

|

| Prospectus Net Expense Ratio |

0.37%

|

| Maximum Sales Charge |

--- |

|

| The total annual operating expense shown is before management fee waivers or expense caps. For more information on waivers/reimbursements, please see the prospectus. The total annual operating expense is also referred to as the prospectus gross expense ratio. |

|

|

Type |

Date |

% |

| --- |

--- |

--- |

--- |

|

|

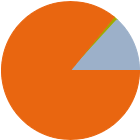

| % of Net Assets |

|

U.S. Stocks |

0.0 |

|

Non-U.S. Stocks |

0.0 |

|

Bonds |

85.9 |

|

Cash |

0.9 |

|

Other |

13.2 |

|

|

|

| Data through 2025-08-31 |

|

|

|

|

| Morningstar Fixed-Income Sectors |

|

| % Fund |

|

Government |

24.50 |

|

Corporate |

17.94 |

|

Securitized |

56.04 |

|

Municipal |

0.68 |

|

Cash & Equivalents |

0.83 |

|

Derivative |

0.00 |

|

|

|

% Bonds |

| AAA |

92.20 |

| AA |

4.19 |

| A |

0.95 |

| BBB |

1.41 |

| BB |

0.28 |

| B |

0.23 |

| Below B |

0.74 |

| Not Rated |

0.00 |

|

|

|

|

|

| Total Number of Stock Holdings |

8 |

| Total Number of Bond Holdings |

1500 |

| % of Net Assets in Top 10 Holdings |

36.30 |

|

|

| Turnover % |

(as of 2025-03-31) |

418.00 |

| 30 Day SEC Yield % |

3.59 |

|

|

Maturity

Date

|

Shares

|

Value

$000

|

% of Net

Assets

|

|

|

|

|

|

|

|

Tcw Fds |

--- |

4,877,522 |

4,877,522 |

12.95 |

|

US Treasury Note 0.03625% |

2030-08-31 |

2,286,231 |

2,279,578 |

6.05 |

|

US Treasury Note 0.03875% |

2032-08-31 |

2,180,500 |

2,172,637 |

5.77 |

|

United States Treasury Bonds 0.0475% |

2055-08-15 |

1,141,695 |

1,111,280 |

2.95 |

|

United States Treasury Bonds 0.04875% |

2045-08-15 |

1,026,099 |

1,027,362 |

2.73 |

|

|

United States Treasury Notes 0.0425% |

2035-08-15 |

745,504 |

747,077 |

1.98 |

|

Government National Mortgage Association 0.05% |

2054-09-15 |

391,825 |

387,670 |

1.03 |

|

Government National Mortgage Association 0.025% |

2055-09-22 |

428,675 |

365,191 |

0.97 |

|

Federal National Mortgage Association 0.04% |

2055-09-15 |

385,075 |

359,463 |

0.95 |

|

Federal National Mortgage Association 0.04% |

2052-06-01 |

370,979 |

347,430 |

0.92 |

|

|

|

|

|

|

|

|

| Credit and Counterparty, Extension, Inflation/Deflation, Prepayment (Call), Currency, Emerging Markets, Foreign Securities, Loss of Money, Not FDIC Insured, High Portfolio Turnover, Issuer, Interest Rate, Market/Market Volatility, Distressed Investments, Futures, High-Yield Securities, Mortgage-Backed and Asset-Backed Securities, Other, Restricted/Illiquid Securities, U.S. Government Obligations, Derivatives, Leverage, Pricing, Fixed-Income Securities, Management, Swaps, Unrated Securities |

|

| Show Risk Definitions |

|

|

| Inception Date: 2011-07-29 |

|

| Bryan T. Whalen (2004-12-31) |

|

| Mr. Whalen is Co-Chief Investment Officer and a Generalist Portfolio Manager in TCW’s Fixed Income Group, a team that oversees over $180 billion in fixed income assets including the over $60 billion MetWest Total Return Bond Fund, one of the largest actively managed bond funds in the world. Prior to joining TCW, Mr. Whalen was a Partner at Metropolitan West Asset Management and Co-head of its Securitized Products division. Prior to joining MetWest in 2004, he was a Director in the Fixed Income department at Credit Suisse First Boston in New York. Previously, he was a Vice President at Donaldson, Lufkin & Jenrette. Mr. Whalen earned a BA in Economics from Yale University. He is a CFA charterholder. |

|

| Jerry M. Cudzil (2023-09-06) |

|

| Mr. Cudzil is a Specialist Portfolio Manager and Head of Credit Trading. He oversees the Fixed Income group’s trading of investment grade corporate bonds, high yield bonds, leveraged loans and credit derivatives. Prior to joining TCW in 2012, Mr. Cudzil was a High Yield Bond Trader for Morgan Stanley and Deutsche Bank, specializing in project finance, aviation, and energy securities. He was previously a Portfolio Manager for Dimaio Ahmad Capital, managing the multi-strategy credit fund and aviation fund and leading the firm’s risk management team. Mr. Cudzil began his career as a Corporate Bond Trader for Prudential Securities and has also traded investment grade and high yield debt for Credit Suisse and Goldman Sachs. Mr. Cudzil earned a BA in Economics from the University of Pennsylvania. |

|

| Ruben Hovhannisyan (2023-09-06) |

|

| Mr. Hovhannisyan is an Associate Generalist Portfolio Manager in the Fixed Income Group, a team that oversees over $180 billion in fixed income assets including the over $60 billion MetWest Total Return Bond Fund, one of the largest actively managed bond funds in the world. Prior to his current role, he served as a Senior Portfolio Analyst working alongside the Generalist Portfolio Managers. Mr. Hovhannisyan joined TCW from Metropolitan West Asset Management company, where he spent two years as a collateralized debt obligations specialist and member of the portfolio risk management group. Prior to joining MetWest in 2007, he was an associate at KPMG Structured Finance Group where he was engaged in various projects analyzing structured products. Mr. Hovhannisyan holds a BA in Business/Economics from the University of California, Los Angeles (UCLA) and an MBA from the UCLA Anderson School of Management. He is a CFA charterholder. |

|

|

|

| Metropolitan West Asset Management, LLC. |

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|