| Voya Global High Dividend Low Vol Port S IGHSX |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 141

Global Large-Stock Value Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 184.33 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks long-term capital growth and current income.

|

|

| Under normal market conditions, the Portfolio invests at least 80% of its net assets (plus borrowings for investment purposes) in a portfolio of equity securities. It invests primarily in equity securities included in the MSCI World Value IndexSM ("index"). The Portfolio invests in securities of issuers in a number of different countries, including the United States. |

|

|

| Morningstar Category: Global Large-Stock Value |

|

| Global large-stock value portfolios invest in a variety of international stocks and typically skew towards large caps that are less expensive or growing more slowly than other global large-cap stocks. World large stock value portfolios have few geographical limitations. It is common for these portfolios to invest the majority of their assets in developed markets, with the remainder divided among the globe’s emerging markets. These portfolios are not significantly overweight U.S. equity exposure relative to the Morningstar Global Market Index and maintain at least a 20% absolute U.S. exposure.

|

|

|

| There are no additional fund specific investment risks (e.g. liquidity risk, currency risk, foreign investment risk, etc.) associated with this fund beyond the normal risks generally associated with investing in a mutual fund. |

|

|

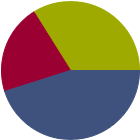

| % of Net Assets |

|

U.S. Stocks |

45.1 |

|

Non-U.S. Stocks |

21.0 |

|

Bonds |

0.0 |

|

Cash |

33.9 |

|

Other |

0.0 |

|

|

|

| Data through 2025-09-30 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

35.96 |

|

Basic Materials |

1.43 |

|

Consumer Cyclical |

4.26 |

|

Financial Services |

25.68 |

|

Real Estate |

4.59 |

|

|

|

|

Sensitive |

36.99 |

|

Communication Services |

8.45 |

|

Energy |

6.32 |

|

Industrials |

12.00 |

|

Technology |

10.22 |

|

|

|

|

Defensive |

27.06 |

|

Consumer Defensive |

8.80 |

|

Healthcare |

13.14 |

|

Utilities |

5.12 |

|

| Data through 2025-09-30 |

|

|

|

| Morningstar World Regions |

|

| % Fund |

| Americas |

73.4 |

|

| North America |

72.8 |

| Latin America |

0.5 |

|

| Greater Europe |

18.1 |

|

| United Kingdom |

5.2 |

| Europe Developed |

12.6 |

| Europe Emerging |

0.0 |

| Africa/Middle East |

0.3 |

|

| Greater Asia |

8.6 |

|

| Japan |

4.8 |

| Australasia |

1.4 |

| Asia Developed |

1.9 |

| Asia Emerging |

0.5 |

|

| Data through 2025-09-30 |

|

|

| Total Number of Stock Holdings |

224 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

8.96 |

|

|

| Turnover % |

(as of 2024-12-31) |

72.00 |

| 30 Day SEC Yield % |

--- |

|

|

Sector |

Country |

% of Net

Assets

|

|

|

|

|

|

|

Meta Platforms Inc Class A |

|

United States |

1.48 |

|

Johnson & Johnson |

|

United States |

1.14 |

|

AbbVie Inc |

|

United States |

1.10 |

|

Procter & Gamble Co |

|

United States |

0.96 |

|

Cisco Systems Inc |

|

United States |

0.88 |

|

|

RTX Corp |

|

United States |

0.76 |

|

PepsiCo Inc |

|

United States |

0.71 |

|

Verizon Communications Inc |

|

United States |

0.69 |

|

Pfizer Inc |

|

United States |

0.63 |

|

British American Tobacco PLC |

|

United Kingdom |

0.61 |

|

|

|

|

|

|

|

|

| Lending, Currency, Foreign Securities, Loss of Money, Not FDIC Insured, Country or Region, Capitalization, Quantitative Investing, Income, Issuer, Market/Market Volatility, Restricted/Illiquid Securities, Underlying Fund/Fund of Funds, Derivatives, Socially Conscious, Real Estate/REIT Sector |

|

| Show Risk Definitions |

|

|

| Inception Date: 2008-01-28 |

|

| Justin Montminy (2025-02-28) |

|

| Justin Montminy is a portfolio manager for the closed end equity funds and a quantitative analyst on the global quantitative equity team at Voya Investment Management. Prior to joining Voya, he was a treasury associate with Citadel LLC, focusing on repo financing and cash management. Justin earned an MBA in finance from New York University Stern School of Business and a BS in finance from the University of Illinois at Urbana-Champaign. He is a CFA® Charterholder. |

|

| Kai Yee Wong (2018-05-01) |

|

| Kai Yee Wong is a portfolio manager on the quantitative equity team at Voya Investment Management responsible for the index, research enhanced index and smart beta strategies. Prior to joining the firm, she worked as a senior equity portfolio manager at Northern Trust responsible for managing various global indices including developed, emerging, real estate. Prior to that, Kai Yee was a portfolio manager with Deutsche Bank. Previously, she held roles with Bankers Trust and Bank of Tokyo. Kai Yee earned a BS from New York University Stern School of Business. |

|

|

|

|

|

|

|

|

|

| Voya Investment Management Co. LLC |

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|