| Fidelity VIP High Income Initial |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 586

High Yield Bond Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 809.39 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks a high level of current income, while also considering growth of capital.

|

|

| The fund primarily invests in income-producing debt securities, preferred stocks, and convertible securities, with an emphasis on lower-quality debt securities. It potentially invests in non-income producing securities, including defaulted securities and common stocks. The fund invests in companies in troubled or uncertain financial condition. It invests in domestic and foreign issuers. The fund uses fundamental analysis of each issuer's financial condition and industry position and market and economic conditions to select investments. |

|

|

| Morningstar Category: High Yield Bond |

|

| High-yield bond portfolios concentrate on lower-quality bonds, which are riskier than those of higher-quality companies. These portfolios generally offer higher yields than other types of portfolios, but they are also more vulnerable to economic and credit risk. These portfolios primarily invest in U.S. high-income debt securities where at least 65% or more of bond assets are not rated or are rated by a major agency such as Standard & Poor's or Moody's at the level of BB (considered speculative for taxable bonds) and below.

|

|

|

| High-Yield Bond Funds: Funds that invest in lower-rated debt securities (commonly referred to as junk bonds) involve additional risk because of the lower credit quality of the securities in the portfolio. There are risks associated with the possibility of a higher level of volatility and increased risk of default. |

|

|

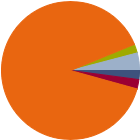

| % of Net Assets |

|

U.S. Stocks |

2.1 |

|

Non-U.S. Stocks |

2.2 |

|

Bonds |

89.6 |

|

Cash |

2.1 |

|

Other |

4.1 |

|

|

|

| Data through 2025-07-31 |

|

|

|

|

| Morningstar Fixed-Income Sectors |

|

| % Fund |

|

Government |

0.79 |

|

Corporate |

96.07 |

|

Securitized |

0.96 |

|

Municipal |

0.00 |

|

Cash & Equivalents |

2.17 |

|

Derivative |

0.00 |

|

|

|

% Bonds |

| AAA |

0.01 |

| AA |

0.00 |

| A |

0.00 |

| BBB |

3.35 |

| BB |

42.80 |

| B |

48.27 |

| Below B |

0.00 |

| Not Rated |

5.58 |

|

|

|

|

|

| Total Number of Stock Holdings |

9 |

| Total Number of Bond Holdings |

726 |

| % of Net Assets in Top 10 Holdings |

9.56 |

|

|

| Turnover % |

(as of 2024-12-31) |

42.00 |

| 30 Day SEC Yield % |

6.28 |

|

|

Maturity

Date

|

Shares

|

Value

$000

|

% of Net

Assets

|

|

|

|

|

|

|

|

Fidelity Cash Central Fund |

--- |

16,652 |

16,655 |

2.10 |

|

Mesquite Engy |

--- |

83 |

16,630 |

2.09 |

|

Fid Private Credit Co Llc |

--- |

1,443 |

13,876 |

1.75 |

|

5 Year Treasury Note Future Sept 25 |

2025-09-30 |

--- |

6,059 |

0.76 |

|

TransDigm, Inc. 6.375% |

2033-05-31 |

4,275 |

4,302 |

0.54 |

|

|

Artera Services LLC 8.5% |

2031-02-15 |

4,495 |

3,723 |

0.47 |

|

Bausch Health Tm B 1ln 10/30 |

2030-10-08 |

3,785 |

3,703 |

0.47 |

|

1261229 Bc Ltd. 10% |

2032-04-15 |

3,610 |

3,675 |

0.46 |

|

EG Global Finance PLC 12% |

2028-11-30 |

3,280 |

3,624 |

0.46 |

|

EchoStar Corp. 3.875% |

2030-11-30 |

2,856 |

3,616 |

0.46 |

|

|

|

|

|

|

|

|

| Foreign Securities, Loss of Money, Not FDIC Insured, Issuer, Interest Rate, Market/Market Volatility, Equity Securities |

|

| Show Risk Definitions |

|

|

| Inception Date: 1985-09-19 |

|

| Benjamin Harrison (2022-01-03) |

|

| Benjamin Harrison is a portfolio manager in the High Income and Alternatives division at Fidelity Investments, where he manages retail and institutional assets. Prior to assuming his current portfolio management responsibilities, Mr. Harrison was a Managing Director of Research and Business Development, where he had oversight of the high income, emerging market debt, and real estate research teams. He also served as a research analyst covering chemical, services, forest products, and technology credits. He has been in the financial industry since joining Fidelity in 2009. |

|

| Jared Beckerman (2024-01-01) |

|

| Jared Beckerman is a research analyst in the High Income and Alternatives division at Fidelity Investments. Fidelity Investments is a leading provider of investment management, retirement planning, portfolio guidance, brokerage, benefits outsourcing, and other financial products and services to institutions, financial intermediaries, and individuals.

In this role, Mr. Beckerman evaluates investment opportunities across multiple asset classes, including stocks, high yield bonds, and leveraged loans. He currently covers companies in the healthcare industry. His prior research coverage included energy services, midstream and refining, casinos and gaming, shipping, aerospace & defense, capital goods, and railroad companies.

Prior to joining Fidelity in 2012, Mr. Beckerman was a research analyst at Sugarloaf Rock Capital where he focused on evaluating public investment opportunities across the media & telecommunications industry. He also was an investment banking analyst at Deutsche Bank. He has been in the financial industry since 2006.

Mr. Beckerman earned his bachelor of science in applied economics and management from Cornell University and his master of business administration from Columbia Business School. |

|

|

|

| Fidelity Management & Research Company LLC |

|

|

|

|

|

| FMR Investment Management (U.K.) Limited |

| Fidelity Management & Research (Japan) Limited |

| Fidelity Management & Research (HK) Ltd |

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|