| Calvert VP SRI Balanced I |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 466

Moderate Allocation Funds

|

|

|

|

Morningstar®

Style Box™

|

| What is this?

|

|

|

|

| As of 2025-08-31 |

|

|

|

| As of 2025-06-30 |

|

|

| Total Fund Assets ($ Mil) |

| 457.17 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks to provide a competitive total return through an actively managed portfolio of stocks, bonds, and money market instruments which offer income and capital growth opportunity.

|

|

| Under normal market conditions, the fund invests between 50% and 75% of net assets in equity securities and between 25% and 50% of net assets in fixed-income securities. Stock investments are primarily common stock of large-cap companies. Fixed-income investments are primarily a wide variety of investment grade debt securities, such as corporate debt securities, mortgage-backed securities and other asset-backed securities. |

|

|

| Morningstar Category: Moderate Allocation |

|

| Funds in allocation categories seek to provide both income and capital appreciation by primarily investing in multiple asset classes, including stocks, bonds, and cash. These moderate strategies seek to balance preservation of capital with appreciation. They typically expect volatility similar to a strategic equity exposure between 50% and 70%.

|

|

|

| There are no additional fund specific investment risks (e.g. liquidity risk, currency risk, foreign investment risk, etc.) associated with this fund beyond the normal risks generally associated with investing in a mutual fund. |

|

|

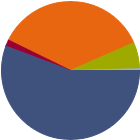

| % of Net Assets |

|

U.S. Stocks |

55.8 |

|

Non-U.S. Stocks |

1.5 |

|

Bonds |

36.2 |

|

Cash |

6.2 |

|

Other |

0.4 |

|

|

|

| Data through 2025-08-31 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

28.48 |

|

Basic Materials |

1.10 |

|

Consumer Cyclical |

9.92 |

|

Financial Services |

15.11 |

|

Real Estate |

2.35 |

|

|

|

|

Sensitive |

57.03 |

|

Communication Services |

9.47 |

|

Energy |

2.11 |

|

Industrials |

7.43 |

|

Technology |

38.02 |

|

|

|

|

Defensive |

14.50 |

|

Consumer Defensive |

4.60 |

|

Healthcare |

8.90 |

|

Utilities |

1.00 |

|

| Data through 2025-08-31 |

|

|

|

| Morningstar Fixed-Income Sectors |

|

| % Fund |

|

Government |

17.02 |

|

Corporate |

22.17 |

|

Securitized |

44.78 |

|

Municipal |

1.59 |

|

Cash & Equivalents |

14.44 |

|

Derivative |

0.00 |

|

|

|

% Bonds |

| AAA |

19.28 |

| AA |

21.98 |

| A |

9.74 |

| BBB |

18.49 |

| BB |

2.76 |

| B |

1.64 |

| Below B |

0.42 |

| Not Rated |

25.68 |

|

|

|

|

|

| Total Number of Stock Holdings |

56 |

| Total Number of Bond Holdings |

442 |

| % of Net Assets in Top 10 Holdings |

36.73 |

|

|

| Turnover % |

(as of 2024-12-31) |

171.00 |

| 30 Day SEC Yield % |

1.64 |

|

|

Sector |

Country |

Maturity Date |

Market Value ($000) |

% of Net Assets |

|

| Morgan Stanley Inst Lqudty Gov Sec Ins |

--- |

USA |

2030-12-31 |

27,948 |

5.65 |

| Microsoft Corp |

|

USA |

--- |

24,368 |

4.92 |

| NVIDIA Corp |

|

USA |

--- |

23,967 |

4.84 |

| Federal National Mortgage Association 5.5% |

--- |

USA |

2055-09-01 |

21,822 |

4.41 |

| Apple Inc |

|

USA |

--- |

17,338 |

3.50 |

|

| Federal National Mortgage Association 5% |

--- |

USA |

2055-09-15 |

16,934 |

3.42 |

| Alphabet Inc Class C |

|

USA |

--- |

15,374 |

3.11 |

| Amazon.com Inc |

|

USA |

--- |

14,464 |

2.92 |

| Broadcom Inc |

|

USA |

--- |

10,376 |

2.10 |

| United States Treasury Notes 4.125% |

--- |

USA |

2027-02-28 |

9,206 |

1.86 |

|

|

|

|

|

|

|

|

| Lending, Credit and Counterparty, Currency, Foreign Securities, Long-Term Outlook and Projections, Loss of Money, Not FDIC Insured, Active Management, High Portfolio Turnover, Interest Rate, Market/Market Volatility, Equity Securities, High-Yield Securities, Mortgage-Backed and Asset-Backed Securities, Restricted/Illiquid Securities, U.S. Government Obligations, Derivatives, Socially Conscious, Shareholder Activity, Portfolio Diversification, Small Cap, Mid-Cap, Real Estate/REIT Sector, Money Market Fund Ownership |

|

| Show Risk Definitions |

|

|

| Inception Date: 1986-09-02 |

|

| Charles B. Gaffney (2016-12-31) |

|

| Charles Gaffney is a vice president of Eaton Vance Management and portfolio manager on Eaton Vance’s global core team. He is a member of the firm’s Equity Strategy Committee. He joined Eaton Vance in 2003. Charlie began his career in the investment management industry in 1996. Before joining Eaton Vance, he was affiliated with Brown Brothers Harriman as a sector portfolio manager and Morgan Stanley Dean Witter as a senior equity analyst. Charlie earned a B.A. from Bowdoin College in 1995 and an MBA from Fordham University in 2002. |

|

| Vishal Khanduja (2013-03-20) |

|

| Vishal is a managing director of Morgan Stanley Investment Management, Co-Head of the Broad Markets Fixed Income team and a portfolio manager. He is responsible for buy and sell decisions and portfolio construction. He joined Calvert Research and Management’s predecessor organization Calvert Investment Management in 2012. Eaton Vance acquired Calvert Investment Management in 2016. Morgan Stanley acquired Eaton Vance in March 2021. Vishal began his career in the investment management industry in 2005. Before joining Eaton Vance, he was a senior vice president, portfolio manager and head of taxable fixed income for Calvert Investments. Previously, he was a vice president and portfolio manager at Columbia Threadneedle and associate director of fixed-income analytics at Galliard Capital. Vishal earned a bachelor of engineering from VJTI, Mumbai, India and an MBA from the Tippie School of Management at the University of Iowa. He is a member of the CFA Institute and CFA Society Boston. He is a CFA charterholder. |

|

| Brian S. Ellis (2015-11-16) |

|

| Brian is a managing director of Morgan Stanley Investment Management and a portfolio manager on the Broad Markets Fixed Income team. He is responsible for buy and sell decisions, portfolio construction and risk management for the firm’s Broad Markets strategies, including Calvert Research and Management Multi-Sector strategies. He joined Calvert Research and Management’s predecessor organization Calvert Investment Management in 2009. Eaton Vance acquired Calvert Investment Management in 2016. Morgan Stanley acquired Eaton Vance in March 2021. Brian began his career in the investment management industry in 2006. Before joining Eaton Vance, he worked as a portfolio manager of fixed-income strategies for Calvert Investments. He was previously affiliated with Legg Mason Capital Management (now ClearBridge Investments). Brian earned a B.S. in finance from Salisbury University. He is a CFA charterholder and an FSA Credential holder. He is a member of the CFA Institute and CFA Society Boston. |

|

|

|

| Calvert Research and Management |

|

|

| Calvert Research and Management |

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|