| LVIP Macquarie SMID Cap Core Fund Std |

|

|

|

| Release date as of 2025-08-31. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-08-31 |

|

Out of 577

Small Blend Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 648.87 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks long-term capital appreciation.

|

|

| The fund invests primarily in stocks of small-and mid-capitalization companies that its manager believes have a combination of attractive valuations, growth prospects, and strong cash flows. Under normal circumstances, it invests at least 80% of its assets in equity securities of small-and mid-capitalization companies (80% policy). |

|

|

| Morningstar Category: Small Blend |

|

| Small-blend portfolios favor U.S. firms at the smaller end of the market-capitalization range. Some aim to own an array of value and growth stocks while others employ a discipline that leads to holdings with valuations and growth rates close to the small-cap averages. Stocks in the bottom 10% of the capitalization of the U.S. equity market are defined as small cap. The blend style is assigned to portfolios where neither growth nor value characteristics predominate.

|

|

|

| Small Cap Funds: Smaller companies typically have higher risk of failure, and are not as well established as larger blue-chip companies. Historically, the smaller company stocks have experienced a greater degree of market volatility than the overall market average. |

|

|

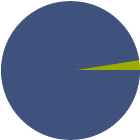

| % of Net Assets |

|

U.S. Stocks |

97.5 |

|

Non-U.S. Stocks |

0.0 |

|

Bonds |

0.0 |

|

Cash |

2.5 |

|

Other |

0.0 |

|

|

|

| Data through 2025-06-30 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

39.30 |

|

Basic Materials |

4.98 |

|

Consumer Cyclical |

10.30 |

|

Financial Services |

17.79 |

|

Real Estate |

6.23 |

|

|

|

|

Sensitive |

43.92 |

|

Communication Services |

2.44 |

|

Energy |

3.81 |

|

Industrials |

21.44 |

|

Technology |

16.23 |

|

|

|

|

Defensive |

16.78 |

|

Consumer Defensive |

1.91 |

|

Healthcare |

13.05 |

|

Utilities |

1.82 |

|

| Data through 2025-06-30 |

|

|

| Total Number of Stock Holdings |

121 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

17.44 |

|

|

| Turnover % |

(as of 2024-12-31) |

11.00 |

| 30 Day SEC Yield % |

0.00 |

|

|

Sector |

P/E |

% of Net

Assets

|

|

|

|

|

|

|

State Street Instl US Govt MMkt Premier |

--- |

--- |

2.46 |

|

East West Bancorp Inc |

|

12.78 |

2.04 |

|

Casey's General Stores Inc |

|

35.55 |

1.95 |

|

Axis Capital Holdings Ltd |

|

9.53 |

1.82 |

|

Guidewire Software Inc |

|

312.27 |

1.77 |

|

|

Webster Financial Corp |

|

12.50 |

1.67 |

|

Reliance Inc |

|

21.11 |

1.47 |

|

Dick's Sporting Goods Inc |

|

15.47 |

1.46 |

|

Pinnacle Financial Partners Inc |

|

12.96 |

1.44 |

|

Reinsurance Group of America Inc |

|

16.71 |

1.36 |

|

|

|

|

|

|

|

|

| Currency, Loss of Money, Not FDIC Insured, Active Management, Issuer, Market/Market Volatility, Equity Securities, Restricted/Illiquid Securities, Small Cap, Mid-Cap, Real Estate/REIT Sector |

|

| Show Risk Definitions |

|

|

| Inception Date: 1991-07-12 |

|

| Christopher S. Adams (2017-04-28) |

|

| Christopher S. Adams, CFA

Vice President, Senior Portfolio Manager

Christopher S. Adams is a senior portfolio manager on the firm’s US Core Equity team and performs analysis and research to support the portfolio management function. He joined the team in 2000 and became a portfolio manager in November 2004. Prior to joining Macquarie Investment Management (MIM) in 1995 as assistant vice president of strategic planning, Adams had approximately 10 years of experience in the financial services industry in the United States and United Kingdom, including positions with Coopers & Lybrand, The Sumitomo Bank, Bank of America, and Lloyds Bank. Adams holds both bachelor’s and master’s degrees in history and economics from the University of Oxford, England, and received an MBA with dual concentrations in finance and insurance/risk management from The Wharton School of the University of Pennsylvania. He is a past president of the CFA Society of Philadelphia. |

|

| David E. Reidinger (2017-04-28) |

|

| Managing Director, Head of US Core Equity

•Joined Macquarie in 2016

•Based in Philadelphia

Dave is Head of Macquarie Asset Management’s (MAM’s) US Core Equity Team, a role he first assumed in March 2025. Dave is responsible for management of the team’s investment portfolios and business, and he performs analysis and research. Before that, Dave was a Senior Portfolio Manager for the team, a

role he assumed in October 2016. Prior to joining the firm, Dave was a Senior Equity Analyst and Portfolio Manager at Chartwell Investment Partners, where he had worked on the firm’s small- and mid-cap growth strategies since 2004. Prior to Chartwell, Dave was a Portfolio Manager at Morgan Stanley Investment Management and a Senior Equity Analyst at Tiger Management. Dave began his investment career in 1993 as an Equity Research Analyst at Goldman Sachs. Dave received a Bachelor of Arts in mathematics and economics from Fordham University and a Master of Business Administration from Columbia Business School. |

|

| Michael S. Morris (2017-04-28) |

|

| David E. Reidinger

Vice President, Senior Portfolio Manager

David E. Reidinger joined Macquarie Investment Management (MIM) in October 2016 as a senior portfolio manager on the firm’s US Core Equity team. He also performs analysis and research to support the portfolio management function. From June 2004 to September 2016, Reidinger was a senior analyst and portfolio manager at Chartwell Investment Partners, where he worked on the firm’s small- and mid-cap growth strategies. Before that, Reidinger was a portfolio manager with Morgan Stanley Investment Management from 2000 to 2003, and a senior equity analyst with Tiger Management from 1998 to 2000. Reidinger began his career in 1993 as an equity research analyst with Goldman Sachs. With more than 20 years of experience as an analyst, he has covered a broad range of industries within the information technology, consumer, and industrial sectors. Reidinger earned bachelor’s degrees in both mathematics and economics from Fordham University, and an MBA from Columbia Business School. |

|

| Francis X. Morris (2017-04-28) |

|

| Senior Managing Director, Senior Portfolio Manager – US Core Equity

•Joined Delaware Investments in 1997, acquired by Macquarie in 2010

•Based in Philadelphia

Frank is a Senior Portfolio Manager for Macquarie Asset Management’s (MAM’s) US Core Equity Team, a role he transitioned to in March 2025 after serving as head of the team for more than 20 years. Frank performs analysis and research to support the portfolios managed by the team. Frank joined Delaware Investments as Vice President and Portfolio Manager. Prior to joining the firm, Frank was Vice President and Director of Equity Research at PNC Asset Management, where he began his investment career in 1983. Frank holds a Bachelor of Arts from Providence College and a Master of Business Administration from Widener University. He is a former member of the Business Advisory Council of the Providence College School of Business. Frank is a past President of the CFA Society of Philadelphia. |

|

| Donald G. Padilla (2017-04-28) |

|

| Donald G. Padilla, CFA

Vice President, Senior Portfolio Manager

Donald G. Padilla is a senior portfolio manager on the firm’s US Core Equity team and performs analysis and research to support the portfolio management function. He joined the team in 2000 and became a portfolio manager in November 2004. Padilla joined Macquarie Investment Management (MIM) in 1994 as assistant controller in the firm’s treasury function, responsible for managing corporate cash investments, developing financial models, and overseeing the financial operations of the Lincoln Life 401(k) annuities segment. Prior to joining the firm, he held various positions at The Vanguard Group. Padilla holds a bachelor’s degree in accounting from Lehigh University, and he is a member of the CFA Society of Philadelphia. |

|

|

|

| Lincoln Financial Investments Corporation |

|

|

|

|

|

| Delaware Investments Fund Advisers |

| Macquarie Investment Management Global Limited |

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|