| BNY Mellon Sustainable US Eq Port Initl |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 1226

Large Blend Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 407.87 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks long-term capital appreciation.

|

|

| The fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in equity securities of U.S. companies that demonstrate attractive investment attributes and sustainable business practices and have no material unresolvable environmental, social and governance (ESG) issues. It invests principally in common stocks. |

|

|

| Morningstar Category: Large Blend |

|

| Large-blend portfolios are fairly representative of the overall US stock market in size, growth

rates and price. Stocks in the top 70% of the capitalization of the US equity market are defined

as large cap. The blend style is assigned to portfolios where neither growth nor value

characteristics predominate. These portfolios tend to invest across the spectrum of US

industries, and owing to their broad exposure, the portfolios' returns are often similar to those of the S&P 500 Index.

|

|

|

| There are no additional fund specific investment risks (e.g. liquidity risk, currency risk, foreign investment risk, etc.) associated with this fund beyond the normal risks generally associated with investing in a mutual fund. |

|

|

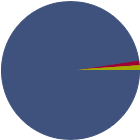

| % of Net Assets |

|

U.S. Stocks |

97.7 |

|

Non-U.S. Stocks |

1.3 |

|

Bonds |

0.0 |

|

Cash |

1.1 |

|

Other |

0.0 |

|

|

|

| Data through 2025-08-31 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

24.28 |

|

Basic Materials |

1.14 |

|

Consumer Cyclical |

6.63 |

|

Financial Services |

16.51 |

|

Real Estate |

0.00 |

|

|

|

|

Sensitive |

54.00 |

|

Communication Services |

4.33 |

|

Energy |

0.00 |

|

Industrials |

13.54 |

|

Technology |

36.13 |

|

|

|

|

Defensive |

21.72 |

|

Consumer Defensive |

6.53 |

|

Healthcare |

11.84 |

|

Utilities |

3.35 |

|

| Data through 2025-08-31 |

|

|

| Total Number of Stock Holdings |

46 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

48.48 |

|

|

| Turnover % |

(as of 2024-12-31) |

25.32 |

| 30 Day SEC Yield % |

0.00 |

|

|

Sector |

P/E |

% of Net

Assets

|

|

|

|

|

|

|

NVIDIA Corp |

|

53.50 |

10.42 |

|

Microsoft Corp |

|

37.69 |

8.19 |

|

Apple Inc |

|

37.58 |

6.36 |

|

Amazon.com Inc |

|

33.55 |

4.74 |

|

Alphabet Inc Class A |

|

26.03 |

4.29 |

|

|

JPMorgan Chase & Co |

|

15.80 |

4.09 |

|

Costco Wholesale Corp |

|

51.38 |

2.85 |

|

The Goldman Sachs Group Inc |

|

17.34 |

2.73 |

|

Intuit Inc |

|

47.96 |

2.51 |

|

Mastercard Inc Class A |

|

37.71 |

2.30 |

|

|

|

|

|

|

|

|

| Loss of Money, Not FDIC Insured, Growth Investing, Value Investing, Market/Market Volatility, Equity Securities, Socially Conscious, Management, Large Cap, Technology Sector |

|

| Show Risk Definitions |

|

|

| Inception Date: 1993-10-07 |

|

| Julianne D. McHugh (2023-03-31) |

|

| Julianne is a senior portfolio manager and Newton’s head of sustainable equities. As an experienced investor, she has been integral in identifying resources to support and enhance the integration of sustainability considerations into the firm’s investment practices. Julianne manages a selection of global and regional equity mandates. She is the lead portfolio manager for the BNY Mellon Large Cap Securities Fund, leveraging the global research team to deliver capital growth by investing in high quality US companies with strong positions in their industries. Julianne has led the Emerging Markets Research Fund since its inception in February 2014. She also serves as a portfolio manager for Newton’s Global Research Equity and Global First Decade Innovators strategies.

Julianne joined Newton in September 2021, following the integration of Mellon Investments Corporation’s equity and multi-asset capabilities into the Newton Investment Management Group. Before joining Newton, Julianne was a senior portfolio manager and senior research analyst at Mellon Investments Corporation and The Boston Company Asset Management (both BNY Mellon group companies).

Prior to joining BNY Mellon, Julianne was an equity analyst at State Street Research & Management. Julianne has a BS in Finance from Lehigh University and an MBA with a Financial Management track from MIT Sloan School of Management. |

|

| Nicholas Pope (2022-01-31) |

|

| Mr. Pope joined Brookfield Investment Management in 2014 as a Director of the natural resources investment team. He is responsible for implementing investment strategy with a focus in energy, including upstream, downstream, chemicals and services. Prior to that, he was a Senior Analyst and Managing Director at Dahlman Rose (and upon acquisition at Cowen & Company) covering Exploration and Production sector. Before that, Mr. Pope was an Analyst at JP Morgan Chase & Co, Research Division, where he covered the U.S. based exploration and production companies. While at JP Morgan, he was also responsible for a number of in-depth research studies, including those relating to specific domestic production regions and emerging gas recovery technologies. Mr. Pope began his career in 2001 as a Senior Project Engineer at ExxonMobil Production Co. Mr. Pope was the recipient of Institutional Investor's Rising Stars of E&P Research in 2011. He earned a Bachelor of Science degree in Chemical Engineering from the Texas A&M University. |

|

|

|

| BNY Mellon Investment Adviser, Inc |

|

|

|

|

|

| Newton Investment Management Ltd |

| Newton Investment Management North America, LLC |

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|