| Federated Hermes High Income Bond II P |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 586

High Yield Bond Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 119.97 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks high current income.

|

|

| The fund invests primarily in a diversified portfolio of high-yield, lower-rated corporate bonds (also known as "junk bonds"). It primarily invests in domestic high-yield, lower-rated bonds, but may invest a portion of its portfolio in securities of issuers based outside of the United States (so-called "foreign securities") in both emerging and developed markets. The fund may invest in derivative contracts and/or hybrid instruments to implement elements of its investment strategy. |

|

|

| Morningstar Category: High Yield Bond |

|

| High-yield bond portfolios concentrate on lower-quality bonds, which are riskier than those of higher-quality companies. These portfolios generally offer higher yields than other types of portfolios, but they are also more vulnerable to economic and credit risk. These portfolios primarily invest in U.S. high-income debt securities where at least 65% or more of bond assets are not rated or are rated by a major agency such as Standard & Poor's or Moody's at the level of BB (considered speculative for taxable bonds) and below.

|

|

|

| High-Yield Bond Funds: Funds that invest in lower-rated debt securities (commonly referred to as junk bonds) involve additional risk because of the lower credit quality of the securities in the portfolio. There are risks associated with the possibility of a higher level of volatility and increased risk of default. |

|

|

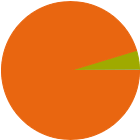

| % of Net Assets |

|

U.S. Stocks |

0.0 |

|

Non-U.S. Stocks |

0.0 |

|

Bonds |

95.3 |

|

Cash |

4.6 |

|

Other |

0.1 |

|

|

|

| Data through 2025-06-30 |

|

|

|

|

| Morningstar Fixed-Income Sectors |

|

| % Fund |

|

Government |

0.00 |

|

Corporate |

95.40 |

|

Securitized |

0.00 |

|

Municipal |

0.00 |

|

Cash & Equivalents |

4.60 |

|

Derivative |

0.00 |

|

|

|

% Bonds |

| AAA |

4.10 |

| AA |

0.00 |

| A |

0.00 |

| BBB |

1.70 |

| BB |

30.50 |

| B |

41.50 |

| Below B |

22.20 |

| Not Rated |

0.00 |

|

|

|

|

|

| Total Number of Stock Holdings |

1 |

| Total Number of Bond Holdings |

451 |

| % of Net Assets in Top 10 Holdings |

8.69 |

|

|

| Turnover % |

(as of 2024-12-31) |

28.00 |

| 30 Day SEC Yield % |

5.20 |

|

|

Maturity

Date

|

Shares

|

Value

$000

|

% of Net

Assets

|

|

|

|

|

|

|

|

Ardonagh Group Finance Ltd. 8.875% |

2032-02-15 |

1,225 |

1,290 |

1.10 |

|

Medline Borrower LP 5.25% |

2029-10-01 |

1,150 |

1,142 |

0.98 |

|

Broadstreet Partners Inc 5.875% |

2029-04-15 |

1,125 |

1,112 |

0.95 |

|

Clarios Global LP 8.5% |

2027-05-15 |

1,100 |

1,107 |

0.95 |

|

McAfee Corp 7.375% |

2030-02-15 |

1,075 |

1,016 |

0.87 |

|

|

1011778 B.C. Unlimited Liability Company / New Red Finance, Inc. 4% |

2030-10-15 |

1,000 |

933 |

0.80 |

|

Madison IAQ LLC 5.875% |

2029-06-30 |

925 |

911 |

0.78 |

|

Athenahealth Group Inc. 6.5% |

2030-02-15 |

900 |

887 |

0.76 |

|

CCO Holdings, LLC/ CCO Holdings Capital Corp. 4.75% |

2030-03-01 |

900 |

873 |

0.75 |

|

Usi Inc 7.5% |

2032-01-15 |

825 |

872 |

0.75 |

|

|

|

|

|

|

|

|

| Credit and Counterparty, Prepayment (Call), Currency, Emerging Markets, Foreign Securities, Loss of Money, Not FDIC Insured, Country or Region, Issuer, Interest Rate, Market/Market Volatility, High-Yield Securities, Restricted/Illiquid Securities, Derivatives, Leverage, Management |

|

| Show Risk Definitions |

|

|

| Inception Date: 1994-03-01 |

|

| Mark E. Durbiano (1994-03-01) |

|

| Mark E. Durbiano, CFA, Senior Portfolio Manager, Head of the Domestic High Yield Group is responsible for portfolio management and research in the fixed income area, concentrating in the domestic high yield sector. Mr. Durbiano joined Federated in 1982 and has been Senior Portfolio Manager and Senior Vice President since 1996. He received a B.A. from Dickinson College and an M.B.A. from University of Pittsburgh. Mr. Durbiano has 38 years of investment experience. |

|

| Kathryn Glass (2023-09-06) |

|

| Kathryn Glass, CFA, Senior Vice President, Senior Portfolio Manager, Co-Head of Domestic High Yield Group. Responsible for portfolio management and research in the fixed income area concentrating in the domestic high yield sector. Previous association: Summer Associate, Goldman Sachs; Analyst, Federated Hermes. B.A., University of Pittsburgh; M.A., Cornell University; M.S.I.A., Carnegie Mellon University. Professional Affiliations: Member, CFA Society of Pittsburgh. Joined Federated Hermes 1999. |

|

| Randal Stuckwish (2023-09-06) |

|

| Randal Stuckwish, CFA, Vice President, Senior Investment Analyst, Portfolio Manager. Responsible for portfolio management and research in the fixed income area concentrating in the domestic high yield sector. Previous associations: Finance Rotational Intern, Ashland, Inc.; Chief Executive Officer, Chief Portfolio Manager, Robert J. McCann Family Student Investment Fund. B.S., Bethany College; M.B.A., Tepper School of Business, Carnegie Mellon University. |

|

|

|

| Federated Investment Management Company |

|

|

|

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|