| Templeton Developing Markets VIP 2 |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

| Style Box Details for Stock Holdings |

|

| Size |

|

| Average Mkt Cap $Mil |

70,364 |

|

|

|

| Market Capitalization |

% of Portfolio |

| Giant |

69.96 |

| Large |

15.07 |

| Medium |

13.55 |

| Small |

1.23 |

| Micro |

0.19 |

| |

|

|

| Trailing Valuations |

Stock

Portfolio

|

| Price/Book |

1.8 |

| Price/Earnings |

11.8 |

| Price/Cash Flow |

7.3 |

|

|

|

|

|

| As of 2025-09-30 |

|

|

|

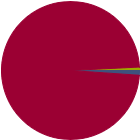

| % of Net Assets |

|

U.S. Stocks |

1.1 |

|

Non-U.S. Stocks |

98.1 |

|

Bonds |

0.0 |

|

Cash |

0.8 |

|

Other |

0.0 |

|

|

|

| Data through 2025-09-30 |

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

35.31 |

|

Basic Materials |

1.42 |

|

Consumer Cyclical |

11.25 |

|

Financial Services |

21.60 |

|

Real Estate |

1.04 |

|

|

|

|

Sensitive |

56.98 |

|

Communication Services |

14.02 |

|

Energy |

1.89 |

|

Industrials |

5.38 |

|

Technology |

35.69 |

|

|

|

|

Defensive |

7.70 |

|

Consumer Defensive |

2.36 |

|

Healthcare |

4.14 |

|

Utilities |

1.20 |

|

| Data through 2025-09-30 |

|

|

| Morningstar World Regions |

|

| % Fund |

| Americas |

13.2 |

|

| North America |

1.1 |

| Latin America |

12.1 |

|

| Greater Europe |

11.6 |

|

| United Kingdom |

0.1 |

| Europe Developed |

6.9 |

| Europe Emerging |

1.4 |

| Africa/Middle East |

3.3 |

|

| Greater Asia |

75.3 |

|

| Japan |

0.0 |

| Australasia |

0.0 |

| Asia Developed |

41.1 |

| Asia Emerging |

34.2 |

|

| Data through 2025-09-30 |

|

|

|

|

| Total Number of Stock Holdings |

82 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

46.92 |

|

|

| Turnover % |

(as of 2023-12-31) |

25.99 |

| 30 Day SEC Yield % |

0.97 |

|

|

Sector |

Country |

% of Net

Assets

|

|

|

|

|

|

|

Taiwan Semiconductor Manufacturing Co Ltd |

|

Taiwan |

14.50 |

|

Prosus NV Ordinary Shares - Class N |

|

Netherlands |

5.73 |

|

SK Hynix Inc |

|

South Korea |

5.25 |

|

Samsung Electronics Co Ltd |

|

South Korea |

3.95 |

|

Alibaba Group Holding Ltd Ordinary Shares |

|

China |

3.54 |

|

|

ICICI Bank Ltd |

|

India |

3.36 |

|

Tencent Holdings Ltd |

|

China |

3.21 |

|

Grupo Financiero Banorte SAB de CV Class O |

|

Mexico |

2.68 |

|

MediaTek Inc |

|

Taiwan |

2.40 |

|

Hon Hai Precision Industry Co Ltd |

|

Taiwan |

2.30 |

|

|

HDFC Bank Ltd |

|

India |

2.01 |

|

Itau Unibanco Holding SA ADR |

|

Brazil |

1.97 |

|

NAVER Corp |

|

South Korea |

1.81 |

|

Techtronic Industries Co Ltd |

|

Hong Kong |

1.73 |

|

Petroleo Brasileiro SA Petrobras Participating Preferred |

|

Brazil |

1.73 |

|

|

China Merchants Bank Co Ltd Class A |

|

China |

1.72 |

|

Bank Bradesco SA ADR |

|

Brazil |

1.69 |

|

Hyundai Motor Co |

|

South Korea |

1.57 |

|

LG Corp |

|

South Korea |

1.33 |

|

Discovery Ltd |

|

South Africa |

1.30 |

|

|

NARI Technology Co Ltd Class A |

|

China |

1.25 |

|

Baidu Inc |

|

China |

1.25 |

|

Genpact Ltd |

|

India |

1.23 |

|

Kasikornbank Public Co Ltd |

|

Thailand |

1.21 |

|

WuXi Biologics (Cayman) Inc |

|

China |

1.15 |

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|