| Fidelity VIP Growth Opportunities Init |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 1024

Large Growth Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 4,607.93 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks to provide capital growth.

|

|

| The fund normally invests primarily in common stocks. It invests in companies that the adviser believes have above-average growth potential (stocks of these companies are often called "growth" stocks). The fund invests in domestic and foreign issuers. It is non-diversified. |

|

|

| Morningstar Category: Large Growth |

|

| Large-growth portfolios invest primarily in big U.S. companies that are projected to grow faster than other large-cap stocks. Stocks in the top 70% of the capitalization of the U.S. equity market are defined as large cap. Growth is defined based on fast growth (high growth rates for earnings, sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields). Most of these portfolios focus on companies in rapidly expanding industries.

|

|

|

| Non-Diversified Funds: Funds that invest more of their assets in a single issuer involve additional risks, including share price fluctuations, because of the increased concentration of investments. |

|

|

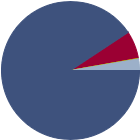

| % of Net Assets |

|

U.S. Stocks |

90.7 |

|

Non-U.S. Stocks |

6.5 |

|

Bonds |

0.0 |

|

Cash |

0.1 |

|

Other |

2.7 |

|

|

|

| Data through 2025-08-31 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

15.85 |

|

Basic Materials |

0.00 |

|

Consumer Cyclical |

12.04 |

|

Financial Services |

3.48 |

|

Real Estate |

0.33 |

|

|

|

|

Sensitive |

75.63 |

|

Communication Services |

22.87 |

|

Energy |

0.02 |

|

Industrials |

5.17 |

|

Technology |

47.57 |

|

|

|

|

Defensive |

8.51 |

|

Consumer Defensive |

1.80 |

|

Healthcare |

4.87 |

|

Utilities |

1.84 |

|

| Data through 2025-08-31 |

|

|

| Total Number of Stock Holdings |

100 |

| Total Number of Bond Holdings |

4 |

| % of Net Assets in Top 10 Holdings |

59.74 |

|

|

| Turnover % |

(as of 2024-12-31) |

58.00 |

| 30 Day SEC Yield % |

--- |

|

|

Sector |

P/E |

% of Net

Assets

|

|

|

|

|

|

|

NVIDIA Corp |

|

51.47 |

15.28 |

|

Microsoft Corp |

|

37.95 |

11.63 |

|

Meta Platforms Inc Class A |

|

26.60 |

6.75 |

|

Amazon.com Inc |

|

33.85 |

6.66 |

|

Broadcom Inc |

|

88.09 |

4.46 |

|

|

Apple Inc |

|

39.87 |

4.39 |

|

Alphabet Inc Class C |

|

26.80 |

3.61 |

|

Roku Inc Class A |

|

--- |

3.07 |

|

Builders FirstSource Inc |

|

19.01 |

1.99 |

|

Flex Ltd |

|

--- |

1.90 |

|

|

|

|

|

|

|

|

| Foreign Securities, Loss of Money, Not FDIC Insured, Growth Investing, Nondiversification, Issuer, Market/Market Volatility, Equity Securities |

|

| Show Risk Definitions |

|

|

| Inception Date: 1995-01-03 |

|

| Kyle Weaver (2015-07-14) |

|

| Kyle Weaver is portfolio manager of the fund, which he has managed since July 2015. He also manages other funds. Since joining Fidelity Investments in 2008, Mr. Weaver has worked as a research analyst and portfolio manager. Mr. Weaver earned his Bachelor of Arts degree in public policy from Stanford University. |

|

| Becky Baker (2023-11-14) |

|

| Becky Baker is a research analyst and portfolio manager in the Equity division at Fidelity Investments. Fidelity Investments is a leading provider of investment management, retirement planning, portfolio guidance, brokerage, benefits outsourcing, and other financial products and services to institutions, financial intermediaries, and individuals.

In this role, Ms. Baker manages Fidelity Select Enterprise Tech Services Portfolio. She co-manages the Fidelity Advisor Growth Opportunities Fund and the technology sleeve of the Fidelity Series All-Sector Equity Fund. Additionally, she covers IT services, software, and other information technology stocks as an analyst.

Prior to assuming her current role, Ms. Baker managed Fidelity Select Leisure Portfolio and covered consumer stocks, including restaurants, hotels, gaming, cruise lines.

Prior to joining Fidelity as an equity research intern, Ms. Baker served an equity analyst intern at SEI Investments. She has been in the financial industry since 2012.

Ms. Baker earned her bachelor of arts degree in economics from Swarthmore College. |

|

|

|

| Fidelity Management & Research Company LLC |

|

|

|

|

|

| FMR Investment Management (U.K.) Limited |

| Fidelity Management & Research (Japan) Limited |

| Fidelity Management & Research (Hong Kong) Ltd |

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|