| Dimensional VA US Large Value |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 1086

Large Value Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 713.83 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks long-term capital appreciation.

|

|

| The fund purchases a broad and diverse group of readily marketable securities of large U.S. companies that the Advisor determines to be value stocks. As a non-fundamental policy, under normal circumstances, it will invest at least 80% of its net assets in securities of large cap U.S. companies. The fund may purchase or sell futures contracts and options on futures contracts for U.S. equity securities and indices, to increase or decrease equity market exposure based on actual or expected cash inflows to or outflows from the Portfolio. |

|

|

| Morningstar Category: Large Value |

|

| Large-value portfolios invest primarily in big U.S. companies that are less expensive or growing more slowly than other large-cap stocks. Stocks in the top 70% of the capitalization of the U.S. equity market are defined as large cap. Value is defined based on low valuations (low price ratios and high dividend yields) and slow growth (low growth rates for earnings, sales, book value, and cash flow).

|

|

|

| There are no additional fund specific investment risks (e.g. liquidity risk, currency risk, foreign investment risk, etc.) associated with this fund beyond the normal risks generally associated with investing in a mutual fund. |

|

|

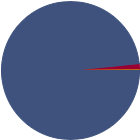

| % of Net Assets |

|

U.S. Stocks |

98.5 |

|

Non-U.S. Stocks |

1.5 |

|

Bonds |

0.0 |

|

Cash |

0.1 |

|

Other |

0.0 |

|

|

|

| Data through 2025-08-31 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

36.88 |

|

Basic Materials |

7.28 |

|

Consumer Cyclical |

5.66 |

|

Financial Services |

23.56 |

|

Real Estate |

0.38 |

|

|

|

|

Sensitive |

45.02 |

|

Communication Services |

7.48 |

|

Energy |

11.06 |

|

Industrials |

14.15 |

|

Technology |

12.33 |

|

|

|

|

Defensive |

18.10 |

|

Consumer Defensive |

4.24 |

|

Healthcare |

13.75 |

|

Utilities |

0.11 |

|

| Data through 2025-08-31 |

|

|

| Total Number of Stock Holdings |

389 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

20.99 |

|

|

| Turnover % |

(as of 2024-10-31) |

15.00 |

| 30 Day SEC Yield % |

--- |

|

|

Sector |

P/E |

% of Net

Assets

|

|

|

|

|

|

|

JPMorgan Chase & Co |

|

15.33 |

4.75 |

|

Exxon Mobil Corp |

|

16.29 |

3.05 |

|

Berkshire Hathaway Inc Class B |

|

16.42 |

2.12 |

|

Johnson & Johnson |

|

18.27 |

2.06 |

|

Chevron Corp |

|

19.76 |

1.73 |

|

|

UnitedHealth Group Inc |

|

17.97 |

1.61 |

|

Cisco Systems Inc |

|

28.59 |

1.56 |

|

AT&T Inc |

|

8.04 |

1.47 |

|

Verizon Communications Inc |

|

8.31 |

1.36 |

|

Wells Fargo & Co |

|

14.17 |

1.28 |

|

|

|

|

|

|

|

|

| Lending, Loss of Money, Not FDIC Insured, Value Investing, Market/Market Volatility, Equity Securities, Other, Derivatives, Management |

|

| Show Risk Definitions |

|

|

| Inception Date: 1995-01-12 |

|

| Jed S. Fogdall (2012-02-28) |

|

| Jed S. Fogdall is a Co-Head of Portfolio Management and Vice President of Dimensional and a member of Dimensional’s Investment Committee. Mr. Fogdall has an MBA from the University of California, Los Angeles and a BS from Purdue University. Mr. Fogdall joined Dimensional as a Portfolio Manager in 2004 and has been responsible for international portfolios since 2010 and domestic portfolios since 2012. |

|

| Allen Pu (2024-02-28) |

|

| Allen Pu is Deputy Head of Portfolio Management, North America, a member of the Investment Committee, Vice President and a Senior Portfolio Manager of the Sub-Adviser. Mr. Pu joined Dimensional as a Portfolio Manager in 2006. Mr. Pu has an M.B.A. from the University of California, Los Angeles, an M.S. and Ph.D. from Caltech, and a B.S. from Cooper Union for the Advancement of Science and Art. |

|

| John A. Hertzer (2022-02-28) |

|

| Mr. Hertzer joined DFA in 2013. Mr. Hertzer began his investment career in 2004 and earned a B.A. from Dartmouth College and an M.B.A. from the University of California Los Angeles. |

|

|

|

| Dimensional Fund Advisors LP |

|

|

| Dimensional Fund Advisors |

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|