| Victory Pioneer High Yield VCT - Cl II |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 586

High Yield Bond Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 27.6 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks to maximize total return through a combination of income and capital appreciation.

|

|

| Normally, the portfolio invests at least 80% of its total assets in below investment grade (high yield) debt securities and preferred stocks. It may invest in high yield securities of any rating, including securities where the issuer is in default or bankruptcy at the time of purchase. The portfolio may invest in investment grade and below investment grade convertible bonds and preferred stocks that are convertible into the equity securities of the issuer. |

|

|

| Morningstar Category: High Yield Bond |

|

| High-yield bond portfolios concentrate on lower-quality bonds, which are riskier than those of higher-quality companies. These portfolios generally offer higher yields than other types of portfolios, but they are also more vulnerable to economic and credit risk. These portfolios primarily invest in U.S. high-income debt securities where at least 65% or more of bond assets are not rated or are rated by a major agency such as Standard & Poor's or Moody's at the level of BB (considered speculative for taxable bonds) and below.

|

|

|

| High-Yield Bond Funds: Funds that invest in lower-rated debt securities (commonly referred to as junk bonds) involve additional risk because of the lower credit quality of the securities in the portfolio. There are risks associated with the possibility of a higher level of volatility and increased risk of default. |

|

|

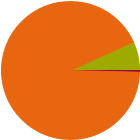

| % of Net Assets |

|

U.S. Stocks |

0.0 |

|

Non-U.S. Stocks |

0.4 |

|

Bonds |

92.8 |

|

Cash |

6.8 |

|

Other |

0.0 |

|

|

|

| Data through 2025-08-31 |

|

|

|

|

| Morningstar Fixed-Income Sectors |

|

| % Fund |

|

Government |

0.88 |

|

Corporate |

92.34 |

|

Securitized |

0.00 |

|

Municipal |

0.00 |

|

Cash & Equivalents |

6.08 |

|

Derivative |

0.71 |

|

|

|

% Bonds |

| AAA |

3.31 |

| AA |

0.00 |

| A |

0.00 |

| BBB |

2.64 |

| BB |

36.61 |

| B |

45.51 |

| Below B |

7.74 |

| Not Rated |

4.19 |

|

|

|

|

|

| Total Number of Stock Holdings |

3 |

| Total Number of Bond Holdings |

190 |

| % of Net Assets in Top 10 Holdings |

16.97 |

|

|

| Turnover % |

(as of 2024-12-31) |

53.00 |

| 30 Day SEC Yield % |

5.63 |

|

|

Maturity

Date

|

Shares

|

Value

$000

|

% of Net

Assets

|

|

|

|

|

|

|

|

Dreyfus Government Cash Mgmt Instl |

--- |

1,318 |

1,318 |

4.73 |

|

Victory Pioneer ILS Interval |

--- |

81 |

777 |

2.79 |

|

CCO Holdings, LLC/ CCO Holdings Capital Corp. 4.5% |

2033-06-01 |

444 |

396 |

1.42 |

|

Global Aircraft Leasing Co Ltd 8.75% |

2027-09-01 |

365 |

376 |

1.35 |

|

U S Acute Care Solutions LLC 9.75% |

2029-05-15 |

330 |

339 |

1.22 |

|

|

First Quantum Minerals Ltd. 8.625% |

2031-06-01 |

310 |

324 |

1.16 |

|

Taseko Mines Limited 8.25% |

2030-05-01 |

306 |

322 |

1.16 |

|

Olympus Water US Holding Corp. 9.75% |

2028-11-15 |

285 |

299 |

1.07 |

|

Macys Retail Holdings LLC 6.125% |

2032-03-15 |

300 |

293 |

1.05 |

|

Trinity Industries, Inc. 7.75% |

2028-07-15 |

274 |

283 |

1.02 |

|

|

|

|

|

|

|

|

| Lending, Credit and Counterparty, Extension, Prepayment (Call), Foreign Securities, Loss of Money, Not FDIC Insured, High Portfolio Turnover, Interest Rate, Market/Market Volatility, Convertible Securities, Equity Securities, High-Yield Securities, Industry and Sector Investing, Inverse Floaters, Mortgage-Backed and Asset-Backed Securities, Municipal Obligations, Leases, and AMT-Subject Bonds, Other, Preferred Stocks, Restricted/Illiquid Securities, Underlying Fund/Fund of Funds, Warrants, U.S. Government Obligations, Derivatives, Leverage, Pricing, Socially Conscious, Increase in Expenses, Shareholder Activity, Amortized Cost, China Region, Credit Default Swaps, Forwards, Management, Zero-Coupon Bond |

|

| Show Risk Definitions |

|

|

| Inception Date: 2001-05-01 |

|

| Kenneth J. Monaghan (2019-10-01) |

|

| Kenneth J. Monaghan is Managing Director, Co-Director of High Yield, and Portfolio Manager at Amundi Pioneer. Based in Durham, he is a Portfolio Manager on US high yield and global high yield strategies. Ken is also Co-Director of a team of portfolio managers who specialize in identifying and capitalizing on high yield and bank loan opportunities globally. The team also provides insight and recommendations for a number of multi-sector fixed income strategies managed by the US fixed income team.

Prior to joining Amundi Pioneer in 2014, Ken was at Rogge Global Partners where he was Partner and Portfolio Manager responsible for US high yield and was an integral part of Rogge’s global high yield strategy; he also ran Rogge’s New York office. He joined Rogge in 2008 from ING Investment Management where he was Managing Director and Portfolio Manager responsible for US high yield. Ken brought ING’s institutional US high yield strategy to Rogge. He co-founded the strategy in 1996 at a predecessor organization to ING and was co-portfolio manager of the strategy from its inception and the sole senior portfolio manager of the strategy from 2007 through June 2014 when he left Rogge. Prior to becoming a portfolio manager, Ken spent 13 years at Salomon Brothers starting as a high yield analyst eventually heading Salomon’s high yield research effort in New York. He subsequently spent five years in London as head of Salomon’s London credit research team and upon his return to New York in 1991 launched Salomon’s nascent distressed credit effort. He spent his final years at Salomon as a Director of Institutional Sales. He began his career as a credit analyst at Lord, Abbett & Co.

Ken is a graduate of Colgate University and holds both a Master of Business Administration (MBA) degree in Finance and a Master of Public Administration (MPA) degree from New York University. |

|

| Matthew Shulkin (2017-10-01) |

|

| Mr. Shulkin, a Senior Vice President, joined Amundi US in 2013 as a member of the U.S. fixed income team and has twenty years of investment experience.

Prior to joining Amundi US, Mr. Shulkin spent five years at Mast Capital Management as an analyst focusing on the paper and forest products, packaging and homebuilding sectors. Previously, Mr. Shulkin was a credit analyst at Tisbury Capital and a member of the high yield team at Putnam Investments. Mr. Shulkin has served as a portfolio manager of the portfolio since 2017.

Matt earned his B.A. from Cornell University in 1996, and his M.B.A. from The Wharton School in 2003. He is a CFA® charterholder. |

|

| Andrew Feltus (2007-04-02) |

|

| ANDREW D. FELTUS, CFA

MANAGING DIRECTOR

CO-DIRECTOR OF HIGH YIELD, PORTFOLIO MANAGER

Joined Amundi Pioneer: 1994

Investment Experience Since: 1991

Andrew Feltus is a Managing Director, Portfolio Manager, and Co-Director of the Amundi Pioneer High Yield team based in Boston. In addition to his role as a Portfolio Manager on U.S. high yield, global high yield, and multisector portfolios, Andrew co-leads a team of portfolio managers who specialize in identifying and capitalizing on high yield and bank loan opportunities globally. The team also provides insight and recommendations for a number of multisector fixed income strategies managed by the U.S. fixed income team.

Andrew has been actively managing fixed income portfolios since 1994. He has extensive experience managing a wide range of debt securities globally, including emerging markets and foreign exchange. His experience includes analyzing and managing derivatives since 1992. Andrew joined Amundi Pioneer as a Fixed Income Analyst and became a Portfolio Manager in 2001. Prior to joining Amundi Pioneer, he worked on the bond desk at Massachusetts Financial Services.

He holds a B.A. in quantitative economics and philosophy from Tufts University. He is a CFA® charterholder. |

|

|

|

| Victory Capital Management Inc. |

|

|

|

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|