| Invesco VI Small Cap Equity II |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 568

Small Blend Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 239.57 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks long-term growth of capital.

|

|

| The fund invests, under normal circumstances, at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities of small-capitalization issuers. The principal type of equity securities in which the fund invests is common stock. The fund's managers consider an issuer to be a small-capitalization issuer if it has a market capitalization, at the time of purchase, no larger than the market capitalization of the largest capitalized issuer included in the Russell 2000® Index. The fund may also invest up to 25% of its net assets in foreign securities. |

|

|

| Morningstar Category: Small Blend |

|

| Small-blend portfolios favor U.S. firms at the smaller end of the market-capitalization range. Some aim to own an array of value and growth stocks while others employ a discipline that leads to holdings with valuations and growth rates close to the small-cap averages. Stocks in the bottom 10% of the capitalization of the U.S. equity market are defined as small cap. The blend style is assigned to portfolios where neither growth nor value characteristics predominate.

|

|

|

| Small Cap Funds: Smaller companies typically have higher risk of failure, and are not as well established as larger blue-chip companies. Historically, the smaller company stocks have experienced a greater degree of market volatility than the overall market average. |

|

|

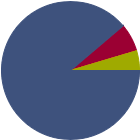

| % of Net Assets |

|

U.S. Stocks |

88.8 |

|

Non-U.S. Stocks |

6.6 |

|

Bonds |

0.0 |

|

Cash |

4.6 |

|

Other |

0.0 |

|

|

|

| Data through 2025-06-30 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

36.73 |

|

Basic Materials |

2.47 |

|

Consumer Cyclical |

9.85 |

|

Financial Services |

20.40 |

|

Real Estate |

4.01 |

|

|

|

|

Sensitive |

42.20 |

|

Communication Services |

0.00 |

|

Energy |

3.22 |

|

Industrials |

24.67 |

|

Technology |

14.31 |

|

|

|

|

Defensive |

21.06 |

|

Consumer Defensive |

4.35 |

|

Healthcare |

15.19 |

|

Utilities |

1.52 |

|

| Data through 2025-06-30 |

|

|

| Total Number of Stock Holdings |

85 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

18.01 |

|

|

| Turnover % |

(as of 2024-12-31) |

50.00 |

| 30 Day SEC Yield % |

--- |

|

|

Sector |

P/E |

% of Net

Assets

|

|

|

|

|

|

|

Invesco Shrt-Trm Inv Treasury Instl |

--- |

--- |

2.65 |

|

Piper Sandler Cos |

|

27.53 |

1.91 |

|

ITT Inc |

|

31.12 |

1.85 |

|

Encompass Health Corp |

|

22.00 |

1.73 |

|

Pinnacle Financial Partners Inc |

|

10.80 |

1.71 |

|

|

AeroVironment Inc |

|

--- |

1.67 |

|

The Bancorp Inc |

|

16.64 |

1.67 |

|

REV Group Inc |

|

25.40 |

1.63 |

|

Applied Industrial Technologies Inc |

|

24.65 |

1.60 |

|

Skyward Specialty Insurance Group Inc |

|

13.54 |

1.59 |

|

|

|

|

|

|

|

|

| Foreign Securities, Loss of Money, Not FDIC Insured, Active Management, Market/Market Volatility, Equity Securities, Small Cap, Mid-Cap, Real Estate/REIT Sector |

|

| Show Risk Definitions |

|

|

| Inception Date: 2003-08-29 |

|

| Juan R. Hartsfield (2006-04-27) |

|

| Juan Hartsfield is a portfolio manager for Invesco small-cap core and small-cap growth products, as well as the Invesco leisure products. Prior to joining Invesco in 2004, Mr. Hartsfield was a portfolio manager with JPMorgan Fleming Asset Mgmt. on various small-cap portfolios. Prior to joining JPMorgan, Mr. Hartsfield served as an associate with Booz Allen & Hamilton. Mr. Hartsfield earned a Bachelor of Science degree in petroleum engineering from The University of Texas at Austin and a Master of Business Administration degree from the University of Michigan. He is a CFA charterholder. |

|

| Davis Paddock (2016-04-29) |

|

| Davis Paddock is a Portfolio Manager for Invesco Small Cap Equity Fund. Mr. Paddock has covered the Industrials and Basic Materials sectors for the Invesco Small Cap Team since 2005. Prior to joining Invesco in 2001, he was an investment banking financial analyst for Merrill Lynch & Co. He also worked for Ocean Energy Inc. as a member of its corporate finance and investor relations department. He entered the industry in 1994. Mr. Paddock earned both his BA degree and MBA from The University of Texas at Austin. He is a CFA charterholder. |

|

|

|

|

|

|

|

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|