| BlackRock Advantage Lg Cp Val V.I. III |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

| Style Box Details for Stock Holdings |

|

| Size |

|

| Average Mkt Cap $Mil |

135,693 |

|

|

|

| Market Capitalization |

% of Portfolio |

| Giant |

18.73 |

| Large |

46.00 |

| Medium |

27.26 |

| Small |

7.79 |

| Micro |

0.22 |

| |

|

|

| Investment Valuation |

Stock

Portfolio

|

| Forward P/E |

16.8 |

| Price/Book |

2.7 |

| Price/Sales |

1.8 |

| Price/Cash Flow |

10.5 |

| Dividend Yield |

2.0 |

| Long-Term Earnings |

8.3 |

| Historical Earnings |

3.0 |

| Sales Growth |

8.0 |

| Cash-Flow Growth |

2.4 |

| Book-Value Growth |

7.5 |

|

|

|

|

|

| As of 2025-09-30 |

|

|

|

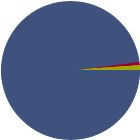

| % of Net Assets |

|

U.S. Stocks |

97.9 |

|

Non-U.S. Stocks |

1.0 |

|

Bonds |

0.0 |

|

Cash |

1.1 |

|

Other |

0.0 |

|

|

|

| Data through 2025-09-30 |

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

35.96 |

|

Basic Materials |

2.97 |

|

Consumer Cyclical |

8.80 |

|

Financial Services |

21.18 |

|

Real Estate |

3.01 |

|

|

|

|

Sensitive |

40.88 |

|

Communication Services |

8.15 |

|

Energy |

4.66 |

|

Industrials |

14.77 |

|

Technology |

13.30 |

|

|

|

|

Defensive |

23.16 |

|

Consumer Defensive |

6.40 |

|

Healthcare |

13.18 |

|

Utilities |

3.58 |

|

| Data through 2025-09-30 |

|

|

|

|

| Total Number of Stock Holdings |

228 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

21.45 |

|

|

| Turnover % |

(as of 2024-12-31) |

128.00 |

| 30 Day SEC Yield % |

0.00 |

|

|

Sector |

P/E |

% of Net

Assets

|

|

|

|

|

|

|

JPMorgan Chase & Co |

|

15.33 |

3.22 |

|

Berkshire Hathaway Inc Class B |

|

16.42 |

2.85 |

|

Amazon.com Inc |

|

33.97 |

2.69 |

|

Walmart Inc |

|

38.43 |

2.46 |

|

Bank of America Corp |

|

14.49 |

2.17 |

|

|

Alphabet Inc Class A |

|

27.79 |

1.65 |

|

Morgan Stanley |

|

16.95 |

1.63 |

|

Johnson & Johnson |

|

18.27 |

1.61 |

|

Pfizer Inc |

|

12.85 |

1.59 |

|

Procter & Gamble Co |

|

21.84 |

1.58 |

|

|

Charles Schwab Corp |

|

22.11 |

1.56 |

|

Honeywell International Inc |

|

21.11 |

1.55 |

|

Alphabet Inc Class C |

|

27.83 |

1.39 |

|

The Travelers Companies Inc |

|

10.67 |

1.30 |

|

UnitedHealth Group Inc |

|

17.97 |

1.24 |

|

|

Union Pacific Corp |

|

18.58 |

1.23 |

|

Meta Platforms Inc Class A |

|

29.49 |

1.23 |

|

Devon Energy Corp |

|

7.21 |

1.20 |

|

Corteva Inc |

|

28.83 |

1.17 |

|

Citigroup Inc |

|

14.08 |

1.17 |

|

|

Entergy Corp |

|

23.66 |

1.16 |

|

TJX Companies Inc |

|

32.41 |

1.16 |

|

Comcast Corp Class A |

|

4.54 |

1.13 |

|

Parker Hannifin Corp |

|

28.55 |

1.10 |

|

Cardinal Health Inc |

|

28.59 |

1.02 |

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|