| Eaton Vance VT Floating-Rate Inc ADV |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 210

Bank Loan Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 515.25 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks to provide a high level of current income.

|

|

| The fund normally invests at least 80% of its net assets (plus any borrowings for investment purposes) in income producing floating rate loans and other floating rate debt securities. It invests primarily in senior floating rate loans of domestic and foreign borrowers ("Senior Loans"). Loans usually are of below investment grade quality and have below investment grade credit ratings, such ratings are associated with securities having high risk and speculative characteristics (sometimes referred to as "junk"). |

|

|

| Morningstar Category: Bank Loan |

|

| Bank-loan portfolios primarily invest in floating-rate bank loans and floating-rate below investment-grade securities instead of bonds. In exchange for their credit risk, these loans offer high interest payments that typically float above a common short-term benchmarks such as Libor or SOFR.

|

|

|

| There are no additional fund specific investment risks (e.g. liquidity risk, currency risk, foreign investment risk, etc.) associated with this fund beyond the normal risks generally associated with investing in a mutual fund. |

|

|

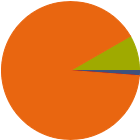

| % of Net Assets |

|

U.S. Stocks |

1.2 |

|

Non-U.S. Stocks |

0.0 |

|

Bonds |

90.5 |

|

Cash |

8.3 |

|

Other |

0.0 |

|

|

|

| Data through 2025-08-31 |

|

|

|

|

| Morningstar Fixed-Income Sectors |

|

| % Fund |

|

Government |

0.00 |

|

Corporate |

90.49 |

|

Securitized |

1.11 |

|

Municipal |

0.00 |

|

Cash & Equivalents |

8.40 |

|

Derivative |

0.00 |

|

|

|

% Bonds |

| AAA |

0.00 |

| AA |

0.00 |

| A |

0.00 |

| BBB |

5.19 |

| BB |

24.51 |

| B |

62.42 |

| Below B |

5.57 |

| Not Rated |

2.32 |

|

|

|

|

|

| Total Number of Stock Holdings |

10 |

| Total Number of Bond Holdings |

478 |

| % of Net Assets in Top 10 Holdings |

14.18 |

|

|

| Turnover % |

(as of 2024-12-31) |

34.00 |

| 30 Day SEC Yield % |

6.90 |

|

|

Maturity

Date

|

Shares

|

Value

$000

|

% of Net

Assets

|

|

|

|

|

|

|

|

Morgan Stanley Inst Lqudty Gov Sec Ins |

2030-12-31 |

45,133 |

45,133 |

8.25 |

|

UKG Inc. |

2031-02-10 |

4,303 |

4,306 |

0.79 |

|

Epicor |

2031-05-30 |

4,047 |

4,062 |

0.74 |

|

Applied Systems, Inc. |

2031-02-24 |

3,875 |

3,876 |

0.71 |

|

Alliant Holdings Intermediate, LLC |

2031-09-19 |

3,827 |

3,822 |

0.70 |

|

|

Gfl Environmental Services |

2032-03-03 |

3,450 |

3,452 |

0.63 |

|

Focus Financial Partners, LLC |

2031-09-15 |

3,266 |

3,268 |

0.60 |

|

Primo Brands (fka Triton Water) |

2028-03-31 |

3,242 |

3,249 |

0.59 |

|

Garda World Security Corporation |

2029-02-01 |

3,218 |

3,223 |

0.59 |

|

Ensemble RCM, LLC |

2029-08-01 |

3,135 |

3,153 |

0.58 |

|

|

|

|

|

|

|

|

| Lending, Credit and Counterparty, Foreign Securities, Long-Term Outlook and Projections, Loss of Money, Not FDIC Insured, Active Management, Interest Rate, Market/Market Volatility, High-Yield Securities, Restricted/Illiquid Securities, U.S. Government Obligations, Shareholder Activity, Portfolio Diversification, Money Market Fund Ownership |

|

| Show Risk Definitions |

|

|

| Inception Date: 2014-04-15 |

|

| Peter M. Campo (2025-06-12) |

|

| Mr. Campo is a member of the High Yield and Bank Loans team. He joined Goldman Sachs Asset Management, L.P in 2018. Prior to joining Goldman Sachs Asset Management, L.P, he worked at Eaton Vance as a portfolio manager and research analyst. |

|

| Michael Turgel (2019-05-01) |

|

| Michael Turgel is a portfolio manager on the Floating-Rate Loan team. He is responsible for buy and sell decisions, portfolio construction and risk management for the firm’s floating-rate loan strategies. He also focuses on coverage of the independent power producer, food and metals industries. He joined Eaton Vance in 2006. Morgan Stanley acquired Eaton Vance in March 2021. Michael began his career in the investment management industry in 2005. Before joining Eaton Vance, he worked as an SEC reporting analyst at Boston Communications Group, Inc. and as an assurance advisory professional for Deloitte & Touche. He earned a bachelor’s degree from the University of Massachusetts, Amherst and an MBA from the Leonard N. Stern School of Business at New York University. He is a member of the CFA Society Boston and is a CFA charterholder. |

|

|

|

|

|

|

|

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|