| Fidelity VIP Extended Mkt Indx Initial |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 568

Small Blend Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 423.64 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks to provide investment results that correspond to the total return of stocks of mid- to small-capitalization U.S. companies.

|

|

| The fund normally invests at least 80% of assets in common stocks included in the Fidelity U.S. Extended Investable Market IndexSM. The index is a float-adjusted market capitalization-weighted index designed to reflect the performance of U.S. mid- and small-cap stocks. |

|

|

| Morningstar Category: Small Blend |

|

| Small-blend portfolios favor U.S. firms at the smaller end of the market-capitalization range. Some aim to own an array of value and growth stocks while others employ a discipline that leads to holdings with valuations and growth rates close to the small-cap averages. Stocks in the bottom 10% of the capitalization of the U.S. equity market are defined as small cap. The blend style is assigned to portfolios where neither growth nor value characteristics predominate.

|

|

|

| Small Cap Funds: Smaller companies typically have higher risk of failure, and are not as well established as larger blue-chip companies. Historically, the smaller company stocks have experienced a greater degree of market volatility than the overall market average. |

|

|

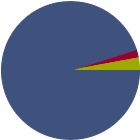

| % of Net Assets |

|

U.S. Stocks |

95.1 |

|

Non-U.S. Stocks |

2.0 |

|

Bonds |

0.0 |

|

Cash |

2.9 |

|

Other |

0.0 |

|

|

|

| Data through 2025-08-31 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

40.53 |

|

Basic Materials |

4.06 |

|

Consumer Cyclical |

12.88 |

|

Financial Services |

16.36 |

|

Real Estate |

7.23 |

|

|

|

|

Sensitive |

41.80 |

|

Communication Services |

3.65 |

|

Energy |

3.50 |

|

Industrials |

19.04 |

|

Technology |

15.61 |

|

|

|

|

Defensive |

17.67 |

|

Consumer Defensive |

3.96 |

|

Healthcare |

11.33 |

|

Utilities |

2.38 |

|

| Data through 2025-08-31 |

|

|

| Total Number of Stock Holdings |

2055 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

8.40 |

|

|

| Turnover % |

(as of 2024-12-31) |

12.00 |

| 30 Day SEC Yield % |

--- |

|

|

Sector |

P/E |

% of Net

Assets

|

|

|

|

|

|

|

Fidelity Cash Central Fund |

--- |

--- |

2.75 |

|

E-mini S&P MidCap 400 Future Sept 25 |

--- |

--- |

1.64 |

|

E-mini Russell 2000 Index Future Sept 25 |

--- |

--- |

1.32 |

|

SoFi Technologies Inc Ordinary Shares |

|

53.08 |

0.43 |

|

EMCOR Group Inc |

|

28.63 |

0.42 |

|

|

Reddit Inc Class A Shares |

|

127.42 |

0.38 |

|

Comfort Systems USA Inc |

|

42.57 |

0.38 |

|

Anglogold Ashanti PLC |

|

--- |

0.37 |

|

Pure Storage Inc Class A |

|

224.02 |

0.37 |

|

Affirm Holdings Inc Ordinary Shares - Class A |

|

452.67 |

0.34 |

|

|

|

|

|

|

|

|

| Lending, Loss of Money, Not FDIC Insured, Index Correlation/Tracking Error, Issuer, Market/Market Volatility, Equity Securities, Passive Management, Small Cap, Mid-Cap |

|

| Show Risk Definitions |

|

|

| Inception Date: 2018-04-17 |

|

| Louis Bottari (2018-04-17) |

|

| Mr. Bottari has worked as an assistant portfolio manager, portfolio manager, and senior portfolio manager with Geode since May 2008. In addition to his portfolio management responsibilities, he is responsible for quantitative research and new product development. Prior to joining Geode, Bottari was employed by Fidelity in 1991 and served as an Assistant Portfolio Manager with Pyramis Global Advisors from 2005 to 2008. |

|

| Payal Kapoor Gupta (2019-06-30) |

|

| Payal Gupta joined Geode in 2019, Ms. Gupta has worked as a portfolio manager. Prior to joining Geode, Ms. Gupta worked at State Street Global Advisors from 2005 to 2019, most recently as senior portfolio manager. Before joining SSGA in 2005, she worked as an analyst at Concentra Integrated Services and at Morgan Stanley. Ms. Gupta holds an MBA with specialization in Investments and Information Systems from Northeastern University and a Bachelor of Science in Information Technology from Bay Path University. |

|

| Peter Matthew (2018-04-17) |

|

| Since joining Geode in 2007, Mr. Matthew has worked as a senior operations associate, portfolio manager assistant, and assistant portfolio manager. Prior to joining Geode, Mr. Matthew was employed by eSecLending from 2005 to 2007 and by State Street Corporation from 2001 to 2005. |

|

| Navid Sohrabi (2019-08-31) |

|

| Navid Sohrabi is portfolio manager of Geode Capital Management, LLC. Since joining Geode in 2019, Mr. Sohrabi has worked as a portfolio manager. Prior to joining Geode, Mr. Sohrabi worked at DWS, most recently as an index portfolio manager. Mr. Sohrabi was Vice President with Deutsche Asset Management and has served as a Portfolio Manager and quantitative multi-asset strategist in the Passive Asset Management business since 2015. Prior to joining Deutsche Bank, Mr. Sohrabi served as a derivatives trader for several institutional asset managers and commodity trading advisors where he developed and managed systematic risk and trading strategies in equities, options, fx and futures. Mr. Sohrabi earned a BA in neurobiology from the University of California, Berkley, and a Masters of Financial Engineering from the Anderson School of Management at the University of California, Los Angeles and is a CFA charterholder. |

|

| Robert Regan (2018-04-17) |

|

| Robert Regan is a Portfolio Manager. He has been with Geode since 2016. Prior to joining Geode, Mr. Regan was a Senior Implementation Portfolio Manager at State Street Global Advisors from 2008 to 2016. Previously, Mr. Regan was employed by PanAgora Asset Management from 1997 to 2008, most recently as a Portfolio Manager. Mr. Regan began his career at Investors Bank and Trust. |

|

|

|

| Fidelity Management & Research Company LLC |

|

|

|

|

|

| Geode Capital Management, LLC |

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|