| Janus Henderson VIT Flexible Bond Instl JAFLX |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 520

Intermediate Core-Plus Bond Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 639.48 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks to obtain maximum total return, consistent with preservation of capital.

|

|

| The Portfolio pursues its investment objective by primarily investing, under normal circumstances, at least 80% of its net assets (plus any borrowings for investment purposes) in bonds. The Portfolio’s average portfolio duration may normally range from 3 years to 7 years. The Portfolio will limit its investment in high-yield/high-risk bonds (also known as “junk” bonds) to 35% or less of its net assets. |

|

|

| Morningstar Category: Intermediate Core-Plus Bond |

|

| Intermediate-term core-plus bond portfolios invest primarily in investment-grade U.S. fixed-income issues including government, corporate, and securitized debt, but generally have greater flexibility than core offerings to hold non-core sectors such as corporate high yield, bank loan, emerging-markets debt, and non-U.S. currency exposures. Their durations (a measure of interest-rate sensitivity) typically range between 75% and 125% of the three-year average of the effective duration of the Morningstar Core Bond Index.

|

|

|

| There are no additional fund specific investment risks (e.g. liquidity risk, currency risk, foreign investment risk, etc.) associated with this fund beyond the normal risks generally associated with investing in a mutual fund. |

|

|

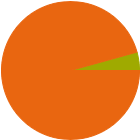

| % of Net Assets |

|

U.S. Stocks |

0.0 |

|

Non-U.S. Stocks |

0.0 |

|

Bonds |

95.7 |

|

Cash |

4.3 |

|

Other |

0.0 |

|

|

|

| Data through 2025-08-31 |

|

|

|

|

| Morningstar Fixed-Income Sectors |

|

| % Fund |

|

Government |

15.95 |

|

Corporate |

27.04 |

|

Securitized |

52.71 |

|

Municipal |

0.00 |

|

Cash & Equivalents |

4.24 |

|

Derivative |

0.06 |

|

|

|

% Bonds |

| AAA |

19.73 |

| AA |

40.42 |

| A |

6.99 |

| BBB |

15.81 |

| BB |

8.29 |

| B |

2.34 |

| Below B |

0.00 |

| Not Rated |

6.41 |

|

|

|

|

|

| Total Number of Stock Holdings |

0 |

| Total Number of Bond Holdings |

667 |

| % of Net Assets in Top 10 Holdings |

18.09 |

|

|

| Turnover % |

(as of 2024-12-31) |

188.00 |

| 30 Day SEC Yield % |

4.53 |

|

|

Maturity

Date

|

Shares

|

Value

$000

|

% of Net

Assets

|

|

|

|

|

|

|

|

US Treasury Note 3.625% |

2030-08-31 |

34,513 |

34,408 |

5.30 |

|

United States Treasury Notes 4.25% |

2035-08-15 |

29,079 |

29,138 |

4.49 |

|

United States Treasury Bonds 4.75% |

2055-05-15 |

12,410 |

12,073 |

1.86 |

|

United States Treasury Bonds 4.875% |

2045-08-15 |

10,540 |

10,552 |

1.63 |

|

United States Treasury Notes 3.625% |

2028-08-15 |

7,824 |

7,834 |

1.21 |

|

|

Booz Allen Hamilton Inc 5.95% |

2035-04-15 |

5,524 |

5,685 |

0.88 |

|

Government National Mortgage Association |

--- |

5,936 |

5,400 |

0.83 |

|

Janus Henderson Em Mkts Dbt Hrd Ccy ETF |

--- |

84 |

4,411 |

0.68 |

|

US Treasury Note 3.875% |

2032-08-31 |

4,146 |

4,133 |

0.64 |

|

Morgan Stanley Private Bank National Association 4.734% |

2031-07-18 |

3,644 |

3,695 |

0.57 |

|

|

|

|

|

|

|

|

| Lending, Short Sale, Foreign Securities, Loss of Money, Not FDIC Insured, Active Management, High Portfolio Turnover, Interest Rate, Market/Market Volatility, High-Yield Securities, Mortgage-Backed and Asset-Backed Securities, Other, Restricted/Illiquid Securities, Derivatives, Fixed-Income Securities, Sovereign Debt, Regulation/Government Intervention, Socially Conscious |

|

| Show Risk Definitions |

|

|

| Inception Date: 1993-09-13 |

|

| Greg J. Wilensky (2020-02-01) |

|

| Greg Wilensky is Head of US Fixed Income and a portfolio manager at Janus Henderson Investors, a position he has held since 2020. Prior to joining the firm, Greg served as senior vice president, director of the US multi-sector fixed income team and held several director and portfolio manager positions that spanned short duration, inflation-protected fixed income, securitised assets, and multi-asset strategies at AllianceBernstein from 1996 to 2019. Prior to that, he was a treasury manager – corporate finance at AT&T Corp. from 1993 to 1996.

Greg received his bachelor of science degree in business administration from Washington University, graduating magna cum laude. He also earned an MBA with high honours from the University of Chicago. Greg holds the Chartered Financial Analyst designation and has 31 years of financial industry experience. |

|

| John Lloyd (2024-06-01) |

|

| John Lloyd is Lead, Multi-Sector Credit Strategies at Janus Henderson Investors, a role he has held since 2022. Additionally, he is a portfolio manager and is responsible for creating the strategic framework, leading investment strategy, launching new products and bringing together ideas globally across the multi-sector credit franchise. John was head of global credit research from 2009, sharing this role since the firm’s merger and joined Janus as a research analyst in 2005. Prior to that, he worked as a private equity associate at H.I.G. Capital in Miami and at Willis Stein & Partners in Chicago. Earlier in his career, he was an investment banking analyst for Deutsche Bank.

John received his bachelor of arts degree in economics from the University of Michigan and his MBA from Dartmouth College, Tuck School of Business. |

|

| Michael Keough (2015-12-31) |

|

| Michael Keough is a Portfolio Manager on the Corporate Credit and US Fixed Income teams at Janus Henderson Investors. He joined Janus as a research analyst in 2007. Prior to his investment management career, he served as a captain in the United States Air Force working as a defense acquisition officer.

Michael received his bachelor of science degree in business management from the United States Air Force Academy, where he was recognised as a Distinguished Graduate in the management department. He has 18 years of financial industry experience. |

|

|

|

| Janus Henderson Investors US LLC |

|

|

|

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|