| Janus Henderson VIT Enterprise Instl JAAGX |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 476

Mid-Cap Growth Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 1,840.23 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks long-term growth of capital.

|

|

| The Portfolio pursues its investment objective by investing primarily in common stocks selected for their growth potential, and normally invests at least 50% of its equity assets in medium-sized companies. The Portfolio considers medium-sized companies to be those whose market capitalization falls within the range of companies in the Russell Midcap® Growth Index. Market capitalization is a commonly used measure of the size and value of a company. It may also invest in foreign securities. |

|

|

| Morningstar Category: Mid-Cap Growth |

|

| Some mid-cap growth portfolios invest in stocks of all sizes, thus leading to a mid-cap profile, but others focus on midsize companies. Mid-cap growth portfolios target U.S. firms that are projected to grow faster than other mid-cap stocks, therefore commanding relatively higher prices. Stocks in the middle 20% of the capitalization of the U.S. equity market are defined as mid-cap. Growth is defined based on fast growth (high growth rates for earnings, sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields).

|

|

|

| Mid Cap Funds: The securities of companies with market capitalizations below $10 billion may be more volatile and less liquid than the securities of larger companies. |

|

|

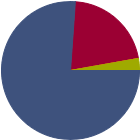

| % of Net Assets |

|

U.S. Stocks |

76.2 |

|

Non-U.S. Stocks |

21.1 |

|

Bonds |

0.0 |

|

Cash |

2.8 |

|

Other |

0.0 |

|

|

|

| Data through 2025-07-31 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

21.38 |

|

Basic Materials |

1.54 |

|

Consumer Cyclical |

5.50 |

|

Financial Services |

10.75 |

|

Real Estate |

3.59 |

|

|

|

|

Sensitive |

59.54 |

|

Communication Services |

5.59 |

|

Energy |

1.09 |

|

Industrials |

18.01 |

|

Technology |

34.85 |

|

|

|

|

Defensive |

19.09 |

|

Consumer Defensive |

0.68 |

|

Healthcare |

13.55 |

|

Utilities |

4.86 |

|

| Data through 2025-07-31 |

|

|

| Total Number of Stock Holdings |

79 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

29.86 |

|

|

| Turnover % |

(as of 2024-12-31) |

14.00 |

| 30 Day SEC Yield % |

0.00 |

|

|

Sector |

P/E |

% of Net

Assets

|

|

|

|

|

|

|

Constellation Software Inc |

|

--- |

4.67 |

|

SS&C Technologies Holdings Inc |

|

26.06 |

3.53 |

|

Flex Ltd |

|

--- |

3.44 |

|

Intact Financial Corp |

|

--- |

3.11 |

|

AppLovin Corp Ordinary Shares - Class A |

|

80.61 |

2.86 |

|

|

Ferguson Enterprises Inc |

|

25.80 |

2.78 |

|

Boston Scientific Corp |

|

57.29 |

2.54 |

|

LPL Financial Holdings Inc |

|

22.02 |

2.53 |

|

Teledyne Technologies Inc |

|

31.51 |

2.31 |

|

Liberty Media Corp Registered Shs Series -C- Formula One |

|

103.72 |

2.09 |

|

|

|

|

|

|

|

|

| Lending, Foreign Securities, Long-Term Outlook and Projections, Loss of Money, Not FDIC Insured, Growth Investing, Active Management, Market/Market Volatility, Equity Securities, Industry and Sector Investing, Socially Conscious, Mid-Cap |

|

| Show Risk Definitions |

|

|

| Inception Date: 1993-09-13 |

|

| Philip Cody Wheaton (2016-07-01) |

|

| Cody Wheaton is a mid-cap growth Portfolio Manager on the US Small/Mid-Cap Growth Team at Janus Henderson Investors. He also serves as a Research Analyst focusing on small- and mid-cap stocks within the financials and consumer sectors. He joined Janus as a research analyst in 2001.

Cody received his bachelor of arts degree in economics and government from Dartmouth College. He holds the Chartered Financial Analyst designation and has 23 years of financial industry experience. |

|

| Brian Demain (2007-11-01) |

|

| Brian Demain is a mid-cap growth Portfolio Manager on the US Small/Mid-Cap Growth Team at Janus Henderson Investors, a position he has held since 2007. Brian joined Janus in 1999 as a research analyst focused on companies in the media and communications sectors. From 2004 to 2007, he led the Communications Sector Research Team.

Brian received his bachelor of arts degree in economics from Princeton University, graduating summa cum laude and Phi Beta Kappa. His academic achievements culminated with winning a Senior Thesis Prize. Brian holds the Chartered Financial Analyst designation and has 25 years of financial industry experience. |

|

|

|

| Janus Henderson Investors US LLC |

|

|

|

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|