| VY® JPMorgan Emerging Markets Equity I IJEMX |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 697

Diversified Emerging Mkts Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 150.7 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks capital appreciation.

|

|

| Under normal circumstances, the portfolio invests at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities of issuers in emerging markets. |

|

|

| Morningstar Category: Diversified Emerging Mkts |

|

| Diversified emerging-markets portfolios tend to divide their assets among 20 or more nations, although they tend to focus on the emerging markets of Asia and Latin America rather than on those of the Middle East, Africa, or Europe. These portfolios invest predominantly in emerging market equities, but some funds also invest in both equities and fixed income investments from emerging markets.

|

|

|

| Foreign Securities Funds/Emerging Market Funds: Risks include, but are not limited to, currency risk, political risk, and risk associated with varying accounting standards. Investing in emerging markets may accentuate these risks. |

|

|

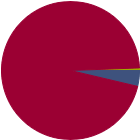

| % of Net Assets |

|

U.S. Stocks |

3.7 |

|

Non-U.S. Stocks |

95.8 |

|

Bonds |

0.0 |

|

Cash |

0.6 |

|

Other |

0.0 |

|

|

|

| Data through 2025-08-31 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

39.76 |

|

Basic Materials |

1.20 |

|

Consumer Cyclical |

17.27 |

|

Financial Services |

20.75 |

|

Real Estate |

0.54 |

|

|

|

|

Sensitive |

54.30 |

|

Communication Services |

12.44 |

|

Energy |

2.42 |

|

Industrials |

10.47 |

|

Technology |

28.97 |

|

|

|

|

Defensive |

5.94 |

|

Consumer Defensive |

3.10 |

|

Healthcare |

2.03 |

|

Utilities |

0.81 |

|

| Data through 2025-08-31 |

|

|

|

| Morningstar World Regions |

|

| % Fund |

| Americas |

19.1 |

|

| North America |

3.7 |

| Latin America |

15.4 |

|

| Greater Europe |

10.6 |

|

| United Kingdom |

0.0 |

| Europe Developed |

4.1 |

| Europe Emerging |

3.9 |

| Africa/Middle East |

2.7 |

|

| Greater Asia |

70.3 |

|

| Japan |

0.0 |

| Australasia |

0.0 |

| Asia Developed |

30.7 |

| Asia Emerging |

39.5 |

|

| Data through 2025-08-31 |

|

|

| Total Number of Stock Holdings |

74 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

39.93 |

|

|

| Turnover % |

(as of 2024-12-31) |

35.00 |

| 30 Day SEC Yield % |

--- |

|

|

Sector |

Country |

% of Net

Assets

|

|

|

|

|

|

|

Taiwan Semiconductor Manufacturing Co Ltd |

|

Taiwan |

11.78 |

|

Tencent Holdings Ltd |

|

China |

7.63 |

|

SK Hynix Inc |

|

South Korea |

4.09 |

|

MercadoLibre Inc |

|

Brazil |

3.16 |

|

Hanwha Aerospace Co Ltd |

|

South Korea |

2.65 |

|

|

Banco Bilbao Vizcaya Argentaria SA |

|

Spain |

2.24 |

|

Tencent Music Entertainment Group ADR |

|

China |

2.20 |

|

Nu Holdings Ltd Ordinary Shares Class A |

|

Brazil |

2.18 |

|

Bajaj Finance Ltd |

|

India |

2.09 |

|

Aselsan Elektronik Sanayi Ve Ticaret AS |

|

Turkey |

1.91 |

|

|

|

|

|

|

|

|

| Lending, Credit and Counterparty, Extension, Prepayment (Call), Currency, Emerging Markets, Foreign Securities, Loss of Money, Not FDIC Insured, Country or Region, Capitalization, Value Investing, Issuer, Interest Rate, Market/Market Volatility, Convertible Securities, High-Yield Securities, IPO, Mortgage-Backed and Asset-Backed Securities, Preferred Stocks, Repurchase Agreements, Restricted/Illiquid Securities, Underlying Fund/Fund of Funds, U.S. Government Obligations, Derivatives, Socially Conscious, China Region, Financials Sector, Real Estate/REIT Sector |

|

| Show Risk Definitions |

|

|

| Inception Date: 2005-12-02 |

|

| Leon Eidelman (2013-04-30) |

|

| Leon Eidelman, CFA, Portfolio Manager and Managing Director, has been with JPMorgan since 2002 and is responsible for global emerging markets portfolios. An employee since 2002, Leon is a member of the group of global emerging markets portfolio managers responsible for the fundamental, bottom-up portfolios, including the GEM Discovery and GEM Focused strategies. He is lead manager of the GEM Discovery strategy and is a portfolio manager on the GEM Focused strategy. Leon holds a B.A. in Economics with a concentration in Finance from Cornell University and is a CFA Charterholder. |

|

| Amit Mehta (2013-04-30) |

|

| Amit Mehta, Managing Director, is a portfolio manager within the Emerging Markets and Asia Pacific (EMAP) Equities team based in London. An employee since 2011, Amit previously worked at Prusik Investment Management (2009-2011) and Atlantis Investment Management (2007-2009) where he was an Asian equities analyst and portfolio manager. Prior to this, he was a global emerging markets analyst at Aviva Investors (2004-2007) and an investment consultant at Mercer Investment Consulting (2000-2004). Amit obtained a B.Sc (Honours) in Mathematics from Kings College London. He is a CFA Charterholder. |

|

| John Citron (2025-03-31) |

|

| John Citron, executive director, is a portfolio manager within the Emerging Markets and Asia Pacific (EMAP) Equities team based in London. An employee since 2009, he previously worked as an industrials analyst within the EMAP Equities team, and before that as a research analyst within the European Equities Research team. John obtained a B.A. (Honours) in Philosophy, Politics and Economics from Oxford University. |

|

| Austin Forey (2005-04-29) |

|

| Austin Forey, Portfolio Manager and Managing Director, has been at JPMorgan (or one of its predecessors) since 1988 and is responsible for global emerging markets portfolios, a role he has fulfilled since 1994. Prior to this he worked in the U.K. team, where he was deputy head of U.K. research. Before this, Austin worked as a research analyst covering engineering, and subsequently all financial sectors. Austin obtained a B.A. in Modern Languages from Cambridge University, and earned a Ph.D. in Modern Languages from Cambridge University. |

|

|

|

|

|

|

|

|

|

| J.P. Morgan Investment Management, Inc. |

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|