| Franklin Allocation VIP 2 |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 466

Moderate Allocation Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 563.69 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks capital appreciation; income is a secondary objective.

|

|

| The fund seeks to achieve its investment goals by allocating its assets among the broad asset classes of equity and fixed income investments through a variety of investment strategies or "sleeves" managed by the investment manager or its affiliates. Under normal market conditions, it allocates approximately 60% of its assets to the equity asset class and 40% of its assets to the fixed income asset class by allocating the fund's assets among the various sleeves. |

|

|

| Morningstar Category: Moderate Allocation |

|

| Funds in allocation categories seek to provide both income and capital appreciation by primarily investing in multiple asset classes, including stocks, bonds, and cash. These moderate strategies seek to balance preservation of capital with appreciation. They typically expect volatility similar to a strategic equity exposure between 50% and 70%.

|

|

|

| There are no additional fund specific investment risks (e.g. liquidity risk, currency risk, foreign investment risk, etc.) associated with this fund beyond the normal risks generally associated with investing in a mutual fund. |

|

|

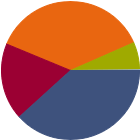

| % of Net Assets |

|

U.S. Stocks |

38.3 |

|

Non-U.S. Stocks |

18.0 |

|

Bonds |

37.2 |

|

Cash |

6.4 |

|

Other |

0.2 |

|

|

|

| Data through 2025-09-30 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

30.36 |

|

Basic Materials |

3.84 |

|

Consumer Cyclical |

10.05 |

|

Financial Services |

15.46 |

|

Real Estate |

1.01 |

|

|

|

|

Sensitive |

51.06 |

|

Communication Services |

8.11 |

|

Energy |

3.01 |

|

Industrials |

13.12 |

|

Technology |

26.82 |

|

|

|

|

Defensive |

18.59 |

|

Consumer Defensive |

4.15 |

|

Healthcare |

11.59 |

|

Utilities |

2.85 |

|

| Data through 2025-09-30 |

|

|

|

| Morningstar Fixed-Income Sectors |

|

| % Fund |

|

Government |

45.48 |

|

Corporate |

28.71 |

|

Securitized |

11.11 |

|

Municipal |

0.24 |

|

Cash & Equivalents |

7.28 |

|

Derivative |

7.19 |

|

|

|

% Bonds |

| AAA |

--- |

| AA |

--- |

| A |

--- |

| BBB |

--- |

| BB |

--- |

| B |

--- |

| Below B |

--- |

| Not Rated |

--- |

|

|

|

|

|

| Total Number of Stock Holdings |

490 |

| Total Number of Bond Holdings |

497 |

| % of Net Assets in Top 10 Holdings |

17.46 |

|

|

| Turnover % |

(as of 2023-12-31) |

56.04 |

| 30 Day SEC Yield % |

1.91 |

|

|

Sector |

Country |

Maturity Date |

Market Value ($000) |

% of Net Assets |

|

| NVIDIA Corp |

|

USA |

--- |

14,726 |

2.62 |

| Franklin Instl U.S. Govt Mny Mkt Fund |

--- |

USA |

--- |

13,652 |

2.43 |

| Microsoft Corp |

|

USA |

--- |

12,584 |

2.24 |

| United States Treasury Notes |

--- |

USA |

--- |

9,412 |

1.68 |

| United States Treasury Notes |

--- |

USA |

--- |

8,806 |

1.57 |

|

| Apple Inc |

|

USA |

--- |

8,628 |

1.54 |

| Amazon.com Inc |

|

USA |

--- |

8,559 |

1.52 |

| United States Treasury Notes |

--- |

USA |

--- |

7,884 |

1.40 |

| United States Treasury Notes |

--- |

USA |

--- |

7,082 |

1.26 |

| United States Treasury Notes |

--- |

USA |

--- |

6,718 |

1.20 |

|

|

|

|

|

|

|

|

| Lending, Credit and Counterparty, Prepayment (Call), Currency, Foreign Securities, Loss of Money, Not FDIC Insured, Growth Investing, Quantitative Investing, Value Investing, Active Management, Income, Interest Rate, Market/Market Volatility, High-Yield Securities, Mortgage-Backed and Asset-Backed Securities, Other, Restricted/Illiquid Securities, Underlying Fund/Fund of Funds, Derivatives, Management, Portfolio Diversification, Variable-Rate Securities, Small Cap, Mid-Cap |

|

| Show Risk Definitions |

|

|

| Inception Date: 2007-07-02 |

|

| Thomas A. Nelson (2019-02-15) |

|

| THOMAS NELSON, CFA, CAIA

Head of Asset Allocation Portfolio Management

Franklin Templeton Investment Solutions

Franklin Advisers, Inc.

Ft. Lauderdale, Florida, United States

Tom Nelson is a senior vice president and head of asset allocation portfolio management for Franklin Templeton Investment Solutions. He is a member of the Investment Strategy & Research Committee.

Mr. Nelson is a portfolio manager of a number of funds offered for sale in various jurisdictions. He is a member of the CFA Institute, the New York Society of Security Analysts and the Chartered Alternative Investment Analyst |

|

| Jacqueline Kenney (2022-10-01) |

|

| Jacqueline Hurley, CFA, is a Portfolio Manager and a member of the Portfolio Management Group within QS Investors. Formerly at Deutsche Asset Management from 2008 – 2010. Prior to joining Deutsche Asset Management, she had 4 years of experience as a consultant at Bearing Point and Accenture.

Ms. Hurley holds a B.A. in Computer Science from Colgate University and an M.B.A. in inance and Accounting from University of Michigan, Ross School of Business. |

|

| Berkeley Belknap (2025-01-31) |

|

| Ms. Belknap is a portfolio manager for asset allocation strategies and the head of US Advisory portfolio management for Franklin Templeton Investment Solutions. In this role, Ms. Belknap leads portfolio management responsibilities for all US portfolios for the Advisory channels, including model platforms, target risk mutual funds, 529 programs and asset allocation portfolios in the insurance channel. She also serves on the team’s Policy Portfolio Positioning Group and is Vice Chair of the Portfolio Review Committee. She has served previously in several roles within Franklin Templeton Investment Solutions. In addition to being a portfolio manager for the US target date funds and the asset allocation portfolios for LATAM, she most recently managed the APAC portfolio management team and process, the manager research team, and the portfolio analysis team. Prior to her portfolio management roles, she served as a senior client portfolio manager responsible for designing, managing, and maintaining multi-asset investment solutions for institutional clients in the US and LATAM. Prior to joining Franklin Templeton, Ms. Belknap spent 11 years at Boston-based Windward Investment Management (Windhaven Investment Management after being acquired by Charles Schwab), which designs global asset allocation ETF portfolios by using both tactical and strategic allocations with a combination of quantitative and qualitative tools. She was a member of the investment committee and a portfolio strategist. She opened the firm’s San Francisco office and helped grow the client base in the western U.S. She also led the integration of the firm with Schwab on the west coast. Previously, Ms. Belknap worked at both Fairview Capital as a partner and portfolio manager and at Trainer, Wortham as a portfolio manager and research analyst, managing equity portfolios for separate accounts. She began her career in investment banking at Morgan Stanley in the global debt group within debt capital markets and with the options trading team within foreign exchange. Ms. Belknap holds a BA degree in history from Yale University. She also holds the CFA Institute Certificate in ESG Investing. |

|

|

|

|

|

|

| Franklin Templeton Investments |

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|