| VanEck VIP Global Resources Fund Initial |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 113

Natural Resources Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 319.69 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks long-term capital appreciation by investing primarily in global resource securities; income is a secondary consideration.

|

|

| The fund invests at least 80% of its net assets in securities of global resource companies and instruments that derive their value from global resources. Global resources include precious metals (including gold), base and industrial metals, energy, natural resources and other commodities. It may invest in securities of companies located anywhere in the world, including the U.S. |

|

|

| Morningstar Category: Natural Resources |

|

| Natural-resources portfolios focus on commodity-based industries such as energy, chemicals, minerals, and forest products in the United States or outside of the United States. Some portfolios invest across this spectrum to offer broad natural-resources exposure. Others concentrate heavily or even exclusively in specific industries. Portfolios that concentrate primarily in energy-related industries are part of the equity energy category.

|

|

|

| Sector Funds: Funds that invest exclusively in one sector or industry involve risks due to the lack of industry diversification and expose the investor to increased industry-specific risks. |

|

|

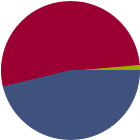

| % of Net Assets |

|

U.S. Stocks |

46.2 |

|

Non-U.S. Stocks |

52.4 |

|

Bonds |

0.0 |

|

Cash |

1.4 |

|

Other |

0.0 |

|

|

|

| Data through 2025-09-30 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

53.45 |

|

Basic Materials |

50.49 |

|

Consumer Cyclical |

1.48 |

|

Financial Services |

0.00 |

|

Real Estate |

1.48 |

|

|

|

|

Sensitive |

37.41 |

|

Communication Services |

0.00 |

|

Energy |

34.25 |

|

Industrials |

3.16 |

|

Technology |

0.00 |

|

|

|

|

Defensive |

9.14 |

|

Consumer Defensive |

6.79 |

|

Healthcare |

0.00 |

|

Utilities |

2.35 |

|

| Data through 2025-09-30 |

|

|

| Total Number of Stock Holdings |

68 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

32.06 |

|

|

| Turnover % |

(as of 2024-12-31) |

57.00 |

| 30 Day SEC Yield % |

--- |

|

|

Sector |

P/E |

% of Net

Assets

|

|

|

|

|

|

|

Shell PLC ADR (Representing - Ordinary Shares) |

|

--- |

4.39 |

|

Exxon Mobil Corp |

|

16.34 |

4.05 |

|

Kinross Gold Corp |

|

--- |

3.34 |

|

Agnico Eagle Mines Ltd |

|

--- |

3.26 |

|

Newmont Corp |

|

12.32 |

3.02 |

|

|

JBS NV Ordinary Shares - Class A |

|

--- |

2.98 |

|

Barrick Mining Corp |

|

--- |

2.91 |

|

Freeport-McMoRan Inc |

|

28.79 |

2.77 |

|

Nutrien Ltd |

|

--- |

2.71 |

|

TotalEnergies SE |

|

--- |

2.63 |

|

|

|

|

|

|

|

|

| Currency, Emerging Markets, Foreign Securities, Loss of Money, Not FDIC Insured, Country or Region, Active Management, Market/Market Volatility, Commodity, Industry and Sector Investing, Mortgage-Backed and Asset-Backed Securities, Restricted/Illiquid Securities, Underlying Fund/Fund of Funds, U.S. Federal Tax Treatment, Derivatives, Socially Conscious, Management, Small Cap, Mid-Cap |

|

| Show Risk Definitions |

|

|

| Inception Date: 1989-09-01 |

|

| Shawn Reynolds (2010-05-01) |

|

| Mr. Reynolds joined VanEck in 2005. He serves as Portfolio Manager for VanEck’s Global Hard Assets Strategy, and oversees the Global Hard Assets Team. He is responsible for company research and portfolio construction.

Prior to joining VanEck, he was employed at Petrie Parkman & Co. as an energy analyst covering North American oil and gas exploration and production companies. From 1991 to 2001, Mr. Reynolds served as an equity research analyst, covering North American, European, and global energy companies out of New York, London, and Australia with Goldman Sachs, Lehman Brothers, and Credit Suisse First Boston. Prior to his career in finance, Mr. Reynolds worked at Tenneco Oil Company from 1987 to 1989 as an exploration geologist.

Mr. Reynolds was previously a board member of several private Latin American oil and gas exploration companies. He is a Member of the Riverview Medical Center Board of Trustees and Meridian Health Pension and Investment Committee; Former President of the Board of Trustees at the Rumson Country Day School.

Mr. Reynolds received an MBA in Finance (Beta Gamma Sigma) from Columbia Business School, an MA in Petroleum Geology from the University of Texas, Austin (Phi Kappa Kappa), and a BS in Engineering from Cornell University. In 2000, he was chosen as The Wall Street Journal’s “Best on the Street” for E&P stock selection. Mr. Reynolds has also authored several technical geology articles in periodicals published by the American Association of Petroleum Geologists. He has appeared on CNBC and has been quoted in The Wall Street Journal, New York Times, and Bloomberg Businessweek, among other notable media outlets. |

|

| Charles T. Cameron (2016-05-01) |

|

| Mr. Cameron joined VanEck in 1995. He currently serves as Deputy Portfolio Manager for VanEck’s Global Hard Assets Strategy, focusing on macroeconomic research and trading oversight. He has over 35 years of experience in international and financial markets.

From 1989 to 1995, he was a trader in both Eurobond and emerging markets fixed income for Standard Chartered. Prior to that, he held trading positions at various sell-side firms, specializing in commodity and fixed income securities. Mr. Cameron received an MBA in Finance from the New York University Leonard N. Stern School of Business and a BS in Finance from Boston College. |

|

|

|

| Van Eck Associates Corporation |

|

|

|

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|