|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 466

Moderate Allocation Funds

|

|

|

|

Morningstar®

Style Box™

|

| What is this?

|

|

|

|

| As of 2025-06-30 |

|

|

|

| As of 2025-06-30 |

|

|

| Total Fund Assets ($ Mil) |

| 3,723.37 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks to provide long-term capital appreciation and reasonable current income.

|

|

| The Portfolio invests 60% to 70% of its assets in dividend-paying and, to a lesser extent, non-dividend-paying common stocks of established large companies. The remaining 30% to 40% of the Portfolio's assets are invested mainly in fixed income securities that the advisor believes will generate a moderate level of current income. These securities include investment-grade corporate bonds, with some exposure to U.S. Treasury and government agency bonds, and mortgage-backed securities. |

|

|

| Morningstar Category: Moderate Allocation |

|

| Funds in allocation categories seek to provide both income and capital appreciation by primarily investing in multiple asset classes, including stocks, bonds, and cash. These moderate strategies seek to balance preservation of capital with appreciation. They typically expect volatility similar to a strategic equity exposure between 50% and 70%.

|

|

|

| There are no additional fund specific investment risks (e.g. liquidity risk, currency risk, foreign investment risk, etc.) associated with this fund beyond the normal risks generally associated with investing in a mutual fund. |

|

|

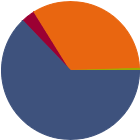

| % of Net Assets |

|

U.S. Stocks |

62.9 |

|

Non-U.S. Stocks |

3.3 |

|

Bonds |

33.4 |

|

Cash |

0.5 |

|

Other |

0.0 |

|

|

|

| Data through 2025-06-30 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

30.64 |

|

Basic Materials |

1.56 |

|

Consumer Cyclical |

11.91 |

|

Financial Services |

15.28 |

|

Real Estate |

1.89 |

|

|

|

|

Sensitive |

52.59 |

|

Communication Services |

9.11 |

|

Energy |

4.35 |

|

Industrials |

5.63 |

|

Technology |

33.50 |

|

|

|

|

Defensive |

16.77 |

|

Consumer Defensive |

5.65 |

|

Healthcare |

8.42 |

|

Utilities |

2.70 |

|

| Data through 2025-06-30 |

|

|

|

| Morningstar Fixed-Income Sectors |

|

| % Fund |

|

Government |

26.45 |

|

Corporate |

64.24 |

|

Securitized |

4.13 |

|

Municipal |

3.81 |

|

Cash & Equivalents |

1.34 |

|

Derivative |

0.03 |

|

|

|

% Bonds |

| AAA |

29.95 |

| AA |

9.86 |

| A |

42.53 |

| BBB |

17.65 |

| BB |

0.01 |

| B |

0.00 |

| Below B |

0.00 |

| Not Rated |

0.00 |

|

|

|

|

|

| Total Number of Stock Holdings |

72 |

| Total Number of Bond Holdings |

1358 |

| % of Net Assets in Top 10 Holdings |

28.28 |

|

|

| Turnover % |

(as of 2024-12-31) |

64.00 |

| 30 Day SEC Yield % |

2.14 |

|

|

Sector |

Country |

Maturity Date |

Market Value ($000) |

% of Net Assets |

|

| Microsoft Corp |

|

USA |

--- |

188,885 |

5.28 |

| NVIDIA Corp |

|

USA |

--- |

186,200 |

5.21 |

| Apple Inc |

|

USA |

--- |

120,193 |

3.36 |

| Amazon.com Inc |

|

USA |

--- |

114,682 |

3.21 |

| Alphabet Inc Class A |

|

USA |

--- |

93,272 |

2.61 |

|

| Broadcom Inc |

|

USA |

--- |

75,027 |

2.10 |

| Meta Platforms Inc Class A |

|

USA |

--- |

72,627 |

2.03 |

| Wells Fargo & Co |

|

USA |

--- |

71,311 |

1.99 |

| Nasdaq Inc |

|

USA |

--- |

45,833 |

1.28 |

| JPMorgan Chase & Co |

|

USA |

--- |

43,193 |

1.21 |

|

|

|

|

|

|

|

|

| Credit and Counterparty, Prepayment (Call), Loss of Money, Not FDIC Insured, Income, Interest Rate, Market/Market Volatility, Equity Securities, Restricted/Illiquid Securities, Fixed-Income Securities, Management |

|

| Show Risk Definitions |

|

|

| Inception Date: 1991-05-23 |

|

| Daniel J. Pozen (2019-03-28) |

|

| Daniel J. Pozen, Senior Managing Director and Equity Portfolio Manager of Wellington Management. He has worked in investment management since 1999, has been with Wellington Management since 2006. Education: B.A., Williams College; M.B.A., Dartmouth College (Tuck). |

|

| Loren L. Moran (2017-01-27) |

|

| Loren L. Moran, CFA, Senior Managing Director and Fixed Income Portfolio Manager of Wellington Management, has been a portfolio manager for the fixed income portion of the Fund since 2017 and securities analysis for the fixed income portion of the Fund since 2014. She has worked in investment management since 2001, has been with Wellington Management since 2014. Education: B.S., Georgetown University. |

|

|

|

| Wellington Management Company LLP |

|

|

|

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|