| Victory Pioneer Bond VCT - Class I |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 520

Intermediate Core-Plus Bond Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 126.15 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks current income and total return.

|

|

| The fund normally invests at least 80% of its net assets (plus the amount of borrowings, if any, for investment purposes) in debt securities issued or guaranteed by the U.S. government, its agencies and instrumentalities, investment grade debt securities (including convertible debt) of corporate or other issuers and cash, cash equivalents and other short-term holdings. It may invest a substantial portion of its assets in mortgage-related securities. |

|

|

| Morningstar Category: Intermediate Core-Plus Bond |

|

| Intermediate-term core-plus bond portfolios invest primarily in investment-grade U.S. fixed-income issues including government, corporate, and securitized debt, but generally have greater flexibility than core offerings to hold non-core sectors such as corporate high yield, bank loan, emerging-markets debt, and non-U.S. currency exposures. Their durations (a measure of interest-rate sensitivity) typically range between 75% and 125% of the three-year average of the effective duration of the Morningstar Core Bond Index.

|

|

|

| There are no additional fund specific investment risks (e.g. liquidity risk, currency risk, foreign investment risk, etc.) associated with this fund beyond the normal risks generally associated with investing in a mutual fund. |

|

|

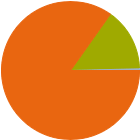

| % of Net Assets |

|

U.S. Stocks |

0.0 |

|

Non-U.S. Stocks |

0.0 |

|

Bonds |

84.8 |

|

Cash |

14.8 |

|

Other |

0.4 |

|

|

|

| Data through 2025-08-31 |

|

|

|

|

| Morningstar Fixed-Income Sectors |

|

| % Fund |

|

Government |

13.73 |

|

Corporate |

34.72 |

|

Securitized |

47.60 |

|

Municipal |

0.00 |

|

Cash & Equivalents |

3.94 |

|

Derivative |

0.00 |

|

|

|

% Bonds |

| AAA |

11.39 |

| AA |

36.67 |

| A |

12.60 |

| BBB |

29.47 |

| BB |

4.13 |

| B |

0.78 |

| Below B |

0.09 |

| Not Rated |

4.87 |

|

|

|

|

|

| Total Number of Stock Holdings |

0 |

| Total Number of Bond Holdings |

733 |

| % of Net Assets in Top 10 Holdings |

12.91 |

|

|

| Turnover % |

(as of 2024-12-31) |

53.00 |

| 30 Day SEC Yield % |

4.41 |

|

|

Maturity

Date

|

Shares

|

Value

$000

|

% of Net

Assets

|

|

|

|

|

|

|

|

Victory Pioneer ILS Interval |

--- |

432 |

4,161 |

3.03 |

|

Dreyfus Government Cash Mgmt Instl |

--- |

2,400 |

2,400 |

1.75 |

|

Federal National Mortgage Association 6.5% |

2055-09-01 |

2,200 |

2,280 |

1.66 |

|

United States Treasury Notes 3.875% |

2027-07-31 |

2,000 |

2,008 |

1.46 |

|

Federal National Mortgage Association 6% |

2055-09-15 |

1,500 |

1,532 |

1.11 |

|

|

Federal National Mortgage Association 2% |

2055-09-15 |

1,700 |

1,350 |

0.98 |

|

Federal National Mortgage Association 2.5% |

2052-01-01 |

1,506 |

1,270 |

0.92 |

|

Federal National Mortgage Association 1.5% |

2042-03-01 |

1,244 |

1,031 |

0.75 |

|

Federal Home Loan Mortgage Corp. 1.5% |

2042-03-01 |

1,150 |

953 |

0.69 |

|

United States Treasury Bonds 2.25% |

2052-02-15 |

1,297 |

776 |

0.56 |

|

|

|

|

|

|

|

|

| Lending, Credit and Counterparty, Extension, Inflation-Protected Securities, Prepayment (Call), Foreign Securities, Loss of Money, Not FDIC Insured, Interest Rate, Market/Market Volatility, Convertible Securities, High-Yield Securities, Industry and Sector Investing, Inverse Floaters, Mortgage-Backed and Asset-Backed Securities, Municipal Obligations, Leases, and AMT-Subject Bonds, Other, Preferred Stocks, Restricted/Illiquid Securities, Underlying Fund/Fund of Funds, U.S. Government Obligations, Derivatives, Leverage, Pricing, Dollar Rolls, Socially Conscious, Increase in Expenses, Shareholder Activity, Amortized Cost, Credit Default Swaps, Forwards, Management, Structured Products, Zero-Coupon Bond |

|

| Show Risk Definitions |

|

|

| Inception Date: 1987-07-21 |

|

| Bradley Komenda (2018-02-01) |

|

| Brad Komenda is Managing Director, Director of Investment Grade Corporates, and Portfolio Manager. As Director of Investment Grade Corporates, he leads a team that supports the management of high-grade credit exposure across all fixed income portfolios managed by Amundi US, including crossover and high-grade CDS exposure. He is a member of the team managing stand-alone long duration and high-grade credit strategies, including portfolios with ESG mandates. Brad is also responsible for managing multi-sector fixed income portfolios.

Prior to joining Amundi US in 2008, Brad spent ten years as an Investment Grade and High Yield Analyst at Columbia Management. He began his career with General Electric Capital and Assurance as an investment grade and high yield research associate where he worked for five years.

He holds a B.A. in Accounting and Business Administration from Central Washington University (1991). He is a CFA® charterholder. |

|

| Kenneth J. Taubes (2004-12-31) |

|

| Ken Taubes is Chief Investment Officer, US and a Portfolio Manager at Amundi US. As Chief Investment Officer, Ken oversees US fixed income, equity, and multi-asset teams, including portfolio management, fundamental research and trading. In addition, Ken leads the day-to-day investment activities of the US fixed income team and is a Portfolio Manager on a number of fixed income multi-sector portfolios.

Ken is Chairman of the US Investment Committee, and a member of the US Executive Committee and US Management Committee. He also is a Trustee of the Pioneer Funds, which oversees Amundi US’s US-registered portfolios.

Prior to joining Amundi US in 1998, Ken was a Senior Vice President and Senior Portfolio Manager at Putnam Investments. Ken also served as Senior Vice President and Corporate Treasurer of Home Owners Savings Bank in Boston, a large New England thrift holding company and one of the nation’s largest mortgage banks, where he worked from 1986 to 1990. He began his career in 1980 as a treasury officer with Bank of New England’s international treasury division.

Ken received a Bachelor of Science in accounting from Syracuse University’s Utica College and an M.B.A. from Suffolk University in Boston. |

|

| Jonathan Scott (2021-11-01) |

|

| Jonathan Scott is a Senior Vice President, Deputy Director of Multi-Sector Fixed Income, and Portfolio Manager. As Deputy Director of Multi-Sector Fixed Income, he helps oversee a team of investment professionals who are responsible for managing multi-sector fixed income strategies and retail funds for US and international investors. He is also a member of portfolio management teams responsible for managing Multi-Sector Fixed Income portfolios.

Jonathan joined Amundi US in 2008, working first in the firm’s Fund Accounting department, and in 2011 as a Fixed Income Risk Analyst for the Investment Risk Management Team, where he worked closely with the Fixed Income team. He joined the Fixed Income team in 2012 as an Investment Associate where he supported portfolio construction and traded Investment Grade Corporate bonds. He was promoted to Associate Portfolio Manager in 2016 and in 2018, was named as a Multi-Sector Portfolio Manager. He also assumed portfolio management responsibilities for a US TIPS portfolio. In 2021, he was promoted to Deputy Director of Multi-Sector Fixed Income.

Jonathan holds a B.A. in Economics and East Asian Studies with a concentration in Chinese from Colby College. He is a CFA® charterholder. |

|

| Timothy D. Rowe (2018-06-08) |

|

| Tim Rowe is Managing Director and Portfolio Manager at Amundi US. Tim is a portfolio manager for investment-grade core bond portfolios, which he has managed at the firm since 1994, and works with the sector teams to construct portfolios that meet clients’ risk and return objectives.

Prior to his current role, Tim was the Director of Multi-Sector Fixed Income where he oversaw a team of investment professionals responsible for managing institutional strategies and retail funds for US and international investors. Prior to that, his responsibilities included managing agency mortgage-backed security portfolios and leading the Securitized Credit team.

Before joining the firm in 1988, Tim was an Assistant Economist at the Federal Reserve Bank of Richmond, Virginia.

He holds a Master of Business Administration with specialization in Finance from the University of Chicago Booth School of Business and a Bachelor of Arts in Economics and History from Duke University. |

|

|

|

| Victory Capital Management Inc. |

|

|

| Victory Capital Management Inc. |

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|