| LVIP American Century Bal Std II |

|

|

|

| Release date as of 2025-08-31. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-08-31 |

|

Out of 480

Moderate Allocation Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 388.61 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks long-term capital growth and current income by investing approximately 60% of its assets in equity securities and the remainder in bonds and other fixed-income securities.

|

|

| For the equity portion of the fund, the fund will generally invest in large capitalization companies the adviser believes show sustainable business improvement using a proprietary multi-factor model that combines fundamental measures of a stock’s value and growth potential with ESG metrics. For the fixed-income portion of the fund, the portfolio managers invest in a diversified portfolio of high- and medium-grade non-money market debt securities. |

|

|

| Morningstar Category: Moderate Allocation |

|

| Funds in allocation categories seek to provide both income and capital appreciation by primarily investing in multiple asset classes, including stocks, bonds, and cash. These moderate strategies seek to balance preservation of capital with appreciation. They typically expect volatility similar to a strategic equity exposure between 50% and 70%.

|

|

|

| There are no additional fund specific investment risks (e.g. liquidity risk, currency risk, foreign investment risk, etc.) associated with this fund beyond the normal risks generally associated with investing in a mutual fund. |

|

|

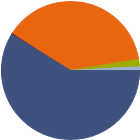

| % of Net Assets |

|

U.S. Stocks |

58.8 |

|

Non-U.S. Stocks |

0.4 |

|

Bonds |

38.2 |

|

Cash |

1.7 |

|

Other |

0.9 |

|

|

|

| Data through 2025-06-30 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

30.46 |

|

Basic Materials |

1.85 |

|

Consumer Cyclical |

12.07 |

|

Financial Services |

14.57 |

|

Real Estate |

1.97 |

|

|

|

|

Sensitive |

54.20 |

|

Communication Services |

8.50 |

|

Energy |

2.34 |

|

Industrials |

8.26 |

|

Technology |

35.10 |

|

|

|

|

Defensive |

15.35 |

|

Consumer Defensive |

4.38 |

|

Healthcare |

9.53 |

|

Utilities |

1.44 |

|

| Data through 2025-06-30 |

|

|

|

| Morningstar Fixed-Income Sectors |

|

| % Fund |

|

Government |

20.46 |

|

Corporate |

25.35 |

|

Securitized |

49.72 |

|

Municipal |

0.79 |

|

Cash & Equivalents |

3.68 |

|

Derivative |

0.00 |

|

|

|

% Bonds |

| AAA |

--- |

| AA |

--- |

| A |

--- |

| BBB |

--- |

| BB |

--- |

| B |

--- |

| Below B |

--- |

| Not Rated |

--- |

|

|

|

|

|

| Total Number of Stock Holdings |

100 |

| Total Number of Bond Holdings |

475 |

| % of Net Assets in Top 10 Holdings |

23.58 |

|

|

| Turnover % |

(as of 2024-12-31) |

75.00 |

| 30 Day SEC Yield % |

1.88 |

|

|

Sector |

Country |

Maturity Date |

Market Value ($000) |

% of Net Assets |

|

| Microsoft Corp |

|

USA |

--- |

20,068 |

5.13 |

| NVIDIA Corp |

|

USA |

--- |

16,360 |

4.18 |

| Apple Inc |

|

USA |

--- |

9,520 |

2.43 |

| Alphabet Inc Class A |

|

USA |

--- |

8,743 |

2.23 |

| Amazon.com Inc |

|

USA |

--- |

8,734 |

2.23 |

|

| Broadcom Inc |

|

USA |

--- |

7,377 |

1.89 |

| Meta Platforms Inc Class A |

|

USA |

--- |

6,724 |

1.72 |

| State Street Institutional U.S. Government Money Market Fund |

--- |

--- |

2049-12-31 |

5,858 |

1.50 |

| Mastercard Inc Class A |

|

USA |

--- |

4,444 |

1.14 |

| United States Treasury Notes 0.0413% |

--- |

USA |

2032-05-31 |

4,437 |

1.13 |

|

|

|

|

|

|

|

|

| Lending, Credit and Counterparty, Extension, Prepayment (Call), Foreign Securities, Loss of Money, Not FDIC Insured, Issuer, Interest Rate, Market/Market Volatility, Bank Loans, Equity Securities, Mortgage-Backed and Asset-Backed Securities, Restricted/Illiquid Securities, Derivatives, Fixed-Income Securities, Socially Conscious, Structured Products |

|

| Show Risk Definitions |

|

|

| Inception Date: 1991-05-01 |

|

| Joseph Reiland (2021-09-01) |

|

| Joe co-manages the U.S. Sustainable Large Cap Core, U.S. Systematic Large Cap Core and U.S. Systematic All Cap Core strategies and provides quantitative research and risk management for these strategies as well as U.S. Large Cap Growth. Joe has been a member of this team since the firm in 2000. Previously, he was an equity analyst in the equity research department at Commerce Bank. Joe has worked in the investment industry since 1995. He earned a bachelor's degree from the Olin School of Business at Washington University in St. Louis. Joe is a CFA charterholder and a member of the CFA Institute. |

|

| Justin M. Brown (2021-09-01) |

|

| Justin co-manages the U.S. Large Cap Growth and U.S. Sustainable Large Cap Core strategies and provides fundamental research and equity analysis on the consumer discretionary, commercial services, and technology sectors for these strategies. Justin has been a member of this team since joining the firm in 2000. Previously, he was an equity analyst at USAA Investment Management Company with responsibilities for technology and retail sector coverage. Prior to USAA, Justin was an equity analyst at Hanifen Imhoff. He earned a bachelor's degree in finance from Texas Christian University. Justin is a CFA charterholder and a member of the CFA Institute. |

|

| Charles Tan (2018-10-31) |

|

| Charles Tan is a senior vice president and co-chief investment officer — Global Fixed Income for American Century Investments®. As co-CIO of Global Fixed Income, Mr. Tan oversees portfolio management and research for the firm’s fixed income strategies, managed in offices in Santa Clara, Calif., New York City, and London, England.

Mr. Tan co-chairs the firm's Global Macro Strategy team, which sets the investment strategy for the Global Fixed Income group, and the Risk Management team, which oversees and manages risk for all strategies managed by the Global Fixed Income group.

Mr. Tan joined the firm in 2018 from Aberdeen Standard Investments (previously Aberdeen Asset Management), where he held a series of leadership roles, including head of North American fixed income. Before that, he was vice president and senior high yield analyst at Moody's Investors Service. Previously, he was a credit officer with First Commercial Bank of Philadelphia (HSBC Bank). He has worked in the investment industry since 1994.

Mr. Tan earned a bachelor's degree in economics from the University of International Business & Economics in Beijing and an MSBA from Bucknell University. |

|

| Robert J Bove (2021-09-01) |

|

| Rob co-manages the U.S. Sustainable Large Cap Core strategy and provides fundamental research and equity analysis on the health care and consumer staples sectors for this strategy as well as the U.S. Large Cap Growth strategy. He has been a member of the team since joining the firm in 2005. Previously, he was an analyst for U.S. Trust Company of New York with responsibilities that included health care sector coverage. Rob has worked in the investment industry since 1994. He earned a bachelor's degree in accounting from Villanova University and a master's degree in business administration with a concentration in finance from New York University. |

|

| Jason Greenblath (2021-08-01) |

|

| Jason Greenblath is vice president, senior portfolio manager and director of Corporate Credit Research for American Century Investments®.

Mr. Greenblath co-leads the Corporate Markets team and is a member of the Global Fixed Income Investment Committee, which sets investment outlook for the Global Fixed Income group.

Before joining American Century Investments in 2019, Mr. Greenblath was senior portfolio manager and head of U.S. Investment Grade Credit at Aberdeen Standard Investments. Prior to that, he was head of U.S. Investment Grade Credit Research. He joined Aberdeen in 2008 as a senior corporate analyst. He previously was a high yield/distressed credit analyst at RBS Greenwich Capital and has worked in the investment industry since 2002.

Mr. Greenblath earned a bachelor's degree in finance from Pennsylvania State University. |

|

| Robert V. Gahagan (2005-12-31) |

|

| Mr. Gahagan, Senior Vice President and Senior Portfolio Manager, joined American Century Investments in 1983. He became a portfolio manager in 1991. He has a bachelor’s degree in economics and an MBA from the University of Missouri – Kansas City. |

|

|

|

| Lincoln Financial Investments Corporation |

|

|

| Lincoln Variable Insurance Product Tr |

|

|

| American Century Investment Management Inc |

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|