| Invesco VI EQV International Equity I |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 373

Foreign Large Growth Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 1,190.79 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks long-term growth of capital.

|

|

| The fund invests primarily in equity securities of foreign issuers. The principal types of equity securities in which the fund invests are common and preferred stock. The fund may also invest up to 1.25 times the amount of the exposure to emerging markets countries in the MSCI ACWI ex USA® Index. It invests primarily in securities of issuers that are considered by the fund's portfolio managers to have potential for earnings or revenue growth. |

|

|

| Morningstar Category: Foreign Large Growth |

|

| Foreign large-growth portfolios focus on high-priced growth stocks, mainly outside of the United States. Most of these portfolios divide their assets among a dozen or more developed markets, including Japan, Britain, France, and Germany. These portfolios primarily invest in stocks that have market caps in the top 70% of each economically integrated market (such as Europe or Asia ex-Japan). Growth is defined based on fast growth (high growth rates for earnings, sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields). These portfolios typically will have less than 20% of assets invested in U.S. stocks.

|

|

|

| Foreign Securities Funds/Emerging Market Funds: Risks include, but are not limited to, currency risk, political risk, and risk associated with varying accounting standards. Investing in emerging markets may accentuate these risks. |

|

|

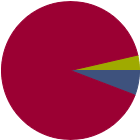

| % of Net Assets |

|

U.S. Stocks |

5.8 |

|

Non-U.S. Stocks |

90.6 |

|

Bonds |

0.0 |

|

Cash |

3.6 |

|

Other |

0.0 |

|

|

|

| Data through 2025-08-31 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

37.37 |

|

Basic Materials |

5.14 |

|

Consumer Cyclical |

7.07 |

|

Financial Services |

25.16 |

|

Real Estate |

0.00 |

|

|

|

|

Sensitive |

46.94 |

|

Communication Services |

5.22 |

|

Energy |

2.38 |

|

Industrials |

19.97 |

|

Technology |

19.37 |

|

|

|

|

Defensive |

15.70 |

|

Consumer Defensive |

5.38 |

|

Healthcare |

10.32 |

|

Utilities |

0.00 |

|

| Data through 2025-08-31 |

|

|

|

| Morningstar World Regions |

|

| % Fund |

| Americas |

17.2 |

|

| North America |

13.0 |

| Latin America |

4.3 |

|

| Greater Europe |

42.4 |

|

| United Kingdom |

10.6 |

| Europe Developed |

31.2 |

| Europe Emerging |

0.0 |

| Africa/Middle East |

0.6 |

|

| Greater Asia |

40.3 |

|

| Japan |

10.9 |

| Australasia |

2.2 |

| Asia Developed |

15.2 |

| Asia Emerging |

12.1 |

|

| Data through 2025-08-31 |

|

|

| Total Number of Stock Holdings |

84 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

23.34 |

|

|

| Turnover % |

(as of 2024-12-31) |

31.00 |

| 30 Day SEC Yield % |

--- |

|

|

Sector |

Country |

% of Net

Assets

|

|

|

|

|

|

|

Taiwan Semiconductor Manufacturing Co Ltd ADR |

|

Taiwan |

4.01 |

|

Investor AB Class B |

|

Sweden |

3.38 |

|

RB Global Inc |

|

Canada |

2.32 |

|

FinecoBank SpA |

|

Italy |

2.24 |

|

Legrand SA |

|

France |

1.94 |

|

|

BAE Systems PLC |

|

United Kingdom |

1.92 |

|

HDFC Bank Ltd ADR |

|

India |

1.90 |

|

Invesco Shrt-Trm Inv Treasury Instl |

--- |

United States |

1.88 |

|

Techtronic Industries Co Ltd |

|

Hong Kong |

1.88 |

|

Barclays PLC |

|

United Kingdom |

1.87 |

|

|

|

|

|

|

|

|

| Emerging Markets, Foreign Securities, Loss of Money, Not FDIC Insured, Country or Region, Growth Investing, Active Management, Market/Market Volatility, Depositary Receipts, Equity Securities, Industry and Sector Investing, Preferred Stocks, Derivatives, Socially Conscious, China Region, Mid-Cap |

|

| Show Risk Definitions |

|

|

| Inception Date: 1993-05-05 |

|

| Richard Nield (2013-04-29) |

|

| Richard Nield, Portfolio Manager of Invesco, has been associated with Invesco and/or its affiliates since 2000. Previously, he served as a senior analyst with Ontario Teacher’s Pension and with OMERS. He also spent three years as an associate investment advisor in retail sales for Canadian broker RBC Dominion Securities. He assumed his current duties in 2003.

Mr. Nield earned a Bachelor of Commerce degree in finance and international businessfrom McGill University in Montreal. He is a CFA charterholder. |

|

| Mark McDonnell (2023-12-29) |

|

| Joining the Hillswick team in 1997, Mr. McDonnell serves as the Firm's President and as Senior Portfolio Manager for fixed income strategies.

Prior to Hillswick, Mark held positions with Smith Barney and Baird Patrick & Company, a regional brokerage firm. He is a graduate of Fordham University.

Mr. McDonnell has been invited to speak at industry events nationwide, pertaining to topics related to macro-economic analysis, fixed income markets & investing strategies for pensions and captive insurance programs.

Mark has served with the U.S. Navy Reserves and U.S. Army Reserves. |

|

| Michael Shaman (2023-12-29) |

|

| Michael Shaman, Portfolio Manager, who has been associated with Invesco and/or its affiliates since 2012. |

|

| Amrita Dukeshier (2025-06-23) |

|

| Amrita joined BCM in 2022. She is responsible for portfolio management, investment due diligence, and new idea generation. Prior to joining the firm, Amrita was a senior equity analyst at Invesco Advisors and an equity analyst at Fidelity Investments. She holds a M.B.A. from The University of Texas at Austin, where she was a member of the M.B.A. Investment Fund, and a B.S. in Computer Science from Indiana University South Bend. |

|

| Brently Bates (2013-04-29) |

|

| Brent Bates , CFA, CPA, is a portfolio manager for the Invesco advisers, Inc. He was a senior analyst with the international Growth team from 2005 until he was promoted to portfolio manager in 2011.

Mr. Bates joined invesco in 1996 as a mutual fund accountant. In 1998, he became an analyst on the Quantitative Analysis team. From 2002 to 2005, he served as an analyst for the Large/Multi-Cap Growth team, responsible for the energy, industrials and technology sectores.

Mr. Bates earned a Bachelor of Business Administration degree from Texas A&M University. He is a CFA charter holder and CPA. |

|

|

|

|

|

|

|

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|