| BNY Mellon VIF Apprec Port Initl |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 1024

Large Growth Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 199.16 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks long-term capital growth consistent with the preservation of capital; its secondary goal is current income.

|

|

| The fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in common stocks. It focuses on "blue chip" companies with total market capitalizations of more than $5 billion at the time of purchase, including multinational companies. |

|

|

| Morningstar Category: Large Growth |

|

| Large-growth portfolios invest primarily in big U.S. companies that are projected to grow faster than other large-cap stocks. Stocks in the top 70% of the capitalization of the U.S. equity market are defined as large cap. Growth is defined based on fast growth (high growth rates for earnings, sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields). Most of these portfolios focus on companies in rapidly expanding industries.

|

|

|

| There are no additional fund specific investment risks (e.g. liquidity risk, currency risk, foreign investment risk, etc.) associated with this fund beyond the normal risks generally associated with investing in a mutual fund. |

|

|

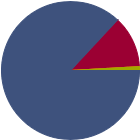

| % of Net Assets |

|

U.S. Stocks |

87.0 |

|

Non-U.S. Stocks |

12.2 |

|

Bonds |

0.0 |

|

Cash |

0.9 |

|

Other |

0.0 |

|

|

|

| Data through 2025-09-30 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

29.09 |

|

Basic Materials |

1.20 |

|

Consumer Cyclical |

12.61 |

|

Financial Services |

14.19 |

|

Real Estate |

1.09 |

|

|

|

|

Sensitive |

58.46 |

|

Communication Services |

10.03 |

|

Energy |

3.95 |

|

Industrials |

7.01 |

|

Technology |

37.47 |

|

|

|

|

Defensive |

12.45 |

|

Consumer Defensive |

3.46 |

|

Healthcare |

8.99 |

|

Utilities |

0.00 |

|

| Data through 2025-09-30 |

|

|

| Total Number of Stock Holdings |

47 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

49.82 |

|

|

| Turnover % |

(as of 2024-12-31) |

14.25 |

| 30 Day SEC Yield % |

0.00 |

|

|

Sector |

P/E |

% of Net

Assets

|

|

|

|

|

|

|

Microsoft Corp |

|

37.65 |

8.70 |

|

NVIDIA Corp |

|

52.05 |

8.16 |

|

Amazon.com Inc |

|

32.48 |

5.99 |

|

Apple Inc |

|

38.28 |

5.75 |

|

Alphabet Inc Class C |

|

27.06 |

5.55 |

|

|

Meta Platforms Inc Class A |

|

26.00 |

4.40 |

|

Visa Inc Class A |

|

33.39 |

3.00 |

|

ASML Holding NV ADR |

|

--- |

2.81 |

|

Intuit Inc |

|

48.38 |

2.77 |

|

Taiwan Semiconductor Manufacturing Co Ltd ADR |

|

--- |

2.69 |

|

|

|

|

|

|

|

|

| Foreign Securities, Loss of Money, Not FDIC Insured, Value Investing, Market/Market Volatility, Depositary Receipts, Equity Securities, Management, Large Cap |

|

| Show Risk Definitions |

|

|

| Inception Date: 1993-04-05 |

|

| Catherine P. Crain (1998-03-31) |

|

| Catherine P. Crain is a Vice President at Fayez Sarofim & Co. and a co-manager of the mutual funds that Fayez Sarofim & Co. manages for BNY Mellon. She is also a portfolio manager for a variety of institutional and high net worth clients. Ms. Crain joined the Firm in 1993 as an Associate. Over the years, areas of research responsibility have included transportation, media and entertainment, and consumer products.

Ms. Crain received a M.B.A. from the University of Texas in 1993 and a B.A. with Highest Honors in the Plan II Liberal Arts Honors Program at the University of Texas at Austin in 1989, where she was elected to Phi Beta Kappa. Prior to joining Fayez Sarofim & Co., she was employed at Merrill Lynch & Co. as a Financial Analyst in the Investment Banking Division in New York and Houston.

Ms. Crain is a life member of the University of Texas McCombs School of Business Advisory Council. She also serves as a member of The Joy School Board of Trustees. |

|

| Christopher B. Sarofim (2000-10-31) |

|

| Christopher B. Sarofim is Vice Chairman of Fayez Sarofim & Co., President of Sarofim International Management Company and a Director of The Sarofim Group. He is a member of Fayez Sarofim & Co.’s Executive, Investment and Finance Committees, a co-manager of the mutual funds that Fayez Sarofim & Co. manages for BNY Mellon and a portfolio manager for a variety of institutional and high net worth clients. Mr. Sarofim joined the Firm in 1988 as an Associate.

Mr. Sarofim received an A.B. in History from Princeton University in 1986. Prior to joining Fayez Sarofim & Co., he worked in corporate finance at Goldman, Sachs & Co.

Mr. Sarofim is a member of the Board of Trustees for The Brown Foundation, Inc. He also serves on the boards of Kemper Corp. and Wood Partners and is on the Advisory Committee of the MD Anderson Cancer Center Board of Visitors. |

|

| Alan R. Christensen (2020-03-04) |

|

| Alan R. Christensen is the President and Head of Investment Risk at Fayez Sarofim & Co. Mr. Christensen oversees the Firm’s marketing, client service, operations and technology initiatives and is a member of the Investment Committee. He is also a portfolio manager for a variety of institutional and high net worth clients. Mr. Christensen joined the Firm in 2005 as an Associate.

Mr. Christensen received a M.B.A. with Distinction from Cornell University in 2005, where he was a Park Fellow and a B.A. in Economics and History from Washington & Lee University in 1995, where he graduated cum laude. Prior to joining Fayez Sarofim & Co., he was employed with Alvarez & Marsal as a Director and Accenture as a Senior Manager in Capital Markets. |

|

| W. Gentry Lee (2010-12-14) |

|

| William ("Gentry”) Lee, Jr. is the Chief Executive Officer and Co-Chief Investment Officer of Fayez Sarofim & Co., a Director of The Sarofim Group and a member of Fayez Sarofim & Co.’s Executive and Investment Committees. In addition to overseeing the Firm’s investment, client service and business operations, he is a co-manager of the mutual funds that Fayez Sarofim & Co. manages for BNY Mellon. He is also a portfolio manager for a variety of institutional and high net worth clients. Mr. Lee joined the Firm in 1998 as an Associate. Over the years, areas of research responsibility have included beverages, technology and transportation.

Mr. Lee received a M.B.A. with High Distinction from Harvard Business School in 1998, where he was a Baker Scholar, and a B.A. with High Honors in Economics from Vanderbilt University in 1994, where he graduated summa cum laude. He was also elected to Phi Beta Kappa. Prior to attending business school and joining Fayez Sarofim & Co., he was employed as a Financial Analyst with Enron Capital & Trade Resources.

Mr. Lee serves on the board of directors of Wood Partners and St. John’s School. Previously, he was a board member of the Carruth Foundation and Memorial Park Conservancy and Co-President of the Houston Vanderbilt University Alumni Chapter. |

|

|

|

| BNY Mellon Investment Adviser, Inc |

|

|

|

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|