| Franklin Small Cap Value VIP 1 |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 462

Small Value Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 1,119.13 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks long-term total return.

|

|

| The fund invests at least 80% of its net assets in investments of small-capitalization (small-cap) companies. It generally invests in equity securities that the fund's investment manager believes are undervalued at the time of purchase and have the potential for capital appreciation. The fund invests predominantly in common stocks. It may invest up to 25% of its total assets in foreign securities. |

|

|

| Morningstar Category: Small Value |

|

| Small-value portfolios invest in small U.S. companies with valuations and growth rates below other small-cap peers. Stocks in the bottom 10% of the capitalization of the U.S. equity market are defined as small cap. Value is defined based on low valuations (low price ratios and high dividend yields) and slow growth (low growth rates for earnings, sales, book value, and cash flow).

|

|

|

| Small Cap Funds: Smaller companies typically have higher risk of failure, and are not as well established as larger blue-chip companies. Historically, the smaller company stocks have experienced a greater degree of market volatility than the overall market average. |

|

|

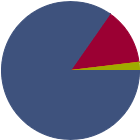

| % of Net Assets |

|

U.S. Stocks |

84.7 |

|

Non-U.S. Stocks |

13.4 |

|

Bonds |

0.0 |

|

Cash |

1.9 |

|

Other |

0.0 |

|

|

|

| Data through 2025-09-30 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

55.55 |

|

Basic Materials |

7.38 |

|

Consumer Cyclical |

14.14 |

|

Financial Services |

31.15 |

|

Real Estate |

2.88 |

|

|

|

|

Sensitive |

40.38 |

|

Communication Services |

0.00 |

|

Energy |

3.85 |

|

Industrials |

23.34 |

|

Technology |

13.19 |

|

|

|

|

Defensive |

4.10 |

|

Consumer Defensive |

0.00 |

|

Healthcare |

3.03 |

|

Utilities |

1.07 |

|

| Data through 2025-09-30 |

|

|

| Total Number of Stock Holdings |

85 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

26.86 |

|

|

| Turnover % |

(as of 2023-12-31) |

65.28 |

| 30 Day SEC Yield % |

1.16 |

|

|

Sector |

P/E |

% of Net

Assets

|

|

|

|

|

|

|

ACI Worldwide Inc |

|

20.57 |

3.24 |

|

Valmont Industries Inc |

|

37.49 |

2.81 |

|

QinetiQ Group PLC |

|

--- |

2.78 |

|

Commercial Metals Co |

|

77.54 |

2.74 |

|

Envista Holdings Corp Ordinary Shares |

|

62.38 |

2.69 |

|

|

MKS Inc |

|

34.56 |

2.63 |

|

CNO Financial Group Inc |

|

14.12 |

2.61 |

|

Vontier Corp Ordinary Shares |

|

16.16 |

2.48 |

|

Horace Mann Educators Corp |

|

13.01 |

2.46 |

|

Gates Industrial Corp PLC |

|

33.68 |

2.42 |

|

|

|

|

|

|

|

|

| Foreign Securities, Loss of Money, Not FDIC Insured, Value Investing, Active Management, Market/Market Volatility, Industry and Sector Investing, Other, Socially Conscious, Portfolio Diversification, Small Cap, Financials Sector, Real Estate/REIT Sector, Technology Sector |

|

| Show Risk Definitions |

|

|

| Inception Date: 1998-05-01 |

|

| Steven B. Raineri (2012-07-02) |

|

| Steven B. Raineri, Vice President and Portfolio Manager of Franklin Advisory Services. Mr. Raineri joined Franklin Templeton in 2005. He has been in the investment industry for more than 20 years. Mr. Raineri began his career at Gabelli & Company, and has also worked for Dresdner Kleinwort Wasserstein and WoodAllen Capital Management. He also spent several years as a business valuation analyst for Arthur Andersen and J&W Seligman Valuations. |

|

| Christopher Meeker (2015-05-01) |

|

| Christopher Meeker, CFA, Portfolio Manager/Research Analyst of Franklin Advisory Services. Mr. Meeker joined Franklin Templeton Investments in September 2012 as a research analyst. He has been in the investment industry for more than 15 years. Prior to joining Franklin Templeton, Mr. Meeker worked as a senior research analyst at Federated Global Investment Management. Mr. Meeker also has prior investment experience at Farr, Miller & Washington LLC, a boutique asset manager. Prior to his buy-side work, Mr. Meeker spent six years as an investment banker with Houlihan Lokey Howard & Zukin, Inc. and AMT Capital Advisors, LLC." |

|

| Nicholas Karzon (2019-12-31) |

|

| Mr. Karzon has been a portfolio manager of the Small Cap Value Fund since December 2019. He joined Franklin Templeton in 2014. |

|

|

|

| Franklin Mutual Advisers, LLC |

|

|

| Franklin Templeton Investments |

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|