| Victory Pioneer Fund VCT - Class I |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 1226

Large Blend Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 163.16 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks reasonable income and capital growth.

|

|

| The portfolio invests in a broad group of carefully selected securities that the portfolio's adviser believes are reasonably priced, rather than in securities whose prices reflect a premium resulting from their current market popularity. It primarily invests in securities of U.S. issuers. The portfolio may invest up to 15% of its total assets in securities of non-U.S. issuers. It will not invest more than 5% of its total assets in the securities of emerging markets issuers. The portfolio may invest up to 15% of its net assets in REITs. |

|

|

| Morningstar Category: Large Blend |

|

| Large-blend portfolios are fairly representative of the overall US stock market in size, growth

rates and price. Stocks in the top 70% of the capitalization of the US equity market are defined

as large cap. The blend style is assigned to portfolios where neither growth nor value

characteristics predominate. These portfolios tend to invest across the spectrum of US

industries, and owing to their broad exposure, the portfolios' returns are often similar to those of the S&P 500 Index.

|

|

|

| There are no additional fund specific investment risks (e.g. liquidity risk, currency risk, foreign investment risk, etc.) associated with this fund beyond the normal risks generally associated with investing in a mutual fund. |

|

|

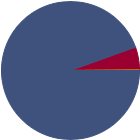

| % of Net Assets |

|

U.S. Stocks |

94.5 |

|

Non-U.S. Stocks |

5.4 |

|

Bonds |

0.0 |

|

Cash |

0.1 |

|

Other |

0.0 |

|

|

|

| Data through 2025-08-31 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

30.92 |

|

Basic Materials |

10.71 |

|

Consumer Cyclical |

7.19 |

|

Financial Services |

13.02 |

|

Real Estate |

0.00 |

|

|

|

|

Sensitive |

61.11 |

|

Communication Services |

4.85 |

|

Energy |

3.82 |

|

Industrials |

15.39 |

|

Technology |

37.05 |

|

|

|

|

Defensive |

7.97 |

|

Consumer Defensive |

2.57 |

|

Healthcare |

3.12 |

|

Utilities |

2.28 |

|

| Data through 2025-08-31 |

|

|

| Total Number of Stock Holdings |

44 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

49.54 |

|

|

| Turnover % |

(as of 2024-12-31) |

65.00 |

| 30 Day SEC Yield % |

--- |

|

|

Sector |

P/E |

% of Net

Assets

|

|

|

|

|

|

|

NVIDIA Corp |

|

57.11 |

7.70 |

|

Microsoft Corp |

|

39.74 |

6.61 |

|

Amazon.com Inc |

|

34.95 |

5.60 |

|

Apple Inc |

|

40.82 |

5.06 |

|

Alphabet Inc Class A |

|

28.51 |

4.85 |

|

|

Truist Financial Corp |

|

11.85 |

4.71 |

|

Martin Marietta Materials Inc |

|

34.25 |

4.63 |

|

Freeport-McMoRan Inc |

|

28.79 |

4.53 |

|

Quanta Services Inc |

|

68.15 |

3.07 |

|

Broadcom Inc |

|

95.88 |

2.78 |

|

|

|

|

|

|

|

|

| Foreign Securities, Loss of Money, Not FDIC Insured, Value Investing, Market/Market Volatility, Equity Securities, Industry and Sector Investing, IPO, Other, Preferred Stocks, Restricted/Illiquid Securities, Underlying Fund/Fund of Funds, Warrants, Derivatives, Leverage, Pricing, Fixed-Income Securities, Socially Conscious, Increase in Expenses, Shareholder Activity, Management, Real Estate/REIT Sector |

|

| Show Risk Definitions |

|

|

| Inception Date: 1997-10-31 |

|

| Jeffrey L. Kripke (2015-07-01) |

|

| Jeff Kripke, Senior Vice President of Amundi US, joined Amundi US in 2015. Prior to joining Amundi US, Mr. Kripke was at Allianz Global Investors, where he was Co-CIO of the Disciplined Equity Group and a portfolio manager since 2014. Previously, Mr. Kripke was at Wellington Management Company from 2001–2013, where he was an associate partner and portfolio manager. |

|

| Craig Sterling (2019-07-31) |

|

| Craig Sterling is a Senior Vice President and Head of Equity Research, U.S. at Amundi Pioneer. He joined Amundi Pioneer in May 2015. Prior to joining Amundi Pioneer, he was Managing Director and Global Head of Equity Research at EVA Dimensions LLC in New York, an independent equity research firm. Prior to June 2011, he served as a Director in the HOLT Group at Credit Suisse. |

|

| James Yu (2019-07-31) |

|

| James Yu, Vice President and Portfolio Manager of Amundi US, joined Amundi US in 2015. Prior to joining Amundi US, Mr. Yu was a Senior Research Analyst at Wells Capital Management, where he supported small-cap value and mid-cap value strategies. Mr. Yu has been an investment professional since 1995. |

|

|

|

| Victory Capital Management Inc. |

|

|

| Victory Capital Management Inc. |

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|