|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 476

Mid-Cap Growth Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 481.42 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks long-term capital appreciation.

|

|

| Under normal circumstances, the fund invests a majority of its net assets in the common stock of small- and mid-sized companies with market capitalizations generally in the range of market capitalizations in the Russell 2500 Growth Index, the fund's benchmark, at the time of purchase. |

|

|

| Morningstar Category: Mid-Cap Growth |

|

| Some mid-cap growth portfolios invest in stocks of all sizes, thus leading to a mid-cap profile, but others focus on midsize companies. Mid-cap growth portfolios target U.S. firms that are projected to grow faster than other mid-cap stocks, therefore commanding relatively higher prices. Stocks in the middle 20% of the capitalization of the U.S. equity market are defined as mid-cap. Growth is defined based on fast growth (high growth rates for earnings, sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields).

|

|

|

| Mid Cap Funds: The securities of companies with market capitalizations below $10 billion may be more volatile and less liquid than the securities of larger companies. |

|

|

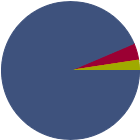

| % of Net Assets |

|

U.S. Stocks |

93.6 |

|

Non-U.S. Stocks |

4.0 |

|

Bonds |

0.0 |

|

Cash |

2.4 |

|

Other |

0.0 |

|

|

|

| Data through 2025-08-31 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

27.67 |

|

Basic Materials |

1.18 |

|

Consumer Cyclical |

14.43 |

|

Financial Services |

10.00 |

|

Real Estate |

2.06 |

|

|

|

|

Sensitive |

47.62 |

|

Communication Services |

0.00 |

|

Energy |

1.41 |

|

Industrials |

25.06 |

|

Technology |

21.15 |

|

|

|

|

Defensive |

24.69 |

|

Consumer Defensive |

3.75 |

|

Healthcare |

20.94 |

|

Utilities |

0.00 |

|

| Data through 2025-08-31 |

|

|

| Total Number of Stock Holdings |

97 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

22.17 |

|

|

| Turnover % |

(as of 2024-12-31) |

82.00 |

| 30 Day SEC Yield % |

--- |

|

|

Sector |

P/E |

% of Net

Assets

|

|

|

|

|

|

|

SPX Technologies Inc |

|

41.36 |

2.57 |

|

The Carlyle Group Inc |

|

17.42 |

2.53 |

|

Columbia Short-Term Cash |

--- |

--- |

2.41 |

|

GCM Grosvenor Inc Ordinary Shares - Class A |

|

60.79 |

2.39 |

|

FTAI Aviation Ltd |

|

42.13 |

2.09 |

|

|

Sterling Infrastructure Inc |

|

39.29 |

2.07 |

|

Parsons Corp |

|

24.16 |

2.05 |

|

Wingstop Inc |

|

42.43 |

2.03 |

|

Curtiss-Wright Corp |

|

46.85 |

2.02 |

|

Colliers International Group Inc Shs Subord Voting |

|

--- |

2.01 |

|

|

|

|

|

|

|

|

| Emerging Markets, Foreign Securities, Loss of Money, Not FDIC Insured, Growth Investing, Active Management, Issuer, Market/Market Volatility, Industry and Sector Investing, Restricted/Illiquid Securities, Small Cap, Mid-Cap |

|

| Show Risk Definitions |

|

|

| Inception Date: 1995-05-03 |

|

| Erika K Maschmeyer (2021-04-15) |

|

| Ms. Maschmeyer has been associated with the Investment Manager as an investment professional since 2016. Ms. Maschmeyer heads the Investment Manager's U.S. equity research efforts and has been a Vice President of the Trust since March 2020. Prior to joining Columbia WAM, Ms. Maschmeyer was a research analyst at Oak Ridge Investments where she was responsible for U.S. consumer discretionary/staples investments. Ms. Maschmeyer began her investment career in 2001 and earned a B.A. from Denison University and an M.B.A from the University of Chicago. |

|

| Pratyasha Rath (2025-09-08) |

|

| Ms. Rath has been associated with the Investment Manager or one of its affiliates since 2017. Ms. Rath began her investment career in 2007 and earned a B.A. from Delhi University, India and an M.S. from the Illinois Institute of Technology, Chicago. |

|

|

|

| Columbia Mgmt Investment Advisers, LLC |

|

|

|

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|