| Templeton Developing Markets VIP 2 |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 697

Diversified Emerging Mkts Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 326.58 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks long-term capital appreciation.

|

|

| The fund invests at least 80% of its net assets in emerging markets investments. Its investments in equity securities may include investments in the securities of companies of any capitalization, including a portion in small and mid capitalization companies. The fund, from time to time, may have significant investments in one or more countries, such as China or South Korea, or in particular industries or sectors. It may invest up to 20% of its net assets in the securities of issuers in developed market countries. The fund is non-diversified. |

|

|

| Morningstar Category: Diversified Emerging Mkts |

|

| Diversified emerging-markets portfolios tend to divide their assets among 20 or more nations, although they tend to focus on the emerging markets of Asia and Latin America rather than on those of the Middle East, Africa, or Europe. These portfolios invest predominantly in emerging market equities, but some funds also invest in both equities and fixed income investments from emerging markets.

|

|

|

| Foreign Securities Funds/Emerging Market Funds: Risks include, but are not limited to, currency risk, political risk, and risk associated with varying accounting standards. Investing in emerging markets may accentuate these risks. |

| Non-Diversified Funds: Funds that invest more of their assets in a single issuer involve additional risks, including share price fluctuations, because of the increased concentration of investments. |

|

|

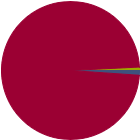

| % of Net Assets |

|

U.S. Stocks |

1.1 |

|

Non-U.S. Stocks |

98.1 |

|

Bonds |

0.0 |

|

Cash |

0.8 |

|

Other |

0.0 |

|

|

|

| Data through 2025-09-30 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

35.31 |

|

Basic Materials |

1.42 |

|

Consumer Cyclical |

11.25 |

|

Financial Services |

21.60 |

|

Real Estate |

1.04 |

|

|

|

|

Sensitive |

56.98 |

|

Communication Services |

14.02 |

|

Energy |

1.89 |

|

Industrials |

5.38 |

|

Technology |

35.69 |

|

|

|

|

Defensive |

7.70 |

|

Consumer Defensive |

2.36 |

|

Healthcare |

4.14 |

|

Utilities |

1.20 |

|

| Data through 2025-09-30 |

|

|

|

| Morningstar World Regions |

|

| % Fund |

| Americas |

13.2 |

|

| North America |

1.1 |

| Latin America |

12.1 |

|

| Greater Europe |

11.6 |

|

| United Kingdom |

0.1 |

| Europe Developed |

6.9 |

| Europe Emerging |

1.4 |

| Africa/Middle East |

3.3 |

|

| Greater Asia |

75.3 |

|

| Japan |

0.0 |

| Australasia |

0.0 |

| Asia Developed |

41.1 |

| Asia Emerging |

34.2 |

|

| Data through 2025-09-30 |

|

|

| Total Number of Stock Holdings |

82 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

46.92 |

|

|

| Turnover % |

(as of 2023-12-31) |

25.99 |

| 30 Day SEC Yield % |

0.97 |

|

|

Sector |

Country |

% of Net

Assets

|

|

|

|

|

|

|

Taiwan Semiconductor Manufacturing Co Ltd |

|

Taiwan |

14.50 |

|

Prosus NV Ordinary Shares - Class N |

|

Netherlands |

5.73 |

|

SK Hynix Inc |

|

South Korea |

5.25 |

|

Samsung Electronics Co Ltd |

|

South Korea |

3.95 |

|

Alibaba Group Holding Ltd Ordinary Shares |

|

China |

3.54 |

|

|

ICICI Bank Ltd |

|

India |

3.36 |

|

Tencent Holdings Ltd |

|

China |

3.21 |

|

Grupo Financiero Banorte SAB de CV Class O |

|

Mexico |

2.68 |

|

MediaTek Inc |

|

Taiwan |

2.40 |

|

Hon Hai Precision Industry Co Ltd |

|

Taiwan |

2.30 |

|

|

|

|

|

|

|

|

| Emerging Markets, Foreign Securities, Loss of Money, Not FDIC Insured, Nondiversification, Value Investing, Active Management, Market/Market Volatility, Other, Socially Conscious, Portfolio Diversification, Small Cap, Mid-Cap |

|

| Show Risk Definitions |

|

|

| Inception Date: 1997-05-01 |

|

| Chetan Sehgal (2017-04-03) |

|

|

|

|

| Andrew Ness (2020-11-09) |

|

| Prior to joining Franklin Templeton in September 2018, Andrew was as a Portfolio Manager at Martin Currie, an Edinburgh based asset manager. He began his

career at Murray Johnstone in 1994 and also worked with Deutsche Asset Management in both London and New York before joining Scottish Widows Investment Partnership in 2007.

Mr Ness holds a B.A. (Hons) in Economics and an MSc in Business Economics from the University of Strathclyde in the UK. He is an Associate Member of the

UK Society of Investment Professionals and a member of the CFA Institute. |

|

|

|

| Templeton Asset Management Ltd. |

|

|

| Franklin Templeton Investments |

|

|

| Franklin Templeton Inv Mgmt Ltd |

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|