| BNY Mellon IP Technology Growth Init |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 245

Technology Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 174.19 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks capital appreciation.

|

|

| The fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in the stocks of growth companies of any size that the adviser believes to be leading producers or beneficiaries of technological innovation. Up to 25% of the fund's assets may be invested in foreign securities. In choosing stocks, the fund looks for technology companies with the potential for strong earnings or revenue growth rates. |

|

|

| Morningstar Category: Technology |

|

| Technology portfolios buy high-tech businesses in the U.S. or outside of the U.S. Most concentrate on computer, semiconductor, software, networking, and Internet stocks. A few also buy medical-device and biotechnology stocks, and some concentrate on a single technology industry.

|

|

|

| Sector Funds: Funds that invest exclusively in one sector or industry involve risks due to the lack of industry diversification and expose the investor to increased industry-specific risks. |

|

|

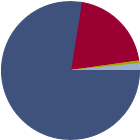

| % of Net Assets |

|

U.S. Stocks |

77.6 |

|

Non-U.S. Stocks |

20.3 |

|

Bonds |

0.0 |

|

Cash |

0.6 |

|

Other |

1.6 |

|

|

|

| Data through 2025-08-31 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

13.08 |

|

Basic Materials |

0.00 |

|

Consumer Cyclical |

9.62 |

|

Financial Services |

1.31 |

|

Real Estate |

2.15 |

|

|

|

|

Sensitive |

86.92 |

|

Communication Services |

15.85 |

|

Energy |

0.00 |

|

Industrials |

2.46 |

|

Technology |

68.61 |

|

|

|

|

Defensive |

0.00 |

|

Consumer Defensive |

0.00 |

|

Healthcare |

0.00 |

|

Utilities |

0.00 |

|

| Data through 2025-08-31 |

|

|

| Total Number of Stock Holdings |

35 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

52.02 |

|

|

| Turnover % |

(as of 2024-12-31) |

34.96 |

| 30 Day SEC Yield % |

0.00 |

|

|

Sector |

P/E |

% of Net

Assets

|

|

|

|

|

|

|

NVIDIA Corp |

|

51.14 |

7.78 |

|

Taiwan Semiconductor Manufacturing Co Ltd ADR |

|

--- |

7.24 |

|

Microsoft Corp |

|

37.65 |

5.38 |

|

Oracle Corp |

|

69.21 |

4.86 |

|

Meta Platforms Inc Class A |

|

25.70 |

4.77 |

|

|

Amazon.com Inc |

|

32.99 |

4.75 |

|

Netflix Inc |

|

51.78 |

4.66 |

|

Micron Technology Inc |

|

24.65 |

4.58 |

|

Intuit Inc |

|

48.07 |

4.17 |

|

Shopify Inc Registered Shs -A- Subord Vtg |

|

--- |

3.83 |

|

|

|

|

|

|

|

|

| Foreign Securities, Loss of Money, Not FDIC Insured, Growth Investing, Market/Market Volatility, Equity Securities, Restricted/Illiquid Securities, Management, Small Cap, Mid-Cap, Technology Sector |

|

| Show Risk Definitions |

|

|

| Inception Date: 1999-08-31 |

|

| Robert C. Zeuthen (2022-03-09) |

|

| Rob is a member of Newton’s equity research team and is a senior portfolio manager on the small mid cap equity team and the lead portfolio manager for the Mobility Innovation strategy. In addition to portfolio management duties, he is responsible for research coverage of the information technology sector.

Rob joined Newton in September 2021, following the integration of Mellon Investments Corporation’s equity and multi-asset capabilities into the Newton Investment Management Group. Before joining Newton, Rob was a senior portfolio manager at Mellon Investments Corporation and The Boston Company Asset Management (both BNY Mellon group companies).

Prior to joining BNY Mellon, Rob worked at Bricoleur Capital leading technology investing for its long/short hedge fund. Rob began his career at Prudential and its subsidiary Jennison Associates, where he helped launch a US small-cap fund and served as an analyst and portfolio manager for global small-cap equities.

Rob has a BS with honors in Finance from Boston College. He holds the CFA designation and is a member of the CFA Institute. |

|

| Brian Byrnes (2024-05-07) |

|

| Brian joined Newton Investment Management in August 2022 and is an Equity Research Analyst within the Secular Pod covering small-cap tech. Prior to joining Newton Investment Management, Brian was a Research Analyst at Eaton Vance acting in a generalist capacity and prior to that held various investment roles at Vanguard. Brian graduated from Elon University and is a CFA1 Charterholder. Outside of work, Brian enjoys reading, cooking, and taking road trips to uncover new locations to surf and ski.

Joined Newton: 2022

Joined BNY Mellon group of companies: 2022

Joined industry: 2013 |

|

|

|

| BNY Mellon Investment Adviser, Inc |

|

|

|

|

|

| Newton Investment Management North America, LLC |

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|