| Invesco V.I. Discovery Mid Cap Growth II |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 476

Mid-Cap Growth Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 953.98 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks capital appreciation.

|

|

| The fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities of mid-cap issuers, and in derivatives and other instruments that have economic characteristics similar to such securities. The fund may invest up to 20% of its net assets in companies in other market capitalization ranges. It invests primarily in U.S. companies but may also purchase securities of issuers in any country, including developed countries and emerging markets. |

|

|

| Morningstar Category: Mid-Cap Growth |

|

| Some mid-cap growth portfolios invest in stocks of all sizes, thus leading to a mid-cap profile, but others focus on midsize companies. Mid-cap growth portfolios target U.S. firms that are projected to grow faster than other mid-cap stocks, therefore commanding relatively higher prices. Stocks in the middle 20% of the capitalization of the U.S. equity market are defined as mid-cap. Growth is defined based on fast growth (high growth rates for earnings, sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields).

|

|

|

| Mid Cap Funds: The securities of companies with market capitalizations below $10 billion may be more volatile and less liquid than the securities of larger companies. |

|

|

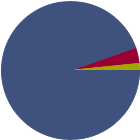

| % of Net Assets |

|

U.S. Stocks |

94.6 |

|

Non-U.S. Stocks |

3.8 |

|

Bonds |

0.0 |

|

Cash |

1.6 |

|

Other |

0.0 |

|

|

|

| Data through 2025-08-31 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

30.24 |

|

Basic Materials |

0.00 |

|

Consumer Cyclical |

17.74 |

|

Financial Services |

10.79 |

|

Real Estate |

1.71 |

|

|

|

|

Sensitive |

53.55 |

|

Communication Services |

2.33 |

|

Energy |

2.62 |

|

Industrials |

25.53 |

|

Technology |

23.07 |

|

|

|

|

Defensive |

16.21 |

|

Consumer Defensive |

1.28 |

|

Healthcare |

12.48 |

|

Utilities |

2.45 |

|

| Data through 2025-08-31 |

|

|

| Total Number of Stock Holdings |

80 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

23.38 |

|

|

| Turnover % |

(as of 2024-12-31) |

97.00 |

| 30 Day SEC Yield % |

--- |

|

|

Sector |

P/E |

% of Net

Assets

|

|

|

|

|

|

|

Hilton Worldwide Holdings Inc |

|

38.64 |

3.09 |

|

Howmet Aerospace Inc |

|

59.02 |

2.63 |

|

Axon Enterprise Inc |

|

184.48 |

2.51 |

|

Monolithic Power Systems Inc |

|

28.91 |

2.48 |

|

Cloudflare Inc |

|

--- |

2.40 |

|

|

Flex Ltd |

|

--- |

2.26 |

|

Palantir Technologies Inc Ordinary Shares - Class A |

|

630.60 |

2.07 |

|

Fastenal Co |

|

39.94 |

2.04 |

|

Cencora Inc |

|

34.50 |

1.97 |

|

Ares Management Corp Ordinary Shares - Class A |

|

85.78 |

1.93 |

|

|

|

|

|

|

|

|

| Emerging Markets, Foreign Securities, Loss of Money, Not FDIC Insured, Growth Investing, Active Management, Market/Market Volatility, Equity Securities, Industry and Sector Investing, Small Cap, Mid-Cap |

|

| Show Risk Definitions |

|

|

| Inception Date: 2000-10-16 |

|

| Ronald J. Zibelli (2008-11-17) |

|

| Mr. Zibelli has been a Senior Vice President of OppenheimerFunds, Inc since January 2014 and a Senior Portfolio Manager since May 2006. He was a Vice President of OppenheimerFunds from May 2006 to January 2014. Prior to joining OppenheimerFunds, he spent six years at Merrill Lynch Investment Managers, during which time he was a Managing Director and Small Cap Growth Team Leader. Prior to joining Merrill Lynch Investment Managers, Mr. Zibelli spent 12 years with Chase Manhattan Bank, including two years as Senior Portfolio Manager at Chase Asset Management. |

|

| Justin J. Livengood (2014-04-30) |

|

| Mr. Livengood has been a Vice President of OppenheimerFunds since May 2006 and a Senior Portfolio Manager since January 2014. He was a Senior Research Analyst from May 2006 to January 2014, responsible for the health care, energy and financial services sectors for mid- and small-cap growth accounts. Before joining OppenheimerFunds in May 2006, Mr. Livengood was a vice president and fund analyst with Merrill Lynch Investment Managers. During his tenure at Merrill Lynch he also worked as an investment banking analyst in the Global Media Group and as an associate with Merrill Lynch Ventures. |

|

|

|

|

|

|

|

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|