| Vanguard VIF International |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 373

Foreign Large Growth Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 3,368.1 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks to provide long-term capital appreciation.

|

|

| The Portfolio invests predominantly in the stocks of companies located outside the United States and is expected to diversify its assets in countries across developed and emerging markets. In selecting stocks, its advisors evaluate foreign markets around the world and choose large-, mid-, and small-capitalization companies considered to have above-average growth potential. The Portfolio uses multiple investment advisors. |

|

|

| Morningstar Category: Foreign Large Growth |

|

| Foreign large-growth portfolios focus on high-priced growth stocks, mainly outside of the United States. Most of these portfolios divide their assets among a dozen or more developed markets, including Japan, Britain, France, and Germany. These portfolios primarily invest in stocks that have market caps in the top 70% of each economically integrated market (such as Europe or Asia ex-Japan). Growth is defined based on fast growth (high growth rates for earnings, sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields). These portfolios typically will have less than 20% of assets invested in U.S. stocks.

|

|

|

| Foreign Securities Funds/Emerging Market Funds: Risks include, but are not limited to, currency risk, political risk, and risk associated with varying accounting standards. Investing in emerging markets may accentuate these risks. |

|

|

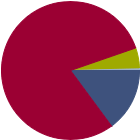

| % of Net Assets |

|

U.S. Stocks |

14.9 |

|

Non-U.S. Stocks |

79.9 |

|

Bonds |

0.0 |

|

Cash |

4.9 |

|

Other |

0.4 |

|

|

|

| Data through 2025-06-30 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

34.87 |

|

Basic Materials |

0.48 |

|

Consumer Cyclical |

23.77 |

|

Financial Services |

10.62 |

|

Real Estate |

0.00 |

|

|

|

|

Sensitive |

50.18 |

|

Communication Services |

8.27 |

|

Energy |

1.59 |

|

Industrials |

11.64 |

|

Technology |

28.68 |

|

|

|

|

Defensive |

14.95 |

|

Consumer Defensive |

4.09 |

|

Healthcare |

10.31 |

|

Utilities |

0.55 |

|

| Data through 2025-06-30 |

|

|

|

| Morningstar World Regions |

|

| % Fund |

| Americas |

24.9 |

|

| North America |

17.8 |

| Latin America |

7.0 |

|

| Greater Europe |

40.9 |

|

| United Kingdom |

7.7 |

| Europe Developed |

32.8 |

| Europe Emerging |

0.0 |

| Africa/Middle East |

0.4 |

|

| Greater Asia |

34.2 |

|

| Japan |

9.3 |

| Australasia |

1.4 |

| Asia Developed |

11.2 |

| Asia Emerging |

12.3 |

|

| Data through 2025-06-30 |

|

|

| Total Number of Stock Holdings |

118 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

33.86 |

|

|

| Turnover % |

(as of 2024-12-31) |

22.00 |

| 30 Day SEC Yield % |

--- |

|

|

Sector |

Country |

% of Net

Assets

|

|

|

|

|

|

|

Taiwan Semiconductor Manufacturing Co Ltd |

|

Taiwan |

6.44 |

|

MercadoLibre Inc |

|

Brazil |

4.83 |

|

Spotify Technology SA |

|

United States |

4.47 |

|

Sea Ltd ADR |

|

Singapore |

3.24 |

|

ASML Holding NV |

|

Netherlands |

3.20 |

|

|

Adyen NV |

|

Netherlands |

3.15 |

|

BYD Co Ltd Class H |

|

China |

2.57 |

|

Coupang Inc Ordinary Shares - Class A |

|

United States |

2.25 |

|

NVIDIA Corp |

|

United States |

1.87 |

|

Nu Holdings Ltd Ordinary Shares Class A |

|

Brazil |

1.84 |

|

|

|

|

|

|

|

|

| Currency, Emerging Markets, Loss of Money, Not FDIC Insured, Country or Region, Market/Market Volatility, Equity Securities, China Region, Management |

|

| Show Risk Definitions |

|

|

| Inception Date: 1994-06-03 |

|

| Thomas Coutts (2016-12-22) |

|

| Thomas Coutts, Partner of Baillie Gifford & Co., which is the 100% owner of Baillie Gifford. He has worked in investment management with Baillie Gifford since 1999, has managed investment portfolios since 2001, and has co-managed a portion of the Portfolio since December 2016.

Education: B.A., Trinity College, Oxford. |

|

| Simon Webber (2009-12-22) |

|

| Simon joined Schroders in 1999 as an analyst on the Global Technology and US teams, before becoming a Global Sector Specialist for the consumer discretionary and telecom sectors. Currently, he is also a portfolio manager on the Global Equity team. In 2006, Simon began to develop the philosophy and investment universe behind the Schroder Global Climate Change strategy, and has co-managed the fund since launch. |

|

| Lawrence Burns (2020-12-22) |

|

| Lawrence Burns joined Baillie Gifford in 2009 and became a Partner of Baillie Gifford & Co. in 2020. He is a portfolio manager in the Manager's strategies that focus on transformative growth companies. Mr. Burns has been a member of the International Growth Portfolio Construction Group since October 2012 and took over as Deputy Chair in July 2019. Mr. Burns is also a co-manager of the International Concentrated Growth Strategy. He has also spent time working in both the Emerging Markets and U.K. Equity Departments. Mr. Burns graduated BA in Geography from the University of Cambridge in 2009.

Mr. Burns has been a member of the team since 2012. |

|

| James Gautrey (2020-12-22) |

|

| James R. Gautrey, CFA, Portfolio Manager at Schroders. He has worked in investment management for Schroders since 2001, has managed assets since 2014, and has co-managed a portion of the Portfolio since December 2020. Education: B.Sc., University College London. |

|

|

|

| Baillie Gifford Overseas Limited |

| Schroder Investment Management North America Inc. |

|

|

|

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|