| Franklin Small Mid Cap Growth VIP 2 |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 476

Mid-Cap Growth Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 426.72 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks long-term capital growth.

|

|

| The fund invests at least 80% of its net assets in investments of small-capitalization (small-cap) and mid-capitalization (mid-cap) companies. It invests predominantly in equity securities, predominantly in common stock. The fund, from time to time, may have significant positions in particular sectors. |

|

|

| Morningstar Category: Mid-Cap Growth |

|

| Some mid-cap growth portfolios invest in stocks of all sizes, thus leading to a mid-cap profile, but others focus on midsize companies. Mid-cap growth portfolios target U.S. firms that are projected to grow faster than other mid-cap stocks, therefore commanding relatively higher prices. Stocks in the middle 20% of the capitalization of the U.S. equity market are defined as mid-cap. Growth is defined based on fast growth (high growth rates for earnings, sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields).

|

|

|

| Mid Cap Funds: The securities of companies with market capitalizations below $10 billion may be more volatile and less liquid than the securities of larger companies. |

|

|

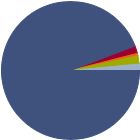

| % of Net Assets |

|

U.S. Stocks |

94.2 |

|

Non-U.S. Stocks |

1.8 |

|

Bonds |

0.6 |

|

Cash |

1.9 |

|

Other |

1.5 |

|

|

|

| Data through 2025-08-31 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

35.86 |

|

Basic Materials |

0.00 |

|

Consumer Cyclical |

24.08 |

|

Financial Services |

10.99 |

|

Real Estate |

0.79 |

|

|

|

|

Sensitive |

47.67 |

|

Communication Services |

7.67 |

|

Energy |

2.13 |

|

Industrials |

17.60 |

|

Technology |

20.27 |

|

|

|

|

Defensive |

16.48 |

|

Consumer Defensive |

0.60 |

|

Healthcare |

14.09 |

|

Utilities |

1.79 |

|

| Data through 2025-08-31 |

|

|

| Total Number of Stock Holdings |

78 |

| Total Number of Bond Holdings |

2 |

| % of Net Assets in Top 10 Holdings |

25.67 |

|

|

| Turnover % |

(as of 2023-12-31) |

43.03 |

| 30 Day SEC Yield % |

-0.22 |

|

|

Sector |

P/E |

% of Net

Assets

|

|

|

|

|

|

|

Roblox Corp Ordinary Shares - Class A |

|

--- |

4.02 |

|

Royal Caribbean Group |

|

22.51 |

3.53 |

|

Ares Management Corp Ordinary Shares - Class A |

|

80.61 |

2.60 |

|

DoorDash Inc Ordinary Shares - Class A |

|

146.14 |

2.56 |

|

Axon Enterprise Inc |

|

165.19 |

2.32 |

|

|

Datadog Inc Class A |

|

436.77 |

2.25 |

|

Tractor Supply Co |

|

27.22 |

2.23 |

|

Howmet Aerospace Inc |

|

55.46 |

2.07 |

|

Monolithic Power Systems Inc |

|

26.29 |

2.06 |

|

Verisk Analytics Inc |

|

36.13 |

2.03 |

|

|

|

|

|

|

|

|

| Loss of Money, Not FDIC Insured, Growth Investing, Active Management, Market/Market Volatility, Other, Restricted/Illiquid Securities, Portfolio Diversification, Small Cap, Mid-Cap |

|

| Show Risk Definitions |

|

|

| Inception Date: 1999-01-06 |

|

| Jennifer Chen (2024-09-30) |

|

| Jennifer Chen is a research analyst with the Franklin Equity Group. She specializes in the equity research and analysis of companies in the media,

entertainment, and video gaming industries.

Prior to joining Franklin Templeton in 2021, Ms. Chen was a private equity director at Saban Capital Group, a media and entertainment-focused investment

firm. She started her career as an investment banking analyst in the mergers and acquisitions group at Morgan Stanley.

Ms. Chen earned her BS in business administration from UC Berkeley and her MBA from Stanford Graduate School of Business |

|

| Michael McCarthy (1995-11-01) |

|

| Michael McCarthy is executive vice president and portfolio manager for Franklin Equity Group (FEG). He is the lead portfolio manager for the Franklin Small Cap Growth strategy, and also assists with the management of the Franklin Small-Mid Cap Growth strategy, which he has helped manage since its inception in 1992. Mr. McCarthy is a Chartered Financial Analyst (CFA) charter holder and earned his B.A. in history from the University of California, Los Angeles. He is a member of the Security Analysts of San Francisco (SASF) and the CFA Institute |

|

| John P. Scandalios (2016-09-01) |

|

| John P. Scandalios is a vice president, research analyst and portfolio manager with Franklin Equity Group. He is the co-manager of the Franklin Technology Fund, Franklin Small-Mid Cap Growth Fund and is a member of the Technology/Communications Research Team. Mr. Scandalios specializes in research analysis of the semiconductor industry.

Mr. Scandalios joined Franklin Templeton Investments(FTI) as an analyst in 1996. Prior to FTI, he completed the management-training program at Chase Manhattan in New York, and was an assistant portfolio manager for Chase Private Bank in Los Angeles. |

|

|

|

|

|

|

| Franklin Templeton Investments |

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|