| Royce Capital Micro-Cap Inv |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 568

Small Blend Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 136.77 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks long-term growth of capital.

|

|

| Normally, the fund invests at least 80% of its net assets in equity securities of micro-cap companies. Although the fund normally focuses on securities of U.S. companies, it may invest up to 25% of its net assets (measured at the time of investment) in securities of companies headquartered in foreign countries. It may invest in other investment companies that invest primarily in equity securities. |

|

|

| Morningstar Category: Small Blend |

|

| Small-blend portfolios favor U.S. firms at the smaller end of the market-capitalization range. Some aim to own an array of value and growth stocks while others employ a discipline that leads to holdings with valuations and growth rates close to the small-cap averages. Stocks in the bottom 10% of the capitalization of the U.S. equity market are defined as small cap. The blend style is assigned to portfolios where neither growth nor value characteristics predominate.

|

|

|

| Small Cap Funds: Smaller companies typically have higher risk of failure, and are not as well established as larger blue-chip companies. Historically, the smaller company stocks have experienced a greater degree of market volatility than the overall market average. |

|

|

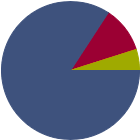

| % of Net Assets |

|

U.S. Stocks |

84.2 |

|

Non-U.S. Stocks |

10.9 |

|

Bonds |

0.0 |

|

Cash |

4.9 |

|

Other |

0.0 |

|

|

|

| Data through 2025-09-30 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

32.11 |

|

Basic Materials |

4.90 |

|

Consumer Cyclical |

10.88 |

|

Financial Services |

15.57 |

|

Real Estate |

0.76 |

|

|

|

|

Sensitive |

54.63 |

|

Communication Services |

2.61 |

|

Energy |

4.56 |

|

Industrials |

23.39 |

|

Technology |

24.07 |

|

|

|

|

Defensive |

13.25 |

|

Consumer Defensive |

3.67 |

|

Healthcare |

9.58 |

|

Utilities |

0.00 |

|

| Data through 2025-09-30 |

|

|

| Total Number of Stock Holdings |

151 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

10.76 |

|

|

| Turnover % |

(as of 2024-12-31) |

19.00 |

| 30 Day SEC Yield % |

--- |

|

|

Sector |

P/E |

% of Net

Assets

|

|

|

|

|

|

|

LightPath Technologies Inc Class A |

|

--- |

1.13 |

|

NPK International Inc |

|

28.00 |

1.11 |

|

Investar Holding Corp |

|

10.76 |

1.09 |

|

Astronics Corp |

|

--- |

1.08 |

|

CECO Environmental Corp |

|

33.58 |

1.08 |

|

|

Natural Gas Services Group Inc |

|

19.63 |

1.07 |

|

nLight Inc |

|

--- |

1.06 |

|

Sprott Inc |

|

--- |

1.06 |

|

Graham Corp |

|

49.37 |

1.05 |

|

Montrose Environmental Group Inc Ordinary Shares |

|

--- |

1.03 |

|

|

|

|

|

|

|

|

| Foreign Securities, Loss of Money, Not FDIC Insured, Equity Securities, Industry and Sector Investing, Other, Management, Small Cap |

|

| Show Risk Definitions |

|

|

| Inception Date: 1996-12-27 |

|

| James P. Stoeffel (2015-05-01) |

|

| James Stoeffel joined Royce in 2009 as a Portfolio Manager. Previously he was a Portfolio Manager for a long/short equity private investment vehicle which he co-founded with Messrs. Brown and Hartman (2008-2009), a Portfolio Manager and Investment Policy Committee member at CRM (2001-2008), Director of Research at Palisade Capital Management (1999-2001), Research Analyst and Vice President in Smith Barney's Emerging Growth Stock Research Group (1993-1999) and an Auditor for a number of companies in the financial services industry (1984-1992). |

|

| Andrew S. Palen (2024-09-30) |

|

| Andrew S. Palen

Portfolio Manager

Employed by Royce since 2015

Assistant Portfolio Manager for:

Royce Pennsylvania Mutual Fund

Previously a Senior Analyst at Armistice Capital (2013-2015), a Summer Associate at UBS Global Management (2012), and an Associate at Comvest Partners (2008-2011). |

|

|

|

|

|

|

| Royce Investment Partners |

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|