| Vanguard VIF Diversified Val |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 1086

Large Value Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 1,384.25 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks to provide long-term capital appreciation and income.

|

|

| The Portfolio invests mainly in large- and mid-capitalization companies whose stocks are considered by the advisor to be undervalued. Undervalued stocks are generally those that are out of favor with investors and that the advisor believes are trading at prices that are below average in relation to measures such as earnings and book value. These stocks often have above-average dividend yields. |

|

|

| Morningstar Category: Large Value |

|

| Large-value portfolios invest primarily in big U.S. companies that are less expensive or growing more slowly than other large-cap stocks. Stocks in the top 70% of the capitalization of the U.S. equity market are defined as large cap. Value is defined based on low valuations (low price ratios and high dividend yields) and slow growth (low growth rates for earnings, sales, book value, and cash flow).

|

|

|

| There are no additional fund specific investment risks (e.g. liquidity risk, currency risk, foreign investment risk, etc.) associated with this fund beyond the normal risks generally associated with investing in a mutual fund. |

|

|

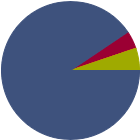

| % of Net Assets |

|

U.S. Stocks |

90.5 |

|

Non-U.S. Stocks |

4.2 |

|

Bonds |

0.0 |

|

Cash |

5.2 |

|

Other |

0.0 |

|

|

|

| Data through 2025-06-30 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

31.19 |

|

Basic Materials |

1.57 |

|

Consumer Cyclical |

9.22 |

|

Financial Services |

19.58 |

|

Real Estate |

0.82 |

|

|

|

|

Sensitive |

48.86 |

|

Communication Services |

6.33 |

|

Energy |

6.40 |

|

Industrials |

12.42 |

|

Technology |

23.71 |

|

|

|

|

Defensive |

19.95 |

|

Consumer Defensive |

4.92 |

|

Healthcare |

13.54 |

|

Utilities |

1.49 |

|

| Data through 2025-06-30 |

|

|

| Total Number of Stock Holdings |

121 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

27.24 |

|

|

| Turnover % |

(as of 2024-12-31) |

35.00 |

| 30 Day SEC Yield % |

1.45 |

|

|

Sector |

P/E |

% of Net

Assets

|

|

|

|

|

|

|

Microsoft Corp |

|

38.39 |

5.27 |

|

Apple Inc |

|

39.88 |

3.74 |

|

Amazon.com Inc |

|

34.18 |

3.59 |

|

Alphabet Inc Class A |

|

27.71 |

3.22 |

|

Bank of America Corp |

|

14.36 |

2.06 |

|

|

Intercontinental Exchange Inc |

|

30.26 |

2.01 |

|

F5 Inc |

|

26.31 |

1.93 |

|

Broadcom Inc |

|

91.04 |

1.87 |

|

Visa Inc Class A |

|

33.92 |

1.80 |

|

Workday Inc Class A |

|

112.91 |

1.75 |

|

|

|

|

|

|

|

|

| Loss of Money, Not FDIC Insured, Market/Market Volatility, Equity Securities, Management |

|

| Show Risk Definitions |

|

|

| Inception Date: 1999-02-08 |

|

| Scott McBride (2019-12-16) |

|

| Scott McBride serves as CEO and portfolio manager on the Large Cap Fundamental Value, Large Cap Disciplined Value, Global Value and Focused Global Value portfolios. He covers technology companies and is a member of the consumer, technology, healthcare and financial sector teams.

Prior to joining the firm, Mr. McBride was an associate consultant with Deloitte Consulting and worked as an investment marketing analyst with Fidelity Investments. Mr. McBride, a CFA® charterholder, received his BA in Economics from Georgetown University and MBA from Columbia University. |

|

| Ross Seiden (2022-02-25) |

|

| Ross Seiden is a Director and Portfolio Manager/Analyst on various US equity strategies. He is also responsible for research coverage of companies in the healthcare sector. Ross began working in the investment field in 2006. Prior to joining Lazard in 2010, he was an Equity Research Associate covering the financials sector at Credit Suisse. Ross has a BBA in Finance and Accounting from the Ross School of Business at the University of Michigan. |

|

| George H. Davis (2019-12-16) |

|

| George Davis serves as Executive Chairman and portfolio manager on the Large Cap Fundamental Value and Large Cap Disciplined Value portfolios. He is a member of the capital goods and financials sector teams.

Prior to joining the firm, Mr. Davis was an assistant to the senior partner of RCM Capital Management. He began his career in equity research with internships at Cramer, Rosenthal & McGlynn and Fidelity Management & Research. Mr. Davis received his BA in Economics and History and MBA from Stanford University. |

|

| Andrew Lacey (2019-12-16) |

|

| Andrew Lacey is a Managing Director and a Portfolio Manager/Analyst on various US equity strategies as well as Global Equity Select. He began working in the investment field upon joining the firm in 1995 as a Research Analyst covering the technology sector. Andrew has an MBA from Columbia University and a BA (Hons) from the College of Social Studies, Wesleyan University. Prior to joining Lazard, Andrew was a teacher at the Pingry School and Buckingham Browne & Nichols for five years. He continues to be involved in education as a board member for KIPP New Jersey and Link Education Partners. |

|

|

|

| Lazard Asset Management LLC |

| Hotchkis & Wiley Capital Management LLC |

|

|

|

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|