|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 512

Small Growth Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 1,480.08 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks to provide long-term capital appreciation.

|

|

| Under normal circumstances the Portfolio invests at least 80% of its assets primarily in common stocks of small companies. These companies tend to be unseasoned but are considered by the Portfolio's advisors to have superior growth potential. Also, these companies often provide little or no dividend income. It uses multiple investment advisors. |

|

|

| Morningstar Category: Small Growth |

|

| Small-growth portfolios focus on faster-growing companies whose shares are at the lower end of the market-capitalization range. These portfolios tend to favor companies in up-and-coming industries or young firms in their early growth stages. Because these businesses are fast-growing and often richly valued, their stocks tend to be volatile. Stocks in the bottom 10% of the capitalization of the U.S. equity market are defined as small cap. Growth is defined based on fast growth (high growth rates for earnings, sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields).

|

|

|

| Small Cap Funds: Smaller companies typically have higher risk of failure, and are not as well established as larger blue-chip companies. Historically, the smaller company stocks have experienced a greater degree of market volatility than the overall market average. |

|

|

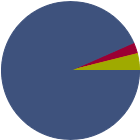

| % of Net Assets |

|

U.S. Stocks |

93.4 |

|

Non-U.S. Stocks |

2.7 |

|

Bonds |

0.0 |

|

Cash |

3.9 |

|

Other |

0.0 |

|

|

|

| Data through 2025-06-30 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

21.89 |

|

Basic Materials |

1.04 |

|

Consumer Cyclical |

13.71 |

|

Financial Services |

6.09 |

|

Real Estate |

1.05 |

|

|

|

|

Sensitive |

49.93 |

|

Communication Services |

3.47 |

|

Energy |

1.96 |

|

Industrials |

17.95 |

|

Technology |

26.55 |

|

|

|

|

Defensive |

28.19 |

|

Consumer Defensive |

3.07 |

|

Healthcare |

24.83 |

|

Utilities |

0.29 |

|

| Data through 2025-06-30 |

|

|

| Total Number of Stock Holdings |

519 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

12.21 |

|

|

| Turnover % |

(as of 2024-12-31) |

51.00 |

| 30 Day SEC Yield % |

0.28 |

|

|

Sector |

P/E |

% of Net

Assets

|

|

|

|

|

|

|

Trimble Inc |

|

66.72 |

1.39 |

|

RB Global Inc |

|

--- |

1.39 |

|

CarGurus Inc Class A |

|

27.94 |

1.37 |

|

Dynatrace Inc Ordinary Shares |

|

29.72 |

1.33 |

|

Doximity Inc Class A |

|

57.75 |

1.29 |

|

|

Churchill Downs Inc |

|

15.64 |

1.25 |

|

Federal Signal Corp |

|

33.65 |

1.12 |

|

Euronet Worldwide Inc |

|

11.98 |

1.06 |

|

Sprout Social Inc Class A |

|

--- |

1.01 |

|

Alight Inc Class A |

|

--- |

1.00 |

|

|

|

|

|

|

|

|

| Loss of Money, Not FDIC Insured, Market/Market Volatility, Equity Securities, Management |

|

| Show Risk Definitions |

|

|

| Inception Date: 1996-06-03 |

|

| Chad Meade (2016-01-25) |

|

| Chad is a Partner and Portfolio Manager at Arrowpoint Partners and has 14 years of experience in the financial industry. He previously served as the Co-Portfolio Manager and Executive Vice President of the Janus Triton Fund (2006-2013) and the Janus Venture Fund (2010-2013). While an equity research analyst at Janus Capital (2001-2011), he focused on small and mid capitalization stocks in the healthcare and industrials sectors. Prior to joining Janus Capital, he was a financial analyst for Goldman Sachs’ global investment research team. Chad graduated summa cum laude from Virginia Tech with a |

|

| Brian Schaub (2016-01-25) |

|

| Brian is a Partner and Portfolio Manager at Arrowpoint Partners and has 13 years of experience in the financial industry. He previously served as the Co-Portfolio Manager and Executive Vice President of the Janus Triton Fund (2006-2013) and the Janus Venture Fund (2010-2013). During his time as an equity research analyst at Janus Capital (2000-2011), he focused on small and mid capitalization stocks in the communications sector. Brian graduated cum laude from Williams College with a bachelor’s degree in Economics and won the Arthur B. Graves, Class of 1858, Essay Prize in Economics for his wor |

|

| Cesar Orosco (2021-02-26) |

|

| CFA, Ph.D., Senior Portfolio Manager at Vanguard. He has been with Vanguard since April 2020, has worked in investment management since 2004, has managed investment portfolios since 2004, and has co-managed a portion of the Fund since February 2021. Education: B.S., Universidad de Lima; Ph.D., University of Pennsylvania. |

|

|

|

| ArrowMark Colorado Holdings, LLC (ArrowMark Partners) |

|

|

|

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|