|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 308

Global Large-Stock Blend Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 373.66 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks long-term capital growth.

|

|

| The fund invests primarily in the equity securities of companies located anywhere in the world, including developing markets. The equity securities in which the fund primarily invests are common stock. Although the fund seeks investments across a number of countries and sectors, from time to time, based on economic conditions, it may have substantial positions in particular countries or sectors. |

|

|

| Morningstar Category: Global Large-Stock Blend |

|

| Global large-stock blend portfolios invest in a variety of international stocks and typically skew towards large caps that are fairly representative of the global stock market in size, growth rates, and price. World large stock blend portfolios have few geographical limitations. It is common for these portfolios to invest the majority of their assets in developed markets, with the remainder divided among the globe’s emerging markets. These portfolios are not significantly overweight U.S. equity exposure relative to the Morningstar Global Market Index and maintain at least a 20% absolute U.S. exposure.

|

|

|

| There are no additional fund specific investment risks (e.g. liquidity risk, currency risk, foreign investment risk, etc.) associated with this fund beyond the normal risks generally associated with investing in a mutual fund. |

|

|

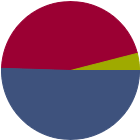

| % of Net Assets |

|

U.S. Stocks |

50.5 |

|

Non-U.S. Stocks |

45.5 |

|

Bonds |

0.0 |

|

Cash |

4.0 |

|

Other |

0.0 |

|

|

|

| Data through 2025-09-30 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

28.64 |

|

Basic Materials |

2.86 |

|

Consumer Cyclical |

11.14 |

|

Financial Services |

14.64 |

|

Real Estate |

0.00 |

|

|

|

|

Sensitive |

57.94 |

|

Communication Services |

10.57 |

|

Energy |

1.55 |

|

Industrials |

21.61 |

|

Technology |

24.21 |

|

|

|

|

Defensive |

13.42 |

|

Consumer Defensive |

1.46 |

|

Healthcare |

10.89 |

|

Utilities |

1.07 |

|

| Data through 2025-09-30 |

|

|

|

| Morningstar World Regions |

|

| % Fund |

| Americas |

54.9 |

|

| North America |

54.9 |

| Latin America |

0.0 |

|

| Greater Europe |

30.2 |

|

| United Kingdom |

9.9 |

| Europe Developed |

20.3 |

| Europe Emerging |

0.0 |

| Africa/Middle East |

0.0 |

|

| Greater Asia |

15.0 |

|

| Japan |

5.5 |

| Australasia |

0.0 |

| Asia Developed |

5.5 |

| Asia Emerging |

3.9 |

|

| Data through 2025-09-30 |

|

|

| Total Number of Stock Holdings |

63 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

31.27 |

|

|

| Turnover % |

(as of 2023-12-31) |

29.48 |

| 30 Day SEC Yield % |

0.93 |

|

|

Sector |

Country |

% of Net

Assets

|

|

|

|

|

|

|

NVIDIA Corp |

|

United States |

5.41 |

|

Microsoft Corp |

|

United States |

4.07 |

|

Amazon.com Inc |

|

United States |

3.80 |

|

Taiwan Semiconductor Manufacturing Co Ltd ADR |

|

Taiwan |

3.68 |

|

Alphabet Inc Class A |

|

United States |

3.28 |

|

|

Apple Inc |

|

United States |

2.35 |

|

Rolls-Royce Holdings PLC |

|

United Kingdom |

2.29 |

|

Airbus SE |

|

Netherlands |

2.24 |

|

Wells Fargo & Co |

|

United States |

2.12 |

|

Safran SA |

|

France |

2.03 |

|

|

|

|

|

|

|

|

| Emerging Markets, Foreign Securities, Loss of Money, Not FDIC Insured, Country or Region, Value Investing, Active Management, Market/Market Volatility, Other, Restricted/Illiquid Securities, Derivatives, Portfolio Diversification, Small Cap, Mid-Cap |

|

| Show Risk Definitions |

|

|

| Inception Date: 1994-03-15 |

|

| Christopher James Peel (2017-05-01) |

|

| Christopher Peel is chief executive officer of Templeton Global Advisors and a portfolio manager and research analyst for the Templeton Global Equity Group. Mr. Peel is lead portfolio manager for

Templeton Foreign Fund and several other funds with similar mandates, in addition to being a

manager for Templeton World Fund and Templeton Growth Fund Inc. |

|

| Warren Pustam (2019-07-24) |

|

| Warren Pustam is a senior vice president, portfolio manager and research analyst for the Templeton Global Equity Group. Mr. Pustam is the lead portfolio manager for Templeton World Fund, a manager on Templeton Growth Fund Inc.,and in additionserves as backup manager for Templeton Foreign Fund, Templeton Global Trust Fund, Templeton Global Fund, and Templeton Global Leaders Fund. He has global research responsibilities for information technology hardware &

equipment, software and services. |

|

| Peter David Sartori (2024-03-31) |

|

| Peter Sartori is Director of Portfolio Management for the Templeton Global Equity Group. Peter

overseas the groups portfolio managers as well as being lead portfolio manager on several of the

group’s funds.

Peter started his career at First State Investments in Melbourne Australia in 1991 and opened their

Hong Kong office in 1997. From 2001 he held senior roles at Scudder Investments in Singapore and Credit Suisse Asset Management in Sydney. |

|

|

|

| Templeton Global Advisors Limited |

|

|

| Franklin Templeton Investments |

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|