| Fidelity VIP Financials Initial |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 98

Financial Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 330.42 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks capital appreciation.

|

|

| The fund primarily invests in common stocks. It normally invests at least 80% of assets in securities of companies principally engaged in providing financial services to consumers and industry. The fund invests in domestic and foreign issuers. It uses fundamental analysis of factors such as each issuer's financial condition and industry position, as well as market and economic conditions, to select investments. The fund is non-diversified. |

|

|

| Morningstar Category: Financial |

|

| Financial portfolios seek capital appreciation by investing primarily in equity securities of U.S. or non-U.S. financial-services companies, including banks, brokerage firms, insurance companies, and consumer credit providers.

|

|

|

| Sector Funds: Funds that invest exclusively in one sector or industry involve risks due to the lack of industry diversification and expose the investor to increased industry-specific risks. |

| Non-Diversified Funds: Funds that invest more of their assets in a single issuer involve additional risks, including share price fluctuations, because of the increased concentration of investments. |

|

|

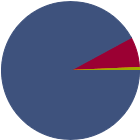

| % of Net Assets |

|

U.S. Stocks |

92.1 |

|

Non-U.S. Stocks |

7.2 |

|

Bonds |

0.0 |

|

Cash |

0.7 |

|

Other |

0.0 |

|

|

|

| Data through 2025-08-31 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

97.31 |

|

Basic Materials |

0.00 |

|

Consumer Cyclical |

0.00 |

|

Financial Services |

97.31 |

|

Real Estate |

0.00 |

|

|

|

|

Sensitive |

2.69 |

|

Communication Services |

0.00 |

|

Energy |

0.00 |

|

Industrials |

0.00 |

|

Technology |

2.69 |

|

|

|

|

Defensive |

0.00 |

|

Consumer Defensive |

0.00 |

|

Healthcare |

0.00 |

|

Utilities |

0.00 |

|

| Data through 2025-08-31 |

|

|

| Total Number of Stock Holdings |

64 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

42.39 |

|

|

| Turnover % |

(as of 2024-12-31) |

37.00 |

| 30 Day SEC Yield % |

--- |

|

|

Sector |

P/E |

% of Net

Assets

|

|

|

|

|

|

|

Mastercard Inc Class A |

|

37.08 |

10.22 |

|

Wells Fargo & Co |

|

13.84 |

6.35 |

|

Bank of America Corp |

|

13.78 |

5.77 |

|

Citigroup Inc |

|

13.52 |

3.52 |

|

Reinsurance Group of America Inc |

|

16.35 |

3.46 |

|

|

Charles Schwab Corp |

|

21.88 |

3.21 |

|

Chubb Ltd |

|

--- |

2.59 |

|

State Street Corp |

|

12.68 |

2.59 |

|

Morgan Stanley |

|

16.41 |

2.45 |

|

Capital One Financial Corp |

|

564.31 |

2.23 |

|

|

|

|

|

|

|

|

| Foreign Securities, Loss of Money, Not FDIC Insured, Issuer, Market/Market Volatility, Equity Securities, Financials Sector |

|

| Show Risk Definitions |

|

|

| Inception Date: 2001-07-18 |

|

| Matt Reed (2019-06-01) |

|

| Since joining Fidelity Investments in 2008, Mr. Reed has worked as a research analyst and portfolio manager. |

|

|

|

| Fidelity Management & Research Company LLC |

|

|

|

|

|

| FMR Investment Management (U.K.) Limited |

| Fidelity Management & Research (Japan) Limited |

| Fidelity Management & Research (HK) Ltd |

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|