| Invesco VI American Franchise II |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 1024

Large Growth Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 948.71 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks capital growth.

|

|

| The fund invests, under normal circumstances, at least 80% of its net assets (plus any borrowings for investment purposes) in securities of U.S. issuers. It invests primarily in equity securities of mid- and large-capitalization issuers and in derivatives and other instruments that have economic characteristics similar to such securities. The principal type of equity security in which the fund invests is common stock. It may invest up to 20% of its net assets in securities of foreign issuers. The fund is non-diversified. |

|

|

| Morningstar Category: Large Growth |

|

| Large-growth portfolios invest primarily in big U.S. companies that are projected to grow faster than other large-cap stocks. Stocks in the top 70% of the capitalization of the U.S. equity market are defined as large cap. Growth is defined based on fast growth (high growth rates for earnings, sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields). Most of these portfolios focus on companies in rapidly expanding industries.

|

|

|

| Non-Diversified Funds: Funds that invest more of their assets in a single issuer involve additional risks, including share price fluctuations, because of the increased concentration of investments. |

|

|

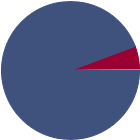

| % of Net Assets |

|

U.S. Stocks |

94.3 |

|

Non-U.S. Stocks |

5.5 |

|

Bonds |

0.0 |

|

Cash |

0.2 |

|

Other |

0.0 |

|

|

|

| Data through 2025-08-31 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

23.79 |

|

Basic Materials |

0.30 |

|

Consumer Cyclical |

14.42 |

|

Financial Services |

8.37 |

|

Real Estate |

0.70 |

|

|

|

|

Sensitive |

69.52 |

|

Communication Services |

17.66 |

|

Energy |

0.73 |

|

Industrials |

8.29 |

|

Technology |

42.84 |

|

|

|

|

Defensive |

6.68 |

|

Consumer Defensive |

1.66 |

|

Healthcare |

4.01 |

|

Utilities |

1.01 |

|

| Data through 2025-08-31 |

|

|

| Total Number of Stock Holdings |

56 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

53.46 |

|

|

| Turnover % |

(as of 2024-12-31) |

52.00 |

| 30 Day SEC Yield % |

--- |

|

|

Sector |

P/E |

% of Net

Assets

|

|

|

|

|

|

|

NVIDIA Corp |

|

57.11 |

12.09 |

|

Microsoft Corp |

|

39.74 |

9.15 |

|

Meta Platforms Inc Class A |

|

27.26 |

6.43 |

|

Amazon.com Inc |

|

34.95 |

6.35 |

|

Broadcom Inc |

|

95.88 |

4.40 |

|

|

Apple Inc |

|

40.82 |

3.81 |

|

Alphabet Inc Class A |

|

28.51 |

3.54 |

|

Netflix Inc |

|

46.05 |

2.87 |

|

Visa Inc Class A |

|

34.01 |

2.42 |

|

Arista Networks Inc |

|

61.48 |

2.40 |

|

|

|

|

|

|

|

|

| Emerging Markets, Foreign Securities, Loss of Money, Not FDIC Insured, Growth Investing, Nondiversification, Active Management, Market/Market Volatility, Equity Securities, Industry and Sector Investing, Mid-Cap |

|

| Show Risk Definitions |

|

|

| Inception Date: 2000-09-18 |

|

| Ronald J. Zibelli (2022-11-28) |

|

| Mr. Zibelli has been a Senior Vice President of OppenheimerFunds, Inc since January 2014 and a Senior Portfolio Manager since May 2006. He was a Vice President of OppenheimerFunds from May 2006 to January 2014. Prior to joining OppenheimerFunds, he spent six years at Merrill Lynch Investment Managers, during which time he was a Managing Director and Small Cap Growth Team Leader. Prior to joining Merrill Lynch Investment Managers, Mr. Zibelli spent 12 years with Chase Manhattan Bank, including two years as Senior Portfolio Manager at Chase Asset Management. |

|

| Ido Cohen (2010-06-28) |

|

| Ido Cohen is a portfolio manger for Invesco large-cap growth equity strategies and is lead manager for Invesco leisure products. He has been associated with Invesco and/or its affiliates since 2010. Prior to joining Invesco, he was a vice president at J&W Seligman Investments from 2007 to 2010, where he worked as a senior analyst focusing on information technology, media and telecommunications equities. Mr. Cohen began his investment career in 1997 as a high yield research analyst with

Banker’s Trust focusing on the telecommunications industry. In 1999 he joined Credit Suisse’s U.S. equities telecommunications research team; he went on to become a senior analyst and co-head of the team in 2004. In 2006, Mr. Cohen joined a technology, media and telecommunications focused investment team at Diamondback Capital, and then in 2007 he joined J&W Seligman’s growth team.

Mr. Cohen is a cum laude graduate of The Wharton School of the University of

Pennsylvania with a Bachelor of Science degree in economics. |

|

|

|

|

|

|

|

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|