| T. Rowe Price Equity Income Port |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 1086

Large Value Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 810.33 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks a high level of dividend income and long-term capital growth primarily through investments in stocks.

|

|

| The fund normally invests at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities with a track record of paying dividends. The adviser believes that income can be a significant contributor to total return over time and expects the fund’s yield to be above that of the Russell 1000® Value Index. |

|

|

| Morningstar Category: Large Value |

|

| Large-value portfolios invest primarily in big U.S. companies that are less expensive or growing more slowly than other large-cap stocks. Stocks in the top 70% of the capitalization of the U.S. equity market are defined as large cap. Value is defined based on low valuations (low price ratios and high dividend yields) and slow growth (low growth rates for earnings, sales, book value, and cash flow).

|

|

|

| There are no additional fund specific investment risks (e.g. liquidity risk, currency risk, foreign investment risk, etc.) associated with this fund beyond the normal risks generally associated with investing in a mutual fund. |

|

|

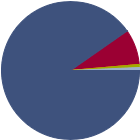

| % of Net Assets |

|

U.S. Stocks |

90.3 |

|

Non-U.S. Stocks |

8.3 |

|

Bonds |

0.0 |

|

Cash |

0.7 |

|

Other |

0.7 |

|

|

|

| Data through 2025-08-31 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

34.08 |

|

Basic Materials |

1.56 |

|

Consumer Cyclical |

6.48 |

|

Financial Services |

22.18 |

|

Real Estate |

3.86 |

|

|

|

|

Sensitive |

38.19 |

|

Communication Services |

6.14 |

|

Energy |

9.07 |

|

Industrials |

12.88 |

|

Technology |

10.10 |

|

|

|

|

Defensive |

27.74 |

|

Consumer Defensive |

8.61 |

|

Healthcare |

13.26 |

|

Utilities |

5.87 |

|

| Data through 2025-08-31 |

|

|

| Total Number of Stock Holdings |

119 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

18.68 |

|

|

| Turnover % |

(as of 2024-12-31) |

21.30 |

| 30 Day SEC Yield % |

0.00 |

|

|

Sector |

P/E |

% of Net

Assets

|

|

|

|

|

|

|

MetLife Inc |

|

14.05 |

2.10 |

|

Southern Co |

|

25.76 |

1.98 |

|

Citigroup Inc |

|

14.02 |

1.97 |

|

Qualcomm Inc |

|

15.58 |

1.97 |

|

Charles Schwab Corp |

|

25.10 |

1.91 |

|

|

JPMorgan Chase & Co |

|

14.96 |

1.84 |

|

Wells Fargo & Co |

|

13.93 |

1.79 |

|

L3Harris Technologies Inc |

|

33.52 |

1.74 |

|

Kimberly-Clark Corp |

|

17.78 |

1.69 |

|

Amazon.com Inc |

|

32.99 |

1.69 |

|

|

|

|

|

|

|

|

| Foreign Securities, Loss of Money, Not FDIC Insured, Value Investing, Active Management, Market/Market Volatility, Equity Securities, Industry and Sector Investing, Other, Large Cap |

|

| Show Risk Definitions |

|

|

| Inception Date: 1994-03-31 |

|

| John D. Linehan (2015-11-01) |

|

| John Linehan is the portfolio manager for the Equity Income Strategy and co-portfolio manager of the US Large-Cap Value Strategy for T. Rowe Price. In addition, he is the chief investment officer of Equity and a member of the firm's US Equity Steering, Equity Brokerage and Trading Control, and Counterparty Risk Committees.

Mr. Linehan is Chairman of the Investment Advisory Committee at T. Rowe. He is a large-cap value portfolio manager in the U.S. Equity Division and also co-chair of the Investment Advisory Committee for the Institutional Large-Cap Value Strategy. From February 2010 to June 2014, Mr. Linehan was head of U.S. Equity and chairman of the U.S. Equity Steering Committee. He is a member of the firm's U.S. Equity Steering, Equity Brokerage and Trading Control, and Counterparty Risk Committees. He earned a B.A. from Amherst College and an M.B.A. from Stanford University, where he was the Henry Ford II Scholar, an Arjay Miller Scholar, and the winner of the Alexander A. Robichek Award in finance. Mr. Linehan is a CFA® charterholder. |

|

|

|

| T. Rowe Price Associates, Inc. |

|

|

|

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|