| Vanguard VIF High Yield Bond |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 586

High Yield Bond Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 803.39 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks to provide a high level of current income.

|

|

| The fund invests primarily in a diversified group of high-yielding, higher-risk corporate bonds-commonly known as "junk bonds"-with medium- and lower-range credit-quality ratings. It invests at least 80% of its assets in corporate bonds that are rated below Baa. The fund may not invest more than 20% of its assets in any of the following, in the aggregate: bonds with credit ratings lower than B or the equivalent, convertible securities, preferred stocks, and fixed and floating rate loans of medium- to lower-range credit quality. |

|

|

| Morningstar Category: High Yield Bond |

|

| High-yield bond portfolios concentrate on lower-quality bonds, which are riskier than those of higher-quality companies. These portfolios generally offer higher yields than other types of portfolios, but they are also more vulnerable to economic and credit risk. These portfolios primarily invest in U.S. high-income debt securities where at least 65% or more of bond assets are not rated or are rated by a major agency such as Standard & Poor's or Moody's at the level of BB (considered speculative for taxable bonds) and below.

|

|

|

| High-Yield Bond Funds: Funds that invest in lower-rated debt securities (commonly referred to as junk bonds) involve additional risk because of the lower credit quality of the securities in the portfolio. There are risks associated with the possibility of a higher level of volatility and increased risk of default. |

|

|

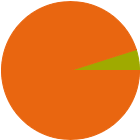

| % of Net Assets |

|

U.S. Stocks |

0.0 |

|

Non-U.S. Stocks |

0.0 |

|

Bonds |

95.1 |

|

Cash |

4.9 |

|

Other |

0.0 |

|

|

|

| Data through 2025-09-30 |

|

|

|

|

| Morningstar Fixed-Income Sectors |

|

| % Fund |

|

Government |

5.64 |

|

Corporate |

89.42 |

|

Securitized |

0.00 |

|

Municipal |

0.00 |

|

Cash & Equivalents |

4.94 |

|

Derivative |

0.00 |

|

|

|

% Bonds |

| AAA |

5.32 |

| AA |

3.44 |

| A |

0.00 |

| BBB |

2.65 |

| BB |

47.72 |

| B |

34.76 |

| Below B |

4.77 |

| Not Rated |

1.34 |

|

|

|

|

|

| Total Number of Stock Holdings |

0 |

| Total Number of Bond Holdings |

980 |

| % of Net Assets in Top 10 Holdings |

5.02 |

|

|

| Turnover % |

(as of 2024-12-31) |

50.00 |

| 30 Day SEC Yield % |

5.55 |

|

|

Maturity

Date

|

Shares

|

Value

$000

|

% of Net

Assets

|

|

|

|

|

|

|

|

Ingram Micro Inc. |

--- |

5,610 |

5,460 |

0.68 |

|

United States Treasury Notes |

--- |

5,350 |

5,266 |

0.66 |

|

United States Treasury Notes |

--- |

5,075 |

5,004 |

0.62 |

|

1011778 B.C. Unlimited Liability Company / New Red Finance, Inc. |

--- |

3,990 |

3,761 |

0.47 |

|

1261229 Bc Ltd. |

--- |

3,540 |

3,635 |

0.45 |

|

|

CCO Holdings, LLC/ CCO Holdings Capital Corp. |

--- |

3,835 |

3,533 |

0.44 |

|

Medline Borrower LP |

--- |

3,565 |

3,440 |

0.43 |

|

United States Treasury Notes |

--- |

3,413 |

3,430 |

0.43 |

|

Energizer Holdings Inc |

--- |

3,430 |

3,366 |

0.42 |

|

Froneri Lux Finco S.a r.l. |

--- |

3,340 |

3,342 |

0.42 |

|

|

|

|

|

|

|

|

| Credit and Counterparty, Extension, Prepayment (Call), Loss of Money, Not FDIC Insured, Income, Interest Rate, Market/Market Volatility, High-Yield Securities, Restricted/Illiquid Securities, Management |

|

| Show Risk Definitions |

|

|

| Inception Date: 1996-06-03 |

|

| Michael Chang (2022-08-29) |

|

| Michael Chang, CFA, Portfolio Manager at Vanguard. He has been with Vanguard since 2017, has worked in investment management since 2002, has managed investment portfolios since 2011, and has co-managed the Fund since its inception in 2021. Education: B. Com., University of British Columbia |

|

| Elizabeth H. Shortsleeve (2022-08-29) |

|

| Elizabeth H. Shortsleeve, Senior Managing Director, Partner, and Fixed Income Portfolio Manager of Wellington Management. She has worked in investment management since 2007, and has co-managed the Portfolio since 2022. Education: B.A., Georgetown University; M.B.A., Dartmouth College. |

|

|

|

| Wellington Management Company LLP |

| The Vanguard Group Inc |

|

|

|

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|