| LVIP American Century Value Std II |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 1086

Large Value Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 912.53 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks long-term capital growth; income is a secondary consideration.

|

|

| In selecting stocks for the fund, the portfolio managers look for companies of all sizes whose stock price may not reflect the company's value. The managers attempt to purchase the stocks of these undervalued companies and hold each stock until the price has increased to, or is higher than, a level the managers believe more accurately reflects the fair value of the company. |

|

|

| Morningstar Category: Large Value |

|

| Large-value portfolios invest primarily in big U.S. companies that are less expensive or growing more slowly than other large-cap stocks. Stocks in the top 70% of the capitalization of the U.S. equity market are defined as large cap. Value is defined based on low valuations (low price ratios and high dividend yields) and slow growth (low growth rates for earnings, sales, book value, and cash flow).

|

|

|

| There are no additional fund specific investment risks (e.g. liquidity risk, currency risk, foreign investment risk, etc.) associated with this fund beyond the normal risks generally associated with investing in a mutual fund. |

|

|

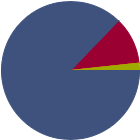

| % of Net Assets |

|

U.S. Stocks |

87.2 |

|

Non-U.S. Stocks |

11.1 |

|

Bonds |

0.0 |

|

Cash |

1.7 |

|

Other |

0.0 |

|

|

|

| Data through 2025-06-30 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

30.37 |

|

Basic Materials |

2.01 |

|

Consumer Cyclical |

2.99 |

|

Financial Services |

21.80 |

|

Real Estate |

3.57 |

|

|

|

|

Sensitive |

32.77 |

|

Communication Services |

5.93 |

|

Energy |

7.47 |

|

Industrials |

12.84 |

|

Technology |

6.53 |

|

|

|

|

Defensive |

36.87 |

|

Consumer Defensive |

11.84 |

|

Healthcare |

19.00 |

|

Utilities |

6.03 |

|

| Data through 2025-06-30 |

|

|

| Total Number of Stock Holdings |

97 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

23.62 |

|

|

| Turnover % |

(as of 2024-12-31) |

37.00 |

| 30 Day SEC Yield % |

2.23 |

|

|

Sector |

P/E |

% of Net

Assets

|

|

|

|

|

|

|

Berkshire Hathaway Inc Class A |

|

16.82 |

3.41 |

|

Johnson & Johnson |

|

18.60 |

3.06 |

|

JPMorgan Chase & Co |

|

14.59 |

2.96 |

|

Exxon Mobil Corp |

|

16.47 |

2.43 |

|

U.S. Bancorp |

|

10.94 |

2.27 |

|

|

Cisco Systems Inc |

|

27.56 |

2.25 |

|

Medtronic PLC |

|

25.95 |

1.91 |

|

Bank of America Corp |

|

14.14 |

1.90 |

|

Verizon Communications Inc |

|

8.93 |

1.74 |

|

State Street Institutional U.S. Government Money Market Fund |

--- |

--- |

1.69 |

|

|

|

|

|

|

|

|

| Loss of Money, Not FDIC Insured, Value Investing, Active Management, Market/Market Volatility, Restricted/Illiquid Securities, Derivatives, Shareholder Activity, Small Cap, Mid-Cap |

|

| Show Risk Definitions |

|

|

| Inception Date: 1996-05-01 |

|

| Kevin Toney (2003-12-31) |

|

| Kevin Toney, CFA, CIO, senior vice president and senior portfolio manager for American Century Investments, joined the company in 1999 as an investment analyst and became a portfolio manager in 2006. Kevin is responsible for the teams that manage the company’s value and real estate equity strategies that comprise the firm’s Global Value Equity discipline. Before joining American Century Investments, Kevin was an associate in the M&A group of Toronto Dominion Securities. He has worked in the investment industry since 1993. |

|

| Brian Woglom (2005-12-31) |

|

| Brian have more than five years of experience with American Century. He was a member of the team of investment professionals managing the U.S. Value Yield, U.S. Value, U.S. Large Cap Value, U.S. Mid Cap Value and U.S. Equity Market Neutral Value strategies and related accounts, and he co-manages U.S. Large Cap Value, U.S. Value, U.S. Mid Cap Value and U.S. Equity Market Neutral Value. He joined American Century Investments in 2005. Previously, Brian was an investment analyst for Argo Partners and an analyst for the portfolio management unit of Metropolitan Life Insurance Co. He has worked in the investment industry since 1998. Brian earned a bachelor's degree in economics from Amherst College and a master’s degree in business administration from the University of Michigan. He is a CFA® charterholder and a member of the CFA Institute. |

|

| Dave M. Byrns (2022-02-19) |

|

| Mr. Byrns, Portfolio Manager, has been a member of the team since joining American Century Investments in 2014 as an investment analyst. He became a senior investment analyst in 2016 and a portfolio manager in 2020. David has over 3 years experience in the investment industry. He was an Equity Analyst for the Multiple Attribute Dividend Growth, Large Cap Quality Growth, High Yield Equity and Multiple Attribute Growth strategies. Prior to joining Hilliard Lyons in 2009, David was a Jr. Equity Analyst at Fifth Third Asset Management for the dividend growth strategies.

David has a B.S.B.A. from the University of Dayton where he was selected as a portfolio manager for the student portion of the university’s endowment. He has passed all three levels of the CFA Examination and is accumulating the necessary work experience to be awarded his charter. He is also a member of the CFA Institute. |

|

| Philip Sundell (2002-12-31) |

|

| Vice President of American Century since 2022 and Portfolio Manager of American Century since 2017. He joined American Century in 1997 and became a senior analyst in 2007. He began his investment career in 1992 and has a BS from Missouri State University and an MBA from Texas Christian University. |

|

| Michael Liss (1998-12-31) |

|

| Michael Liss, CFA, is Vice President and Senior Portfolio Manager of American Century. Mr. Liss has been with American Century since 1998. He holds a bachelor’s degree in accounting and finance from Albright College and an MBA in finance from Indiana University. |

|

|

|

| Lincoln Financial Investments Corporation |

|

|

| Lincoln Variable Insurance Product Tr |

|

|

| American Century Investment Management Inc |

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|