| LVIP American Century InflProtStdII |

|

|

|

| Release date as of 2025-08-31. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-08-31 |

|

Out of 141

Inflation-Protected Bond Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 485.73 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks long-term total return using a strategy that seeks to protect against U.S. inflation.

|

|

| The fund invests substantially all of its assets in investment-grade debt securities. To help protect against U.S. inflation, under normal conditions the fund will invest over 50% of its assets in inflation-indexed debt securities. It also may invest in debt securities that are not inflation-indexed. The fund also may invest in derivative instruments, provided that such investments are in keeping with the fund's investment objective. |

|

|

| Morningstar Category: Inflation-Protected Bond |

|

| Inflation-protected bond portfolios invest primarily in debt securities that adjust their principal values in line with the rate of inflation. These bonds can be issued by any organization, but the U.S. Treasury is currently the largest issuer for these types of securities.

|

|

|

| There are no additional fund specific investment risks (e.g. liquidity risk, currency risk, foreign investment risk, etc.) associated with this fund beyond the normal risks generally associated with investing in a mutual fund. |

|

|

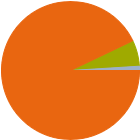

| % of Net Assets |

|

U.S. Stocks |

0.0 |

|

Non-U.S. Stocks |

0.0 |

|

Bonds |

92.9 |

|

Cash |

6.1 |

|

Other |

1.0 |

|

|

|

| Data through 2025-06-30 |

|

|

|

|

| Morningstar Fixed-Income Sectors |

|

| % Fund |

|

Government |

56.74 |

|

Corporate |

9.96 |

|

Securitized |

26.65 |

|

Municipal |

0.52 |

|

Cash & Equivalents |

6.13 |

|

Derivative |

0.00 |

|

|

|

% Bonds |

| AAA |

9.55 |

| AA |

78.66 |

| A |

6.58 |

| BBB |

5.20 |

| BB |

0.00 |

| B |

0.00 |

| Below B |

0.00 |

| Not Rated |

0.02 |

|

|

|

|

|

| Total Number of Stock Holdings |

0 |

| Total Number of Bond Holdings |

157 |

| % of Net Assets in Top 10 Holdings |

34.56 |

|

|

| Turnover % |

(as of 2024-12-31) |

65.00 |

| 30 Day SEC Yield % |

4.95 |

|

|

Maturity

Date

|

Shares

|

Value

$000

|

% of Net

Assets

|

|

|

|

|

|

|

|

United States Treasury Notes 0.0188% |

2034-07-15 |

29,492 |

29,514 |

6.09 |

|

State Street Instl US Govt MMkt Premier |

2030-12-31 |

26,576 |

26,576 |

5.48 |

|

United States Treasury Notes 0.0138% |

2033-07-15 |

24,967 |

24,245 |

5.00 |

|

Federal National Mortgage Association 0.0663% |

2030-11-15 |

13,825 |

15,642 |

3.23 |

|

United States Treasury Notes 0.0013% |

2031-07-15 |

15,857 |

14,592 |

3.01 |

|

|

United States Treasury Notes 0.005% |

2028-01-15 |

13,264 |

13,017 |

2.68 |

|

United States Treasury Notes 0.0013% |

2030-01-15 |

13,751 |

12,977 |

2.68 |

|

United States Treasury Bonds 0.0138% |

2044-02-15 |

13,350 |

11,206 |

2.31 |

|

United States Treasury Notes 0.0038% |

2027-07-15 |

10,031 |

9,895 |

2.04 |

|

United States Treasury Bonds 0.0075% |

2045-02-15 |

13,553 |

9,891 |

2.04 |

|

|

|

|

|

|

|

|

| Credit and Counterparty, Extension, Prepayment (Call), Foreign Securities, Loss of Money, Not FDIC Insured, Interest Rate, Market/Market Volatility, Restricted/Illiquid Securities, Derivatives, Shareholder Activity, Structured Products |

|

| Show Risk Definitions |

|

|

| Inception Date: 2004-05-07 |

|

| James E. Platz (2007-09-28) |

|

| Platz is vice president and a senior portfolio manager with American Century, his employer since October 2003. Prior to joining American Century, Platz was a vice president, senior portfolio manager for Standish Mellon Asset Management, formerly Certus Asset Advisors, since August 1995.

He received a bachelor’s degree in history and political economies of industrial societies from the University of California – Berkeley, and an MBA from the University of Southern California. He is a CFA charterholder. |

|

| Robert V. Gahagan (2002-12-31) |

|

| Mr. Gahagan, Senior Vice President and Senior Portfolio Manager, joined American Century Investments in 1983. He became a portfolio manager in 1991. He has a bachelor’s degree in economics and an MBA from the University of Missouri – Kansas City. |

|

| Miguel Castillo (2015-05-01) |

|

| Miguel Castillo is a vice president and portfolio manager for American Century Investments®.

Mr. Castillo, who joined the company in 2008 as a portfolio research analyst in the Portfolio Advisory Group, served as senior fixed income trader prior to becoming portfolio manager. Mr. Castillo is a member of the Rates and Currency Markets team within the firm's Fixed Income group, where he contributes his expertise to the management of a number of fixed income strategies.

Before joining American Century Investments, he was a fixed income trader with Banco de Mexico, where he implemented monetary policy. He has worked in the investment industry since 2002. Mr. Castillo holds a bachelor's degree in banking and finance from Escuela Bancaria Y Comercial, Mexico City, and a master's degree in business administration from the University of Minnesota. |

|

|

|

| Lincoln Financial Investments Corporation |

|

|

| Lincoln Variable Insurance Product Tr |

|

|

| American Century Investment Management Inc |

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|