| Fidelity VIP Freedom 2015 Service 2 |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 81

Target-Date 2015 Funds

|

|

|

|

Morningstar®

Style Box™

|

| What is this?

|

|

|

|

| As of 2025-08-31 |

|

|

|

| As of 2025-09-30 |

|

|

| Total Fund Assets ($ Mil) |

| 59.09 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks high total return with a secondary objective of principal preservation as the fund approaches its target date and beyond.

|

|

| The fund invests in a combination of Fidelity® U.S. equity funds, international equity funds, bond funds, and short-term funds. The adviser allocates assets according to a neutral asset allocation strategy that adjusts over time until it reaches an allocation similar to that of the VIP Freedom Income Portfolio℠, approximately 10 to 19 years after the year 2015. |

|

|

| Morningstar Category: Target-Date 2015 |

|

| Target-date portfolios provide diversified exposure to stocks, bonds, and cash for those investors who have a specific date in mind (in this case, the years 2011-2015) for retirement. These portfolios aim to provide investors with an optimal level of return and risk, based solely on the target date. Management adjusts the allocation among asset classes to more-conservative mixes as the target date approaches, following a preset glide path. A target-date portfolio is part of a series of funds offering multiple retirement dates to investors.

|

|

|

| Fund of Funds: An investment option with mutual funds in its portfolio may be subject to the expenses of those mutual funds in addition to those of the investment option itself. |

|

|

|

|

|

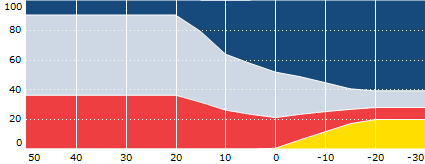

| Allocation |

|

Bonds |

|

US Stocks |

|

Non-US Stocks |

|

Cash |

|

Other |

|

|

|

|

|

|

% of Net Assets |

|

| U.S. Stocks |

16.7 |

|

| Non-U.S. Stocks |

18.4 |

|

| Bonds |

58.2 |

|

| Cash |

6.3 |

|

| Other |

0.5 |

|

|

| Total |

100.0 |

|

|

|

|

|

Data through

2025-08-31 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

37.74 |

|

Basic Materials |

5.99 |

|

Consumer Cyclical |

8.88 |

|

Financial Services |

21.82 |

|

Real Estate |

1.05 |

|

|

|

|

Sensitive |

48.62 |

|

Communication Services |

9.82 |

|

Energy |

2.81 |

|

Industrials |

17.16 |

|

Technology |

18.83 |

|

|

|

|

Defensive |

13.64 |

|

Consumer Defensive |

3.85 |

|

Healthcare |

7.77 |

|

Utilities |

2.02 |

|

| Data through 2025-08-31 |

|

|

|

| Morningstar Fixed-Income Sectors |

|

| % Fund |

|

Government |

53.93 |

|

Corporate |

12.96 |

|

Securitized |

16.91 |

|

Municipal |

0.01 |

|

Cash & Equivalents |

12.67 |

|

Derivative |

3.52 |

|

|

|

% Bonds |

| AAA |

86.80 |

| AA |

3.25 |

| A |

7.29 |

| BBB |

7.28 |

| BB |

1.19 |

| B |

0.95 |

| Below B |

0.00 |

| Not Rated |

-6.76 |

|

|

|

|

|

| Total Number of Stock Holdings |

0 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

92.65 |

|

|

| Turnover % |

(as of 2024-12-31) |

35.00 |

| 30 Day SEC Yield % |

--- |

|

|

Sector |

Country |

Maturity Date |

Market Value ($000) |

% of Net Assets |

|

| Fidelity VIP Investment Grd Bd II Initl |

--- |

USA |

--- |

19,934 |

33.79 |

| Fidelity Inflation-Prot Bd Index |

--- |

USA |

--- |

8,112 |

13.75 |

| Fidelity VIP Overseas Initial |

--- |

USA |

--- |

7,106 |

12.04 |

| Fidelity VIP Government MMKT Initial |

--- |

USA |

--- |

4,542 |

7.70 |

| Fidelity VIP Emerging Markets Initial |

--- |

USA |

--- |

3,504 |

5.94 |

|

| Fidelity VIP Growth Initial |

--- |

USA |

--- |

3,032 |

5.14 |

| Fidelity Long-Term Trs Bd Index |

--- |

USA |

--- |

2,450 |

4.15 |

| Fidelity VIP Growth & Income Initial |

--- |

USA |

--- |

2,068 |

3.50 |

| Fidelity International Bond Index |

--- |

USA |

--- |

2,047 |

3.47 |

| Fidelity VIP Contrafund Initial |

--- |

USA |

--- |

1,867 |

3.17 |

|

|

|

|

|

|

|

|

| Inflation-Protected Securities, Prepayment (Call), Foreign Securities, Loss of Money, Not FDIC Insured, Country or Region, Index Correlation/Tracking Error, Issuer, Interest Rate, Market/Market Volatility, Equity Securities, Underlying Fund/Fund of Funds, Leverage, Management, Passive Management, Target Date |

|

| Show Risk Definitions |

|

|

| Inception Date: 2005-04-26 |

|

| Andrew J Dierdorf (2011-06-30) |

|

| Andrew Dierdorf is co-manager of each fund, which he has managed since October 2009 (other than Fidelity Freedom® Index 2055 Fund, Fidelity Freedom® Index 2060 Fund, and Fidelity Freedom® Index 2065 Fund). He has managed Fidelity Freedom® Index 2055 Fund since June 2011, Fidelity Freedom® Index 2060 Fund since August 2014, and Fidelity Freedom® Index 2065 Fund since June 2019. He also manages other funds. Since joining Fidelity Investments in 2004, Mr. Dierdorf has worked as a portfolio manager. |

|

| Brett F. Sumsion (2014-01-21) |

|

| Brett Sumsion is co-manager of each fund, which he has managed since January 2014 (other than Fidelity Freedom® Index 2060 Fund and Fidelity Freedom® Index 2065 Fund). He has managed Fidelity Freedom® Index 2060 Fund since August 2014 and Fidelity Freedom® Index 2065 Fund since June 2019. He also manages other funds. Since joining Fidelity Investments in 2014, Mr. Sumsion has worked as a portfolio manager.

Mr. Sumsion earned his bachelor of arts degree from Brigham Young University and his MBA from The Wharton School at the University of Pennsylvania. He is a CFA charterholder. |

|

| Finola McGuire Foley (2025-04-30) |

|

| Finola Foley is a portfolio manager in the Global Asset Allocation group at Fidelity Investments. In this role Finola McGuire Foley is co-manager of each fund, which she has managed since June 2018 (other than Fidelity Freedom® Index 2065 Fund). She has managed Fidelity Freedom® Index 2065 Fund since June 2019. She also manages other funds. Since joining Fidelity Investments in 2003, Ms. Foley has worked as an assistant portfolio manager and portfolio manager Previously, Ms. Foley held various roles within Fidelity, including portfolio analyst and senior business analyst at Strategic Advisers LLC. She has been in the financial industry since joining Fidelity in 2005. Ms. Foley earned her BS in business information systems from University College Cork and her MBA in finance from Bentley University. She is a CFA charterholder. |

|

| Cait Dourney (2025-04-30) |

|

| Cait Dourney is a portfolio manager in the Global Asset Allocation (GAA) group at Fidelity Investments. Fidelity Investments is a leading provider of investment management, retirement planning, portfolio guidance, brokerage, benefits outsourcing, and other financial products and services to institutions, financial intermediaries, and individuals. GAA is an investment team within Fidelity's Asset Management Solutions division, an investment organization that provides industry-leading multi-asset solutions to the retail and institutional marketplace.

In this role, Ms. Dourney is a portfolio manager on the target date team, including Fidelity-managed 529 portfolios.

Prior to assuming her current responsibilities, Ms. Dourney was a member of the asset allocation research team, which conducts fundamental and quantitative research to develop asset allocation recommendations for Fidelity’s portfolio managers and investment teams. AART generates insights on macroeconomic, policy, and financial market trends and their implications for strategic and active asset allocation. Ms. Dourney was the head of business cycle research, modeling the business cycle in the U.S. and other major economies. Ms. Dourney also co-managed the team’s active asset allocation pilot portfolio. Prior to joining Fidelity in 2014, she worked at Bank of New York Mellon in wealth management. She has been in the financial industry since 2013.

Ms. Dourney earned her Bachelor of Arts in economics and French from Wake Forest University. She is also a CFA® charterholder and holds the Certified Business Economist (CBE) designation. |

|

|

|

| Fidelity Management & Research Company LLC |

|

|

|

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|