| Neuberger Berman AMT M/C Intrinsic Val S |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 378

Mid-Cap Value Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 130.97 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks growth of capital.

|

|

| The fund normally invests at least 80% of its net assets in equity securities of mid-capitalization companies, which the fund manager defines as those with a total market capitalization within the market capitalization range of the Russell Midcap® Value Index at the time of purchase. The fund's strategy consists of using a bottom-up, fundamental research driven approach to identify stocks of companies that are trading below the portfolio manager's estimate of their intrinsic value and that he believes have the potential for appreciation over time. |

|

|

| Morningstar Category: Mid-Cap Value |

|

| Some mid-cap value portfolios focus on medium-size companies while others land here because they own a mix of small-, mid-, and large-cap stocks. All look for U.S. stocks that are less expensive or growing more slowly than the market. Stocks in the middle 20% of the capitalization of the U.S. equity market are defined as mid-cap. Value is defined based on low valuations (low price ratios and high dividend yields) and slow growth (low growth rates for earnings, sales, book value, and cash flow).

|

|

|

| Mid Cap Funds: The securities of companies with market capitalizations below $10 billion may be more volatile and less liquid than the securities of larger companies. |

|

|

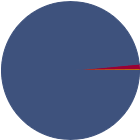

| % of Net Assets |

|

U.S. Stocks |

98.5 |

|

Non-U.S. Stocks |

1.4 |

|

Bonds |

0.0 |

|

Cash |

0.1 |

|

Other |

0.0 |

|

|

|

| Data through 2025-09-30 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

28.46 |

|

Basic Materials |

1.87 |

|

Consumer Cyclical |

13.12 |

|

Financial Services |

8.75 |

|

Real Estate |

4.72 |

|

|

|

|

Sensitive |

56.37 |

|

Communication Services |

1.39 |

|

Energy |

6.58 |

|

Industrials |

17.86 |

|

Technology |

30.54 |

|

|

|

|

Defensive |

15.17 |

|

Consumer Defensive |

2.55 |

|

Healthcare |

4.68 |

|

Utilities |

7.94 |

|

| Data through 2025-09-30 |

|

|

| Total Number of Stock Holdings |

72 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

25.03 |

|

|

| Turnover % |

(as of 2024-12-31) |

21.00 |

| 30 Day SEC Yield % |

--- |

|

|

Sector |

P/E |

% of Net

Assets

|

|

|

|

|

|

|

Ciena Corp |

|

173.17 |

2.96 |

|

Aptiv PLC |

|

19.54 |

2.83 |

|

CenterPoint Energy Inc |

|

27.80 |

2.65 |

|

Hewlett Packard Enterprise Co |

|

27.38 |

2.54 |

|

L3Harris Technologies Inc |

|

32.66 |

2.50 |

|

|

Teledyne Technologies Inc |

|

31.61 |

2.49 |

|

Williams Companies Inc |

|

31.48 |

2.43 |

|

Gates Industrial Corp PLC |

|

--- |

2.41 |

|

AerCap Holdings NV |

|

7.51 |

2.13 |

|

FirstEnergy Corp |

|

20.74 |

2.09 |

|

|

|

|

|

|

|

|

| Event-Driven Investment/Arbitrage Strategies, Currency, Foreign Securities, Loss of Money, Not FDIC Insured, Value Investing, Issuer, Market/Market Volatility, Industry and Sector Investing, Other, Restricted/Illiquid Securities, Pricing, Increase in Expenses, Shareholder Activity, Management, Mid-Cap, Real Estate/REIT Sector |

|

| Show Risk Definitions |

|

|

| Inception Date: 2005-04-29 |

|

| Amit Solomon (2021-05-01) |

|

| Amit Solomon, PhD, is a Managing Director of Neuberger Berman Management LLC and Neuberger Berman LLC. Mr. Solomon joined the firm in 2008. Prior to joining the firm, Mr. Solomon was a principal and senior research analyst at D.J. Greene, the investment adviser to the Fund’s predecessor partnership and account, from 2002 to 2008. D.J. Greene was acquired by Neuberger Berman in 2008. |

|

| James F. McAree (2021-05-01) |

|

| James F. McAree is a Senior Vice President of Neuberger Berman Investment Advisers LLC. James F. McAree is a Managing Director of the Manager. Mr. McAree joined the firm in 2008 and has managed the Fund since May 2021.

Prior to joining the firm, Mr. McAree was a principal and research analyst at D.J. Greene, the investment adviser to the Fund’s predecessor partnership and account, from 2005 to 2008. D.J. Greene was acquired by Neuberger Berman in 2008. Mr. McAree was a research analyst for the Fund’s predecessors from 2005 to 2010. |

|

| Rand W. Gesing (2021-05-01) |

|

| Rand W. Gesing is a Senior Vice President of the Manager. Mr. Gesing joined the firm in 2008 and has managed the Fund since May 2021. |

|

| Scott A Hoina (2024-05-01) |

|

| Scott A. Hoina is a Senior Vice President of the Manager. Mr. Hoina joined the firm in 2008 and has managed the Fund since May 2024. |

|

| Michael C. Greene (2011-12-09) |

|

| Michael C. Greene, Managing Director, joined the firm in 2008 when David J. Greene and Company was acquired by Neuberger Berman. Michael is a Senior Portfolio Manager for the Greene Group’s mid- and all-cap strategies. Prior to the acquisition, he was Chief Executive Officer and Chief Investment Officer at David J. Greene and Company, LLC since 1999. He provided leadership for David J. Greene and Company and managed the firm’s mid- and all-cap strategies. He joined David J. Greene and Company in 1985 as a research analyst, became a member of the Investment Committee in 1991 and a member of the Executive Committee in 1995. Michael began his investment career at Drexel Burnham Lambert, where he applied an already well-established value approach to sell-side analysis of retail stocks. He gained substantial experience in fundamental analysis of companies, as well as perspective in the investment philosophies and needs of institutional clients. He serves as a board member of the Masters School in Dobbs Ferry, NY and as Vice President of the David and Alan Greene Family Foundation, Inc. He holds a BA in Economics from Colgate University and an MBA from New York University’s Graduate School of Business. |

|

| Benjamin H. Nahum (2021-05-01) |

|

| Benjamin H. Nahum, Managing Director, joined the firm in 2008 when David J. Greene and Company was acquired by Neuberger Berman. Benjamin is the Senior Portfolio Manager for the Neuberger Berman Small Cap Intrinsic Value strategy. Prior to the acquisition, he was an executive vice president andprincipal at David J. Greene and Company, LLC where he managed the small/SMid cap strategies since inception in 1997. During his tenure, small/SMid cap assets under management havegrown from $7.0 million to $2.8 billion at peak. He was also a member of the firm’s investment committee. Previously, Benjamin worked as an analyst and portfolio manager at Lewis Partners, a New York City based hedge fund, and as a special situation analyst and portfolio manager at MKI Securities Corp. He holds a BA from Clark University and a JDfrom Brooklyn Law School. |

|

|

|

| Neuberger Berman Investment Advisers LLC |

|

|

|

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|