| Neuberger Berman AMT Quality Eq Port S |

|

|

|

| Release date as of 2025-09-30. Data on page is subject to change. |

|

|

Overall Morningstar

Rating™

|

| What is this?

|

|

|

| As of 2025-09-30 |

|

Out of 1226

Large Blend Funds

|

|

|

|

|

|

| Total Fund Assets ($ Mil) |

| 887.65 |

|

|

|

| Investment Objective & Strategy |

|

| The investment seeks long-term growth of capital by investing primarily in securities of companies that meet the fund's environmental, social and governance (ESG) criteria.

|

|

| To pursue its goal, the fund invests primarily in common stocks of mid- to large-capitalization companies that meet the fund's quality oriented financial and ESG criteria. It seeks to reduce risk by investing across many different industries. The Portfolio Manager employs a fundamental, research driven approach to stock selection and portfolio construction, with a focus on long term sustainability issues that, in the judgement of the Portfolio Manager, are financially material. |

|

|

| Morningstar Category: Large Blend |

|

| Large-blend portfolios are fairly representative of the overall US stock market in size, growth

rates and price. Stocks in the top 70% of the capitalization of the US equity market are defined

as large cap. The blend style is assigned to portfolios where neither growth nor value

characteristics predominate. These portfolios tend to invest across the spectrum of US

industries, and owing to their broad exposure, the portfolios' returns are often similar to those of the S&P 500 Index.

|

|

|

| There are no additional fund specific investment risks (e.g. liquidity risk, currency risk, foreign investment risk, etc.) associated with this fund beyond the normal risks generally associated with investing in a mutual fund. |

|

|

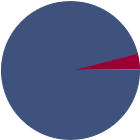

| % of Net Assets |

|

U.S. Stocks |

96.0 |

|

Non-U.S. Stocks |

3.9 |

|

Bonds |

0.0 |

|

Cash |

0.1 |

|

Other |

0.0 |

|

|

|

| Data through 2025-08-31 |

|

|

|

|

| Morningstar Equity Sectors |

|

|

|

% of Stocks |

|

Cyclical |

41.47 |

|

Basic Materials |

1.15 |

|

Consumer Cyclical |

14.90 |

|

Financial Services |

25.42 |

|

Real Estate |

0.00 |

|

|

|

|

Sensitive |

48.67 |

|

Communication Services |

8.94 |

|

Energy |

1.18 |

|

Industrials |

7.10 |

|

Technology |

31.45 |

|

|

|

|

Defensive |

9.85 |

|

Consumer Defensive |

1.40 |

|

Healthcare |

8.45 |

|

Utilities |

0.00 |

|

| Data through 2025-08-31 |

|

|

| Total Number of Stock Holdings |

38 |

| Total Number of Bond Holdings |

0 |

| % of Net Assets in Top 10 Holdings |

57.02 |

|

|

| Turnover % |

(as of 2024-12-31) |

4.00 |

| 30 Day SEC Yield % |

--- |

|

|

Sector |

P/E |

% of Net

Assets

|

|

|

|

|

|

|

Amazon.com Inc |

|

33.55 |

10.13 |

|

Microsoft Corp |

|

37.69 |

9.99 |

|

Alphabet Inc Class A |

|

26.03 |

8.77 |

|

Interactive Brokers Group Inc Class A |

|

37.02 |

6.29 |

|

Berkshire Hathaway Inc Class B |

|

16.88 |

5.11 |

|

|

Mastercard Inc Class A |

|

37.71 |

4.13 |

|

Kyndryl Holdings Inc Ordinary Shares |

|

23.14 |

3.91 |

|

GoDaddy Inc Class A |

|

23.64 |

3.08 |

|

Apple Inc |

|

37.58 |

2.83 |

|

Arista Networks Inc |

|

57.82 |

2.78 |

|

|

|

|

|

|

|

|

| Currency, Foreign Securities, Loss of Money, Not FDIC Insured, Nondiversification, Value Investing, Issuer, Market/Market Volatility, Equity Securities, Industry and Sector Investing, Other, Pricing, Socially Conscious, Increase in Expenses, Shareholder Activity, Management, Mid-Cap, Large Cap |

|

| Show Risk Definitions |

|

|

| Inception Date: 2006-05-01 |

|

| Daniel Hanson (2022-04-01) |

|

| Daniel Hanson, CFA, Managing Director, joined the firm in January 2022. Dan is the Senior Portfolio Manager and Head of the U.S. Quality Equity team. Dan joined Neuberger Berman from Waddell & Reed and Ivy Investments, where he was Chief Investment Officer. Previously, he served as Head of Impact Investing for JANA Partners. Prior to that role, he was Partner and Head of U.S. Equities, and Co-Chair of the Investment Strategy Committee with Jarislowsky Fraser Global Investment Management. Previously, Dan spent 10 years at BlackRock where he launched and managed the firm’s first fundamental, active ESG strategy, the BlackRock Socially Responsible Equity strategy. Dan is involved in a number of initiatives in the area of governance, corporate reporting, and sustainable investing. Dan was a founding member of the board of directors of the Sustainable Accounting Standards Board (“SASB") in 2011. He served on the professional faculty of the University of California-Berkeley Haas School of Business, where he taught sustainable investing from 2016-2019. In that role, he was a judge for the Moskowitz Research Prize, which recognizes outstanding quantitative research in sustainable and responsible investing. Dan received his Bachelor’s Degree in Economics and French from Middlebury College, and earned an MBA, Accounting and Analytic Finance, from The University of Chicago. He is a CFA charterholder. |

|

|

|

| Neuberger Berman Investment Advisers LLC |

|

|

|

|

|

|

|

|

© Copyright 2025 Morningstar, Inc. All rights reserved. Morningstar, the Morningstar logo, Morningstar.com, Morningstar Tools are either trademark or service marks of Morningstar, Inc. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or any losses arising from any use of information. Past performance is no guarantee of future performance. |

|

Past performance is no guarantee of future results.

Returns will vary and shares may be worth more or less than their original cost when sold.

|

|